Each week I’ll be picking a random ASX stock that I’ve rarely seen discussed online – and that I do NOT hold – that you voted for, for us to dive into for some Due Diligence (“DD”).

This is for us to have a look at what it does, comb over their financials, and conduct some polling on general sentiment. Not all of these stocks may be sexy or appealing; the whole point is to shine a light on what companies are doing out there on the ASX which never get much coverage – for good or bad.

The main purpose being to add some more variety in coverage to the standard blue chips or meme stocks we see pumped day in and day out, and hopefully discover some hidden gems or innovative companies on the Aussie market.

Here’s this week’s Random Stock of the Week.

Company name: Atlas Pearls

Ticker: ATP

Industry: Luxury Goods

Headquarters: Perth, WA

Market cap: ~$23m

Current share price: ~$0.05

1-year Performance: +354.55%%

What they do, smoothbrain version: produce the pearl necklaces your wife’s boyfriend gives to her.

What they say they do, wanky version: “Atlas Pearls has an enviable reputation as a global leader in eco-pearling, specialising in the Pinctada maxima, producing beautiful

and highly sought after silver and white South Sea pearls.” 🍆👋

What they do, actual version: Owners of seven pearl farms dotted throughout the Indonesian islands, Atlas Pearls (ATP) are a Western Australian business who are one of the world’s largest growers and sellers of premium white and silver South Sea pearls.

Established in the 1990’s, the company specialises in raising, growing & harvesting operations for the Pintada maxima species of oyster, which are renowned for the size and quality of the pearls they produce.

These oysters only grow in the nutrient-rich waters found around the Indonesian archipelago, and being saltwater pearls – which take longer to produce than their freshwater counterparts – fetch a premium price point.

ATP use a process to ‘selectively breed’ oysters in order to maximise their genetics conducive to pearl quality, then run a careful multi-year maintenance program to ensure the oysters are grown, cleaned & transported in only the most optimal conditions.

Even despite all of this extra effort and labour, in the end of the 4-year process only around 50% of the pearls harvested will be considered of suitable “commercial” grade.

Their operation is wholly sustainable and eco-friendly, and participates in a variety of environmental programs that help the oysters themselves contribute to the overall health of the reefs nearby. The oysters are transported to different farms at differing parts of their life stage to reduce risks of algae & environmental factors that would inhibit pearl production.

The company is mainly a trade-focused “B2B” operation instead of a retail one, selling pearls in bulk quantities to a range of commercial partners around the world.

This traditionally involved attending flagship in-person physical auctions and other sales events, with monthly auctions at their storefront in Bali, and other viewing events dotted throughout the year in Japan & Hong Kong where their product is highly popular.

Atlas employs over 900 workers – many of which are part-time Indonesians who assist in manual harvesting of the pearls themselves. All up, it now harvests over 500,000 pearls each year, having steadily increased their pearl production consistently for the past 5 years, and with 2021 in particular a bumper year with harvest numbers clocking in at over 560,000.

