Each week I’ll be picking a random ASX stock that I’ve rarely seen discussed online that you voted for, for us to dive into for some Due Diligence (“DD”).

This is for us to have a look at what it does, comb over their financials, and conduct some polling on general sentiment. Not all of these stocks may be sexy or appealing; the whole point is to shine a light on what companies are doing out there on the ASX which never get much coverage – for good or bad.

The main purpose being to add some more variety in coverage to the standard blue chips or meme stocks we see pumped day in and day out, and hopefully discover some hidden gems or innovative companies on the Aussie market.

Here’s this week’s Random Stock of the Week.

Company name: xReality Group

Ticker: XRG

Industry: Entertainment/Tactical Services

Headquarters: Sydney, NSW

Market cap: ~$23m

Current share price: ~$0.069

1-year Performance: +430.77%

What they do, smoothbrain version: Counterstrike:GO, except for actual badasses instead of neckbeards… and indoor skydiving.

What they say they do, wanky version: “xReality Group Limited builds immersive XR products and experiences that enhance lives. xReality Group’s portfolio includes physical and digital simulation used across the enterprise, defence and consumer markets.” 🍆👋

What they do, actual version: Sydney-based xReality Group (XRG) are a mixed consumer entertainment/defense technology company who formerly solely specialised in operating “indoor skydiving” retail experiences around Australia.

They were previously listed on the ASX under the ticker IDZ as Indoor Skydiving Australia before rebranding as XRG in late 2021.

The company was founded and is largely run by experienced Australian ex-military (with SAS experience) soldiers in command positions, and while retail was obviously a main driver of revenue, their connections to the armed forces & their training always played a significant part in the lifeblood of XRG.

During the bulk of the company’s listed history, their core offering were their iFLY-branded series of indoor skydiving facilities in which customers could pay for sessions (around 1 minute in length), suit up and hop inside a high-powered vertical “wind tunnel” and simulate the sensation of free-fall experienced in actual skydiving.

This is actually a company that I was randomly semi-involved in personally at the time of their launch & in the subsequent following few years, as I worked for a company that handled the marketing of their skydiving experiences to retail consumers. They were quite innovative for their time and were anticipated as decently inventive new tourist attractions for their respective locations.

Their original centre launched in Penrith in Western Sydney in 2014, with the Gold Coast following a couple of years later, and indoor skydiving centres rolling out in other locations across the country afterwards – as well as one in Malaysia.

Unfortunately, getting each of these facilities up and running proved highly capital-intensive and often prone to delays in their rollouts or blowouts in setup and engineering/electrical costs, as well as regulation & safety requirements.

Despite being quite popular as experiences in themselves, the business model often required a heavy diet of both debt and capital raises throughout the company’s history to get each new centre up and running.

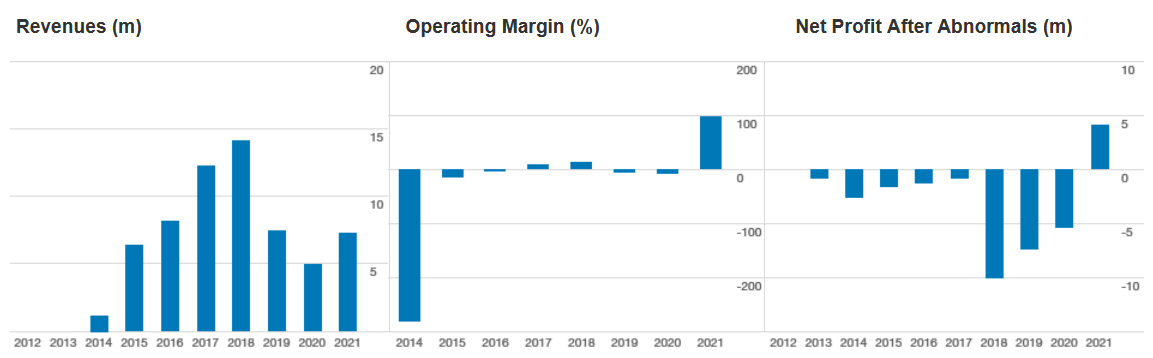

While revenues steadily climbed for several years, profit did not follow, and the share price continually sold down after an initial two-year rise following its IPO.

