There are nearly 2,000 listed companies on the ASX, which can make things overwhelming for new investors without an idea of where to start. So how do you begin conducting Due Diligence on finding promising stocks to invest in?

Here’s our guide for some of the tools you could use to perform a simple example “DD” process.

WHAT YOU’LL NEED:

- Tradingview’s Screener – https://www.tradingview.com/screener/

- MarketIndex – https://www.marketindex.com.au/

- Simply WallSt – https://simplywall.st

- Commsec – https://www.commsec.com.au

Note: I am not affiliated in any way with any of these websites/products, they’re simply the best I’ve found at doing what we need for this purpose.

After seeing the massive recent influx of new Aussie investors we’ve had to the market over the past couple of years – I’ve also seen a large amount of people throwing money away, and getting burned on their first few investments.

This is particularly noticeable with newbies following ‘pump and dumps’ on social media platforms without knowing anything about companies they’re investing in, or how to find stocks or companies for themselves.

As a result, I wanted to dive in a little bit to an example of my own (basic) Due Diligience (a.k.a ‘DD’) process for finding potential quality ASX companies.

Note I said INVEST IN; i.e hold for more than a week at a time without being impatient and selling because your portfolio doesn’t climb 50% per week.

That also doesn’t necessarily mean you have to resign yourself to only throwing your money into large, “blue chip” large cap stocks that have been covered to death, and then falling asleep for 2 years and hoping for gains afterwards.

There can also be a happy medium to be had between achieving index-level gains at best, and sheer gambling on ‘speccy’ penny stocks by following social media pumps – which you should pretty much definitely not do.

It simply means having a methodology for due diligence, and trying to see if you can achieve index-beating growth – without boring mofos telling you that if you aren’t putting all your money in a white-bread index ETF, you’re basically acting like Scarface with a mound of cocaine.

There can also be a happy medium to be had between achieving index-level gains at best, and sheer gambling on ‘speccy’ penny stocks.

Note that this DD process is oriented around the surface-level of Fundamental Analysis (FA), not going into the workings of Technical Analysis (“TA”, a.k.a dissecting graphs, also a.k.a “reading tea leaves”).

It’s also a summary of what are some useful online tools out there, what are some important basic metrics for newbies to know about companies to provide yourself with a baseline of investing knowledge, where and how to find them, etc.

Again, this is just how I like to do it to try and discover stocks that are still ‘fun’ enough/can produce good returns – while not just being joke speculative gambles.

Also, this is just one example of a methodology you could follow to conduct Due Diligence among many out there.

In my case, I prefer to focus on profitable small-caps (and this is what the example process you’ll see here shows) for a range of reasons.

Some of the positives include:

- Has proven their business model can be profitable…

- …yet still often a lot of room for potential growth

- Lack of mainstream broker coverage means you can find inefficiencies

- A single major contract can cause a large jump in share price

- Often have a high degree of insider-ownership, meaning the owner/board/CEO are more motivated to grow the business

- Frequently become a target for acquisitions

Of course, individual stock picking is still risky regardless of what strategy you follow, and it’s entirely possible for even companies with solid profit figures to generate negative returns.

You can still make your own use of the tools mentioned here and tweak the numbers to find all kinds of companies that meet your own target criteria too, of course.

My intent here is influenced by my own initially wasting money/being an investing n00b a few years back – just like you folks reading this probably are now – and buying into stupid ‘meme stocks’ 🚀🚀 with no fundamentals at peak meme level, and being left bag holding.

This is what I’m aiming to hopefully protect you against here so you don’t have to go through the same painful process.

Ideally, you can then provide yourself with a layer of ‘protection’ by knowing how to do proper, basic DD.

The Methodology

So, let’s get started with the first things you’ll need – the tools.

In some ways in the 2020’s, we’re really fortunate to have so many options online nowadays for websites that offer analytics and screening tools for stocks. However in other ways, we’re also not – as a lot of them are pretty crap in terms of functionality; especially for Australian stocks.

There’s really only a couple of things you need to get by in my opinion for initial, screener-level DD, without having to spend hours and hours of your day diving into excessive amounts of boring numbers.