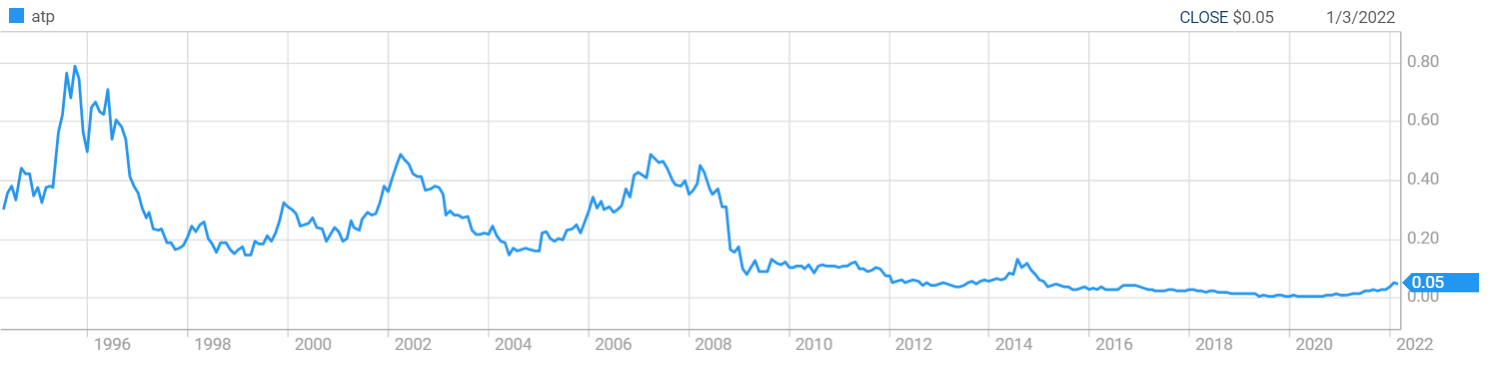

ATP has been listed on the ASX for over 25 years; its share price peaked at $0.80 wayyy back in 1996, and fluctuated steadily downward year on year thereafter.

Factors such as unpredictable seasonality, issues with harvest sizes, declining pearl sizes & quality grades, and a lack of management’s ability to keep operational costs under control all combined for a gradual loss of faith among shareholders.

Its stock hit all-time-lows of under 1 cent in 2019-2020, as average pearl sizes and grades hit their all-time lows and the company seemed to be a regular loss-making enterprise with no real concrete plan moving forward.

The turnaround for ATP’s performance started in mid-2020, with a couple of contributing factors all chipping in. First, Atlas underwent a management restructure towards the tail end of 2019, and the next year a decision was made to sell off an under-producing asset.

ATP had originally purchased a stake in perfume producer Essential Oils Tasmania in 2013, and after years of it going nowhere, sold off its holding in June 2020 for a cash injection of $1.5 million.

Secondly, the company also made the decision to extend harvest times for their pearls to an ideal 24-month growing period for consistency of harvest quality & operations, which also coincided in an uptick in the quality and size of their pearl inventory.

Covid-19 had also hit by this time, and while the initial fear was that travel restrictions, lockdowns and the newly-imposed physical interaction restrictions on Indonesia would have negative effects on the business, it in fact ended up having the opposite impact.

This was largely due to Atlas deciding to close their retail stores, and focus on developing an online platform for conducting their auctions and allowing the digital sale of pearls and clearing of more inventory.

They held 11 online auction sales throughout FY 2021, selling over 82,000 pearls online for a total direct online revenue of over $3.3 million through trade customers, enabling them to buy in bulk.

The newfound distribution channel also would allow them to conduct more frequent online auctions throughout the year at times of their choosing, rather than being limited to only the semi-regular scheduled in-person auctions.

While it only accounted for 18% of their revenue, it was so successful the company has now committed to conducting an omnichannel approach in which auctions are conducted physically and online in parallel in order to maximise bid values & eyeballs.

All of these improvements – along with solid cost-efficiencies implemented by updated management policies – resulted in a series of increasingly positive financial reports quarter after quarter for most of the rest of 2020 & 2021 that the share price finally gradually began to re-rate to a level more approaching the book value of the company’s assets.

As we sit here after yet another positive report in early 2022 causing another share price spike, how does Atlas Pearls look as an investment moving forward now they’re making substantial profits? And is it sustainable? Let’s have a look at the good & bad.

Atlas listed on the ASX in 1993, and over the past 20 years has returned -2.35% p.a. annualised (including dividends).

What looks good:

- For quite a long time, ATP has been extremely undervalued based on simple ‘pure’, basic fundamentals given its assets. Even after its recent sharp share price spikes, and even when building its current debt (around $2.5 million) into its market cap, taking basic ratios such as its Price to Earnings (~1.6) and Price to Book (~1) still makes it look pretty damn cheap given where it sits at time of writing.

- At its current ~$21m market cap with over $31m of total assets (!), even though there is typically a 20% discount given to what are considered “biological assets” due to their increased vulnerability, this still looks underpriced.

- ATP reported the following improvements year on year for 2021: revenue up 81%, NTA per share up 111%, EPS up 73%. This caused the share price to jump up from $0.04 to $0.05; a 25% increase… for a more than 100% increase in tangible assets. Again, an indicator of still being undervalued despite recent spikes.

-

If we take the company’s figures of 82,000 pearls combining for a $3.3 million revenue figure, that equates to a price of about $40 per pearl achieved through trade partners….

- Yet, if ATP can properly devise a way to add more retail as a viable sales channel (particularly online), where the markup for these pearls and pearl jewellery is massive (and pearls sell for hundreds of dollars apiece depending on grade), the potential for hugely increased margins is pretty tantalising.