This culminated in the price of shares hitting an all-time-low of $0.013 in early 2019 following a period of ongoing issues, be it profit downgrades, some legal disputes, a breach of financing facilities and a number of director resignations.

During this period the company tried a range of initiatives – ‘frequent flier’ type loyalty programs, launching gift cards, optimising its online booking system and more – and eventually ended up selling off its Perth facility in early 2020 as part of its “recovery strategy” to reduce its liabilities.

Just as the company was beginning to roll this out, in March 2020 Covid-19 hit and forced the closure of its facilities – another crippling blow to what was already looking like a sputtering business.

Fortunately in the background, XRG had been working on ways to diversify their business model. The company had been orienting more of their time and money towards branching out into Virtual Reality experiences, launching their FREAK Entertainment line soon thereafter.

These are centres offering consumer-oriented simulations for highly-lifelike car racing, as well as more involved VR experiences such as escape rooms, virtual arenas, futuristic laser tag and various other digital adventures.

XRG currently have 3 of these centre locations in Sydney (including the newest-launched in Macquarie Centre in Ryde in November 2021), and one on the Gold Coast.

They also introduced a “home delivery” version of the product during the company’s Covid-19 lockdowns, which proved quite popular.

None of this really had much impact on the stock’s share price, however, and XRG went under some debt restructuring in March 2021 in order to accelerate their recovery plan. Covid lockdowns also impacted much of 2021, including their second half in which they lost 54% of opening hours for their operations due to closures.

What really started to turn the tide for the company sentiment-wise was their acquisition of VR gaming/tech company Red Cartel, which was made in order to aid in the commercialisation of a new line of simulation technology oriented at the military.

The company onboarded a new director in November 2021 – again, with prior extensive military experience, and connections throughout the global defense supply chain to accelerate the launch of their new Operator Tactical Solutions software & hardware suite.

This new, defense-focused arm of the company is designed to provide tactical VR training for military and law enforcement units via their VR Tactical Trainer, Mission Rehearsal System, and Weapons Integration programs.

These allow military organisations to drill & train their staff in various tactical scenarios through a mix of physical & virtual interactions, including close-quarters battle drills and much more while integrating seamlessly onto existing military hardware via VR headset.

They can then debrief and analyse performance and outcomes from a variety of angles, and conduct drills across various building and floorplan layouts that would be extremely expensive to create through actual physical means – pretty cool tech, to be honest.

The market certainly liked this. It meant what was formerly oriented purely as a ‘fun-loving direct to consumer tourist attraction’, had made a strong potential reorientation towards the defense sector in one of the more unusual rebrandings/tactical pivots seen on the ASX in recent years.

It also meant focusing on growth via a far less physically & capitally-intensive growth avenue vs. the drawn-out and expensive process of setting up more indoor skydiving wind tunnels.

Its share price jumped up substantially for the first time in years as a result, with the company also having recently completed the rebrand of their business to xReality Group/XRG to reflect their newly-diverse product line.

Whether this newly repositioned military-and-VR focus will result in a great increase in revenue (and profitability?) remains to be seen, but at the very least the company’s outlook is finally looking fresh/positive for the first time in a while.

XRG are based in Sydney, listed on the ASX in 2013, and has returned -11.02% p.a. annualised (with no dividends paid) since its IPO.

What looks good:

- Like many businesses that are customer-facing, the company got hammered due to Covid restrictions. Almost immediately after these were repealed, they saw a strong rebound in hours/sessions across all brands, and luckily were able to operate unrestricted over the 2021 Christmas/school holiday period. The loosening of QLD border restrictions also benefitted the Gold Coast iFLY centre, as will the return of international tourists given the Gold Coast’s popular status as a travel destination.

- As a result, they’ve returned to levels of revenue around what they had in March 2021 after dipping again due to the impact of the Omicron variant.