TOOL #1 – Tradingview’s Stock Screener

That said, your one of your first stops should be to bookmark this URL:

https://www.tradingview.com/screener/

I’ve tried pretty much every other tool out there online over the past few years, and only Tradingview’s screener offers the best combination of:

- Free

- Quick/responsive UI

- Excellent range of filters

- Works on most devices

- Has Dark Mode so it doesn’t burn my eyes (personal preference)

It’s worth just signing up for a Free account so it can remember your preferences, columns, etc. I don’t see any reason to pay them money for the basic needs we’ll cover here, but if you want more advanced stuff then feel free.

This tool provides a list of pretty much every listed company on every major stock exchange in one spot.

Since we’re here to find potential investments on the ASX though, you just toggle the little “flag” icon on the top right to Aus, and you’re ready to begin.

THE FILTERS

Now, this will depend on a lot of things such as your personal investment “strategy” and risk tolerance.

However bear in mind the whole point of filtering (from my point of view) is to exclude shitty companies.

This might mean that they have crap debt figures that make them less safe, or don’t have a proven business model that can be profitable – or at least have growing revenue if you’re after ‘spec stocks’.

If you’re after the pure gamble route of chucking money onto a company that people are hyping based on raw sentiment in the hopes of fluking a multi-bagger (a.k.a a stock that goes up several hundred % based mostly on hype)…

…then you should probably leave this article/website and head back onto Facebook Groups to chase whatever Pump and Dump is being pushed today, and hope you simply get lucky.

You literally might as well just go to the track and bet on a horse with this “strategy”, and forget the stock market. It’ll save you time, at the very least.

For me personally, what I try and look for is stuff that walks something of a line between Blue Chip 👴 (yawn) and ‘Rocket 🚀’ (gambling – avoid).

That is to say, stuff that isn’t typically going to be a snoozefest, over-covered ASX200 company (with some exceptions) and gain you a yawn-inducing amount of gains per year… but also not dogshit that makes no money and relies purely on media coverage or social media hype.

These are typically the type of bandwagon, crap stocks that will die as soon as the hype dies down and leave you holding worthless bags.

The goal FOR ME PERSONALLY (get the idea yet?) is to ideally try and find stocks that end up with gains within ranges that are higher than ASX index ETFs, while still having solidly profitable business models behind them.

Any higher, and awesome what a bonus; any lower, and well… even if they could end up around the ~20% gain mark (including dividends, if they pay them) then you still can probably end up beating the index.

And, well… that could also likely lead to beating pretty much any other spot to put your money into in the current economic climate.

So, some basic metrics to become familiar with when starting out –

Price to Earnings (P/E ratio): yes, I know this is to speculative/meme investors what kryptonite is to Superman, but it’s one of the most basic figures to determine at least one main aspect of a company’s general value relative to the share price.

It’s also good because it can somewhat be scaled to match your level of risk tolerance. If you want ‘riskier’ stuff, then at the most basic level you can just scale the P/E ratio higher.

Of course, this doesn’t work for speculative stuff that doesn’t actually have a P/E ratio (you need Earnings to have an ‘E’).

In those cases, I tend to use the official ASX Website, Commsec (see below in Section 4) or a similar tool to review the “Company Financials” section and look at the yearly revenue, to see if it’s at least trending up as a substitute.

When most analysts out there say that “the stock market is currently overvalued”, they are typically looking at its total P/E ratio vs. its historic averages.

In this case, the higher the ratio = the more and more ‘overvalued’, and possibly, “risky” a company is to invest in.

At time of writing, there are 1846 ASX companies listed on Tradingview in total; if I put in a P/E Ratio of Below 30 into its filters as a starting point, that number quickly drops to 452.

Immediately, this is something of a telltale sign of how many listed companies aren’t earning decent coin relative to their share price.

Just remember, that P/E figures are backward facing and based on past earnings, and that ‘past performance is not necessarily an indicator of future performance’.

It’s more of a solid foundation to provide security that the business has proven their model can actually generate revenue, and turn that revenue into profit.

This totally depends on how risky you want to go, and the lower the P/E number, generally the lower the “rocket potential” will be for growth as well (but still not always).

Return on Equity (RoE): literally, shows how much income they made vs. the amount of investment the shareholders own.

Again, this is a nice way to show how well a company uses the investments they get to make profit. The higher = the better they are at making money from equity. Let’s set this to a minimum of 30 for the sake of this discussion.

Performance – yearly: this is how what I try and do differs from typical “value investing” a.k.a pure Warren Buffet style ‘Boomer’ stuff.