- Their 2020 to 2021 EBITDA increase from $178,000 to $5.6 million was pretty eye-popping, and you’d hope that this is indicative of a future trend rather than a one-off.

- They have used some of their revenue over the past year to acquire an additional sea lease in the waters of West Lembata for another farm area to add more volume & aquatic diversity to existing operations.

- Year on year, the company harvested 462,530 pearls in 2020 vs 562,872 in 2021 (a 21% increase).

- They’ve stated in their most recent update that they’re aiming to sell 75,000 pearls over the next quarter, which if maintained on an annualised basis of 300k per year, at the average price of $40 per pearl means $12m of revenue as a baseline – not accounting for any higher achieved price increases.

- The company has continued to sensibly pay down their debt/loan with main shareholder-backed creditor Boneyard Industries instead of hinting at a dividend policy, continually making their balance sheet look less risky:

- In tail-end 2021 and now through to 2022, Covid lockdowns have been decreasing in Indonesia which should have onflow effects in terms of both accessing in-person sales events and smoother running of operations.

- They’re largely a sustainable business that’s eco-friendly in the “agricultural” (sort of) space; this prevents it from being subject to any anti-ESG sentiment tailwinds, and may in fact benefit from these if it starts to garner any eyeballs from instos moving forward.

- Since the start of their recent turnaround, the company has been doing a better job of cost control and reducing overall unnecessary capex numbers/costs, with a decrease from $2.7m to $2.1m over the previous year’s quarter, which translates to another nearly $2.5 million per year in profit just from these savings.

- Pearl quality – one of their chief drivers of profit that continually declined over the past couple of decades – looks to be on the rebound as of 2020 onward. If this can continue (or at least stabilise instead of declining), it would lead to their recent higher margins being maintained & then scale with volume accordingly.

- They reported increased average sell price for pearls of nearly 6% higher vs 2020; can this be repeated? If this was applied to 2021 resulting in a $42.4 average price per pearl, the onflow effects to revenue would be significant.

- Management/insiders still own a pretty decent proportion of the shares on issue, and will be incentivised to keep the share price growing strong:

- Likewise, there has been some mild levels of on-market buying by insider owners over the past year (especially given the tiny market cap size of the company), and no insiders selling off their shares. All indications are they know the turnaround is underway, passing on a small degree confidence to retail:

- Their online auction system granting more favourable margins has a multiplicative effect; if they can increase this from the 18% figure reported recently, this too will contribute strongly to the bottom line.

- The company has given strong indications that global pearl demand has been on an uptick over the past couple of years, as retail spending on luxury goods has increased.

- Subjectively, their front-facing website/storefront/brand looks quite good, and has a premium feel brand-wise. It’s all too common to come across ASX micro-caps that have shitty digital/design assets that look like they were made by a graduate in powerpoint, but there’s a degree of quality here that at least shows care and effort (which carries over to their annual report/company comms designs too).

What doesn’t look good:

- ATP as a stock experiences very low average daily trade volume. Only around a meagre few tens of grand’s worth of stock has changed hands each day on average over the past several months, and it can occasionally go days without any shares changing hands at all.

- This lack of liquidity reflects both on the lack of attention given to the stock as a whole (and likely a contributor to it being potentially undervalued), and makes it harder to get in or out:

- Environmental & seasonal businesses’ success can vary wildly year to year due to issues outside of management and operational control. While the company has a strong inventory at the moment, if they do increase sales levels and then an unexpected environmental effect damages a harvest, it will immediately impact their revenues on a fairly drastic level as the company will be playing “catch up” with regards to oyster/pearl supply.

- This performance turnaround has only been a recent occurrence, with years – in fact, decades – of the company being an underperformer and lacking any kind of strong track record as a business and a stock. They’ve flip-flopped between paying dividends, high and manageable debt levels, investing in outside endeavours and everything in between… do you trust that this is really a “new” version of ATP moving forward?

- While they’ve been making an effort to pay it down, debt is still a concern given the unreliability of their revenues from quarter to quarter.

- The on-market purchases by management that have taken place recently have been miniscule and aren’t exactly massive indicators of confidence; none have happened since the share price has recently run up, and those that have taken place are chump change (wow, $8k… slow down, high-roller…) in the grand scheme of things.