- They’re aiming to roll out four more FREAK sites at various Westfields over the next year; these are far less capital intensive to get up and running than their skydiving offerings (which cost around $10 million each to set up), and represent a more viable/scalable growth strategy on the retail side moving forward.

- They generated a 29% increase in NTA per share from Dec 2020 to 2021. Much of the improvement came from XRG undertaking some important debt restructuring earlier in 2021 which allowed them to improve their overall cash position.

-

Their Operator Tactical Solutions segment will be conducting trials with various international defense force arms & law enforcement agencies, with the aims of attaining contracts after exhibiting at a range of military and defense conferences throughout the year.

- Management still have a decent amount of insider ownership of the stock, and are incentivised to turn things around for their own benefit as well as that of retail shareholders.

- Insiders have also shown a ‘decent’ level of stock purchases themselves over the past year showing some confidence, even though the numbers are small buys (but then again, perhaps not so small relative to how tiny the company’s market cap is).

- At a mere ~$23 million market cap, purely given the value of their assets, internal IP creation potential, and level of in-place revenue generation, this looks potentially undervalued. The raw value of their skydiving centres alone make up a significant chunk of this value proposition, let alone everything else they’ve expanded out into.

- Their Macquarie Centre’s VR revenue has not yet been factored into their numbers, and should start showing up as an addition to the bottom line in their next financial report.

- Their acquisition of the Red Cartel software arm will allow XRG to develop their own IP. This would have the dual effect of providing new licensable product, while also cutting down on existing licensing fees.

- This in-house development team have also already released their first software game oriented at a younger audience, helping to open up their existing VR offerings to a wider potential customer base (kids) for extra revenue.

- Even despite all of the fragmented issues Covid caused in the end quarter of 2021, they still were able to report positive EBITDA despite this – even with additional investment being made in their tactical product development & setting up their newest FREAK Entertainment facility during the period.

- They also were able to be cashflow positive, ending up with a cash balance of over $1 million as of their Dec 31 2021 update. This may stave off the need for any capital raising for a while depending on how aggressive they’re planning to be with future expansion/product R&D.

- XRG have made recent efforts to inject their board with more financial/private sector expertise rather than solely consisting of the more military-focused/experienced side of things, adding more diversified skillsets to management.

- VR is something of a “hot topic” product line at the moment given all the sentiment from giants such as Facebook around the ‘Metaverse’. We’ve already seen similar effects of the hype around this rubbing off on other ASX-listed stocks such as Vection Technologies (ASX:VR1) which experienced a massive share price jump after becoming affiliated with big US tech such as Facebook & Webex.

- By association, the company’s name change was essential in creating more investor interest; it’s likely people in the past were simply turned off by the IDZ ticker/business name and not realising the full scope of what XRG actually does/is aiming to do on the VR side.

- In the micro-cap space, all it takes is one significant contract to send a share price skyrocketing, and XRG are now equipped with a product they’re able to pitch to many cashed-up government clients around the world.

- Globally, major countries have continued to increase their military spends over the first portion of the 2020’s, particularly the likes of the USA, China, India & the UK – all potential clients for what XRG is offering product-wise.

What doesn’t look good:

- The core skydiving part of the business has been an eternal struggle to make profitable while still aiming to expand. While the company has had admirable growth plans, it hadn’t translated into a story that was appealing to investors, and those who got in at IPO would have been down massively on their initial investment just a couple of years later.

- They received around $650k worth of government JobKeeper assistance combined during financial year 2020 & 2021, which artificially inflated some of their numbers for the period.

- Their Sydney indoor skydiving centre being based in Penrith means that it gets far less mainstream brand recognition than if it were based somewhere more central to the Sydney CBD. Being more centrally located would allow it to more easily draw in larger group bookings for corporate clients, garner more media attention from city-based media, etc.