This style often traditionally tells you to find businesses that have been down and in the red for the past X amount of time but are actually worth more, buy in at a bargain price and be patient, blah blah. A valid investment style for sure, but not the focus of this post.

I prefer to look at companies with strong fundamentals that have been in the green over the past year as a sort of inherent ‘sentiment filter’, and continue to ride their wave.

I just set this to “greater than 0” personally:

That brings us to 76 companies that qualify at time of writing.

Here’s an example of why the “sentiment factor” matters. Let’s take a look at the company Magellan Financial Group (MFG), which otherwise almost always scores quite high on ‘fundamental’ filters like this.

Poor old MFG is a rock-solid company, that has a strong track record, is highly profitable, has a reasonably low P/E ratio, has had continually growing revenue… yet take a look at its share price performance during the second half of 2021:

https://www.marketindex.com.au/asx/mfg

Looking at raw ‘fundamental’ value on these filters, you’d think there would be no reason why this company wouldn’t be soaring.

However because it doesn’t have very positive sentiment as a result of a single year worth of fund underperformance & some management controversies, it wouldn’t pass the cut here even if that seems illogical.

I also like to put 6 month (and maybe even 3 month) performance filters to “greater than 0” as well, so you can see stocks which still have good sentiment in more recent days given most companies provide some kind of update quarterly, or at least during their half-yearly.

Let’s set this to “Above 0” for yearly, 6-monthly, and 3-monthly.

So with the filters of: P/E Ratio <30; Return on Equity >30; Yearly + 6 + 3 month Performance >0, we’re already down to only ~32 companies on the whole ASX!

So what next?

Market Cap: in the most basic terms, how ‘big’ the company is. Not literally, of course, but relative to its valuation listing on the market – its number of shares, versus its current share price.

A note for the newbies on Market Cap: don’t think that because a company has a “lower share price” than another company as its raw dollar figure that it’s therefore “cheaper”; it doesn’t work that way. You need to look at the total market cap figure instead.

You’ll see in this filter that most of the stocks at the top of the Market Cap sorted list are some of the larger, ‘Boomer Stock’ names you’ll no doubt recognise. However, by filtering this way it shows companies of all sizes which still have some rock-solid fundamentals and positive recent sentiment as well.

But hey, we’re not here to see the same tired blue chips.

So, go ahead and Sort that Market Cap column from Low to High instead and take a look at some of the smaller companies, as these potentially can have more leeway for rapid growth than their more massive and established counterparts:

Some of the more innovative and upcoming companies on the ASX can be found this way, and this is generally the space I like to dabble in.

If that’s what you’re after, go for it and then jump down to the next step; but remember you can also toggle the Sector filter and get rid of any companies in spaces you’re not particularly interested in.

Oh, what do you know – there’s TPC Consolidated (ASX:TPC) which has climbed quite consistently over 12 months, nice.

Feel free to browse through its Balance Sheet column and have a look at some juicy financials for a small company if you have the time, or take a look at some of the other companies within the smallcap space that pique your interest.

Otherwise, let’s use it as the example for the next step, seeing we don’t really know much about the company other than these raw numbers.

The next place you’ll likely want to go is here:

TOOL #2 – MarketIndex’s Company Profiles

https://www.marketindex.com.au/

Why? Great site, fast, simple, clean UI. It’s just an excellent, lightweight and well-designed site (and Aussie-made, too) that covers pretty much all the “at a glance” info you need.

Just search for any stock ticker (will use TPC for this example) in the search bar, and you’ll be directed to its profile page:

https://www.marketindex.com.au/asx/tpc

What we want from here is to scroll down to the Announcements section, and click on the “Price Sensitive Only” filter so we can see all the most important company public announcements made to the ASX.

Find the most recent quarterly update or half-yearly report, and take the time to absorb what the company has achieved over the past financial period.

If you’ve got a short attention span, at least familiarise yourself properly with the Financials section if you couldn’t be bothered reading the more vague ‘fluff’ parts of the report.

Does it look like their year on year trends are growing? If so, is it decent growth? Is there anything that could be warping the numbers (i.e: did they get an injection of JobKeeper? Did they sell some assets off so it makes their income numbers look better than they actually are? Do they have plans to diversify from mining to uranium-powered dildos?)

You can learn a lot about a company from a scan of these.