- It will be crucial to see whether or not the recovery in pearl size and quality is permanent, or just a temporary blip. The fact that there is literally no way for everyday investors to know or anticipate this makes it even more of a gamble than regular investing in profitable businesses that have more standard inventory/products they have more predictable control over.

- If you’re after a dividend, this will likely be a while away. ATP paid dividends at various points throughout their company history, however this doesn’t seem likely in the immediate future as paying off existing debt is likely to be the first priority.

- Even though it was from near-all-time-lows, the share price has already run hard over the past year, with a 350%+ increase. While this came on the back of strong performance, it makes you wonder how much more gains the market is willing to price in given the company’s somewhat chequered history.

- Was the spike in pearl desirability & retail spend just another side-effect of the overall beneficial conditions that Covid-19 created for some businesses? Jewellery & luxury goods companies on the ASX experienced a pretty common uptick in revenue across the board as people had nothing else to spend their savings on – we saw this reflected in other listed companies such as Michael Hill (MHJ), Lovisa (LOV), etc. in which people splurged on non-essentials that might normally go into travel/tourism, dining out, and similar money-sinks.

Summary: Atlas Pearls looks like a company in which the combination of both change in management optimisations and global sentiment trends for their product – white, high-quality pearls – are colliding at just the right time.

Retailers across the globe have indicated seeing significant upticks in pearl sales & demand since the peak of Covid-19 lockdowns initially curtailed demand, and many retail distributors are reporting some of their best-ever sales results.

In addition, several farms that struggled through the initial portion of the pandemic have ceased production, meaning that there are potentially fewer pearls coming into the market in the next couple of years and granting further pricing power to companies like Atlas.

Many farms in Australian waters (mostly located off the coast of Western Australia) have also been ravaged by disease, leading to further supply issues which do not affect ATP’s holdings in Indonesian seas.

According to the most recent figures released by the Australian Bureau of Agricultural and Resource Economics and Sciences, exports of Australian pearls clocked in at just $56 million in the 2018-19 financial year, compared with $241 million 10 years prior.

Greater macro environmental conditions could be a factor for Atlas, however. While the company takes major precautions to ensure the health of their oyster crops, impacts of global warming & the increase in C02 could throw off the delicate balance that oysters need to build their pearls.

These unknowns aside, what is known is that ATP looks to have finally turned the corner in terms of getting the structural aspects of their business – and finances – into a sustainably profitable format moving forward.

Assuming there are no other major unforeseen external events (and who knows what to expect given the world we’ve been living in the past couple of years), then they’ve become a business where a path to consistent profits is clearly visible as long as pearl demand stays strong.

Conclusion: ATP is the rare case of an ASX micro-cap where the fundamentals are so strong, that the sentiment is mostly what is holding it back – instead of vice-versa.

Usually, companies on this end of the spectrum are hoping they’re able to come up with a business model that might be profitable years down the line, if at all, or are smaller tech that has no physical assets other than their IP to speak of.

ATP is the exact opposite, and as a result whether or not to invest in the stock largely comes down to how much you’re willing to bet on management and the last year or two not being a total one-off miracle.

The company’s past track record is likely building in a strong price discount to the current share price, as is the fragility of their assets. However, over the end of 2021 and first half of 2022, the market seems to finally be taking notice.

Volumes of the stock are up; technical indicators are pointing in the right direction for the first time in years; and the stock has enough built-in asset value that even were it to continue to run up to the ~10c per share mark, it would be hard to call it ‘overvalued’.

Even allowing it a maximum P/E ratio of ~5 to price in some risk could see around the ~20c mark being “fair value” for ATP.

As a result, I remain interested in this stock as a potential purchase, even if I do wish I had followed my gut and gotten in earlier when I first looked at this around the ~3c per share mark.

This is especially true in a position heading further into 2022 in which value investing & fundamentals are starting to come back to the forefront. It’s the same principal that made stocks such as iron ore producer Grange Resources (GRR) such a strong performer; the value proposition is so strong, it is almost bound to eventually shift sentiment, at least until the share price shifts back to a more neutrally-valued level.

Depending how frisky I’m feeling, I may just join the Good Ship ATP and buy in myself at some point in the near future. Just don’t fuck things up please, management.

Company website: https://www.atlaspearls.com.au/

MarketIndex page: https://www.marketindex.com.au/asx/atp

Feel free to add your own opinions on ATP in the comments below.

Would you buy this stock? Why or why not? Feel free to vote in the poll.