- Debt is by far our biggest concern with this company’s prospects. They’ve always carried a significant amount of debt to go along with all this expansion, and at some point they will need to start paying some more of it off considering how high the interest rate repayments are. The debt levels are already concerning as is, but become even moreso in a potentially rising interest rate environment:

- Given their already high level of debt facilities, they have also often sat on a concerningly small amount of cash available at various periods in the past. This feels like a capital raise may be due very soon depending on whether or not their most recent revenue figures can hold (or grow), particularly with the share price at strong levels recently. The company may wish to take advantage of this to conduct a raise & sure-up their financial position.

- A lot of the future potential of this stock is relying on this new military-oriented pivot actually working practically & commercially, as opposed to just theoretically. Shareholders are/will be banking on their ability to achieve at least one significant government/private contract for their tactical training suite, in order to set the precedent and establish a baseline of revenue for this arm of the company.

- Branching out into VR is a field that, while it is less capital-intensive to grow, also has far less of a competitive ‘moat’ vs. the arduous task of constructing the indoor skydiving wind tunnels. The skydiving centres are harder to set up, but also harder for competitors to join the scene by association.

- The company has had a fair amount of board turnover and turmoil over recent years in order to get to its current position. Stock markets typically reward stability and don’t like uncertainty, especially where management is concerned.

Summary: While their existing indoor skydiving and VR centre venues continue to produce solid revenue especially now that Covid lockdowns appear to be a thing of the past, all eyes of shareholders current and aspiring are on the new military-centric arm of the company.

XRG have taken a position in a current worldwide climate in which their new flagship product line certainly has an elevated degree of relevance.

In this increasingly tense global environment, countries around the globe (including Australia) have begun allocating more and more of their GDP towards defense and military spend in recent years.

The ability for XRG to leverage existing board member relationships within the defense sector & onboard contracts for their software will obviously be key moving forward, as all of these potential customers and revenue for the product are only theoretical at this point.

Domestic contracts would be nice enough given their potential ability to generate ongoing revenue, but it’s overseas where the real “rocket fuel” might come from.

The USA is the potential golden goose when it comes to defense spending, and establishing even one decent contract there should give the company (and its shareholders) a much more confident outlook and make pitching other countries easier moving forward.

As a company, this is also simply just a pretty unique offering on the ASX.

They don’t have any real direct competitors, and their increased diversification now means that they’re less subject to circumstances out of their control (such as another Covid variant) entirely crippling their business.

Conclusion: The decision to invest into XRG probably largely depends on two things at this point.

The first is how confident you are in the company’s ability to properly monetise the Operator Tactical Solutions line, with no track record, income or revenue to base the decision on.

You’re essentially taking a leap of faith on its commercial viability, and placing trust in management’s words of how desirable the product truly is.

The second is if you believe they are soon to conduct another capital raise, and if so to wait until the share price drops to cap raise price, and looking at buying in then.

The company’s latest results showed that the business is now a stronger cashflow generator since free of Covid restrictions, so they may just be able to survive from quarter to quarter as is without dipping into shareholders’ pockets.

It doesn’t leave much room for any other major acquisitions or expansion however, especially considering how tapped-out XRG already are debt-wise.

With the debt levels they have, it could be argued they may be better served conducting a cap raise while the share price is in a stronger position just to pay down some of their debt anyway; not something existing shareholders likely want to hear given the potential dilution.

It’s probably the debt that is scaring many investors off, because fundamentally the assets they own (just under $40m) make XRG’s market cap look very low; sucking it up and addressing this may be cause for a re-rate.

Much of the near-term future performance of this company likely will depend on how their exhibits at the various conferences they have booked this year (starting in February 2022) are received, and if anything commercial comes of them as a result.

There is definitely some potential here based on its combination of assets & potential moving forward. It’s certainly looking more promising as an investment than it has in the last several years, at the very least.

However I would likely wait to see what the company reports during the upcoming quarter and/or what they do in regards to debt and capital first, even if it costs me some initial profits by investing in it slightly later.

Company website: https://xrgroup.com.au/

MarketIndex page: https://www.marketindex.com.au/asx/xrg

Feel free to add your own opinions on XRG in the comments below.

Would you buy this stock? Why or why not? Feel free to vote in the poll.