This is also often a good time to have a look at the management team; most company reports will have a cheesy “Our People” section with each of the bigwigs (here’s Novonix (NVX) as an example):

For those in control of the company, it doesn’t hurt to have a look at some of the past companies they’ve been involved in and see how they fared.

Did they bomb? Were they kicked out or was there some dodgy shit covered in the media before they left? All worth factoring in.

LinkedIn can be your friend here as it details past work history.

If you’re still happy, then you may want to go back and toggle off the Price Sensitive Only filter and have a look at recent announcements for Insider buy-ins or sell-offs.

It’s not the be-all and end-all, but a lot of people consider it a bad sign if management of the company are continually selling off their slices of ownership – why would they give a damn if the company does well if they’re not fully invested themselves?

Once you’re pretty confident with all of the above and have spent enough time assessing the company, you’re probably approaching the point where you will have more of a decent handle on where the company currently stands.

Something else that can provide another way to visualise things is…

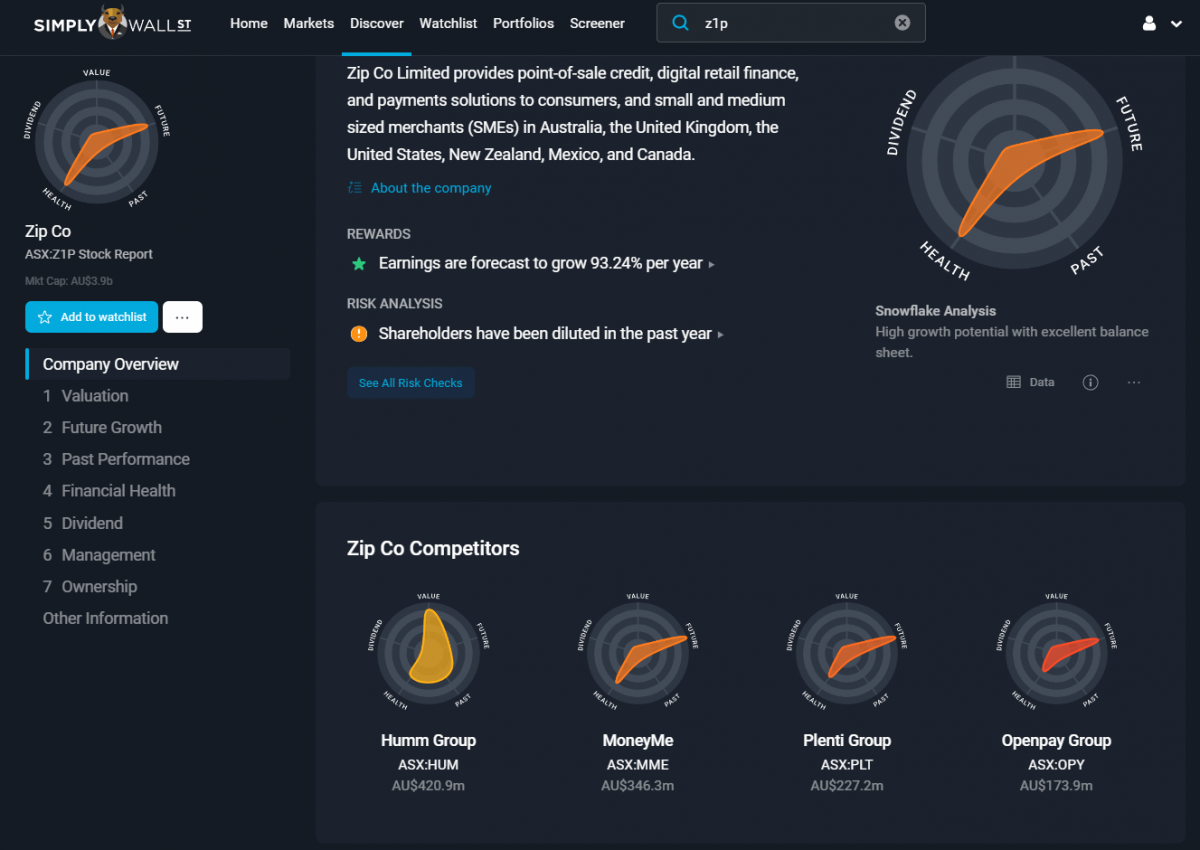

TOOL #3 – Simply Wall Street’s Insider Ownership, Buying & Selling

One other nice little thing I sometimes like to do is jump onto Simply Wall Street and chuck the company into their search bar.

It’s not perfect, but it’s a decent “surface level” reinforcement about where the company sits in an easy-to-digest visual format.

If their unique “Snowflake” widget they provide on each company isn’t totally red, then the company has at least some fundamentals to base your investment on:

Again, if you’re after companies like Z1P that are trading on PURE sentiment with just revenue and no real path to profitability, they still show up looking pretty badly here.

However, if you’re after purely riskier growth companies, then they provide the ability to filter by that metric as well – and again, they’re an Aussie company, so it’s always nice to see locally-produced software.

One thing in particular that Simply WallSt does better than most other platforms is shows the at-a-glance summary of insider ownership and insider buying/selling:

I especially like to look for an Insider Ownership profile that has a strong mix of board ownership, institutional ownership, or funds/venture capital backing the company. If they’re heavily invested, they typically want to see returns on their own money.

This is opposed to stocks in which retail investors (a.k.a, us regular peasants) hold ridiculous amounts of the company vs. ownership. These types of stocks are often scenarios with hundreds/thousands of retail bagholders praying for positive news to get out of the stock.

In other words, something like this = usually good:

… and something like this = usually bad:

Another last thing worth mentioning numbers-wise before you may finally commit to investing is that it’s probably worth having a glance at the…

TOOL #4 – Commsec’s Buyer-to-Seller Ratio

Buy/Sell ratio: the ASX is literally a market, and mostly works on basic supply and demand like any other economy. E.g: the more people want something and the less people willing to give it up, the more likely the price is to be driven up.

Commsec (https://www.commsec.com.au/) is the best platform for seeing this in real-time; you don’t need to actually pay to trade with Commsec, just have an account so you can see this list.

If there’s a lot fewer sellers than buyers, and a heavier total buy volume, then it’s usually a good sign that that the stock is currently in demand, and hopefully it won’t be dumped.

Bear in mind this is just a real-time snapshot, and can also change quickly if there’s a lot of people jumping on and off (usually happens with the ‘meme stocks’ that are ‘trending’ or being pumped and dumped, and those with higher liquidity in general.)

As a result, it’s often best to keep an eye on how the volumes are tracking over a more extended period of time before jumping in. Again, CommSec provides a nice breakdown of each stock’s liquidity including its average Buy/Sell on an annual basis:

However, many of the lower-market-cap profitable smallcaps on the ASX have low levels of liquidity/daily transactional volumes, which can alleviate this somewhat as a factor in this particular use-case.

TOOL #5 – Google News

Lastly, it’s always handy to do a quick search via trusty old Google News.

Missing out on a key bit of media coverage as to recent conduct or management decisions related to the company you’re considering can be a key mistake.

Unfortunately, there are no real decent (Aussie) stocks websites out there that allow you to view a feed of news from sites all across the web, related to the specific stocks you’re after and/or already currently hold. (Note to the developers out there: I’d pay a subscription fee for something like this).

As a result, a quick Google serves as the next-closest thing. At the very least, you might come across a syndicated version of a key achievement or announcement the company made that you’ve missed via the above steps.

To do this, I simply go to Google, click the News tab, search for the company name & ticker code, and choose “Past Year” from the time filter dropdown menu to ensure the news is reasonably current.

If you’re dabbling in the small cap space, you may struggle to find relevant news out there as there’s not too much media within Australia dedicated to smaller companies (outside of the mining industry).

However if the stock is mid-cap size & above there’s almost certain to be some coverage that Google has indexed.

One thing to be careful of with this: Google seems to love Simply Wall Street’s “AI-generated” robot articles for some reason, and given on some stocks there’s no real news to compete, it can rank top of the list.

These articles are just dynamically-generated SEO spam, and while you can get a word-based summary of the Simply Wall Street numbers from it, remember it’s not any actual assessment written by a real person/analyst.

So, that’s about it – again, you can play around with setting the filter numbers higher or lower in Tradingview to scale things accordingly if you want riskier stuff and depending on your own risk tolerance, which is fine.

I personally just don’t see the logic in gambling money into companies that literally can’t prove they can make cash, when there are nearly 2000 companies in total to choose from. But that’s just me, ’cause I am a wuss and unprofitable companies mostly spook me.

And that’s how I do my basic, initial due diligence – how about you? Let us know in the comments below.