Every year, ETFs continue to become more popular as a way both for newcomers to investing to enter the market with access to some instant diversification, or for investors to gain further exposure to a sub-set of the market in a single purchase.

The Australian ETF scene continues to grow as a result, with the major providers of ETFs continuing to cook up new and creative – and some would say, unnecessarily niche – ETFs serving a particular theme.

As a result, the sheer quantity of available ETFs for aspiring Aussie investors can be a little overwhelming; how do you choose the ‘best’ Australian ETF for yourself when there are now so many?

Let’s take a look at the basics on what the best ETF might be for your particular investing style. But first…

Full list of Australian ETFs

To start, here’s a spreadsheet of the current full list of Aussie ETFs you can choose from. It continues to grow regularly, as more and more niche sector ETFs are continually being invented, but we’ll do our best to keep this current:

| Ticker | ETF Name | Management Fee | Purpose/Sector | Inception Date | Return (p.a, compounded, inc. dividends) |

|---|---|---|---|---|---|

| A200 | BetaShares A200 | 0.07% | Tracks the ASX200. | 08 May 2018 | 9.89% |

| AAA | BetaShares Australian High Interest Cash | 0.18% | Regular income-producing ETF. | 08 Mar 2012 | 2.08% |

| AASF | Airlie Australian Share Fund (MF) | 0.78% | Australian ETF focusing on a bottom-up strategy. | 04 Jun 2020 | 26.35% |

| ACDC | ETFS Battery Tech & Lithium | 0.69% | ETF containing a mixture of companies oriented around battery technology. | 03 Sep 2018 | 24.35% |

| ADEF | Apostle Dundas Global Equity Fund | 0.90% | Managed fund with a globally diversified portfolio of companies. | 24 Feb 2021 | 31.36% |

| AGVT | Australian Government Bond | 0.22% | Australian government bonds ETF. | 11 Jul 2019 | 0.74% |

| AGX1 | Antipodes Global Shares (MF) | 1.10% | ETF consisting of 30 global holdings oriented around finding undervalued opportunities. | 07 Nov 2018 | 10.57% |

| ASIA | BetaShares Asia Technology Tigers | 0.67% | Asian ETF featuring Asia's top technology companies. | 21 Sep 2018 | 17.59% |

| ATEC | BetaShares S&P/ASX Australian Technology | 0.48% | Australian ETF featuring Australia's top technology companies. | 05 Mar 2020 | 34.63% |

| AUDS | BetaShares Strong Australian Dollar (MF) | 1.38% | Tracks the Australian Dollar vs. the USD. | 30 Jan 2017 | -7.18% |

| AUMF | iShares Edge MSCI Australia Multifactor ETF | 0.30% | Tracks a subsec of the MSCI Australia IM with additional factors overlaid. | 26 Oct 2016 | 9.47% |

| AUST | BetaShares Managed Risk Australian Share Fund (MF) | 0.49% | ETF tracking the performance of 200 of Australia's largest companies. | 10 Nov 2015 | 6.31% |

| BBOZ | BetaShares Australian Equities Strong Bear Hedge Fund (MF) | 1.38% | ETF used for shorting the performance of the ASX200. | 20 Apr 2015 | -18.23% |

| BBUS | BetaShares U.S. Equities Strong Bear Fund | 1.38% | ETF used for shorting the performance of the S&P500. | 26 Aug 2015 | -36.65% |

| BEAR | BetaShares Australian Equities Bear Hedge Fund | 1.38% | ETF used for shorting the performance of the ASX200. | 09 Jul 2012 | -9.89% |

| BILL | iShares Core Cash | 0.07% | ETF oriented around capital preservation. | 20 Jun 2017 | 1.00% |

| BNDS | BetaShares Legg Mason Australian Bond (MF) | 0.42% | ETF with a diversified portfolio of Australian bonds. | 19 Nov 2018 | 3.37% |

| BNKS | BetaShares Global Banks ETF - Currency Hedged | 0.57% | Global ETF featuring a range of prominent banks, excluding Australia. | 01 Aug 2016 | 8.10% |

| BOND | SPDR S&P/ASX Australian Bond Fund | 0.24% | Australian fixed rate bond market ETF. | 27 Jul 2012 | 3.17% |

| CETF | VanEck Vectors ChinaAMC A-Share | 0.60% | ETF focused on 50 of China's largest listed companies. | 26 Jun 2015 | 0.31% |

| CLDD | BetaShares Cloud Computing | 0.67% | Global ETF consisting of companies that work within the cloud computing sector. | 24 Feb 2021 | 11.65% |

| CLNE | VanEck Vectors Global Clean Energy | 0.65% | Global ETF consisting of 30 companies involved in clean energy production. | 10 Mar 2021 | -1.21% |

| CNEW | VanEck Vectors China New Economy | 0.95% | ETF that tracks a range of fundamentally-sound Chinese growth companies. | 09 Nov 2018 | 25.64% |

| CORE | ETFS Global Core Infrastructure | 0.45% | Developed markets infrastracture companies ETF. | 21 Sep 2017 | 0.03% |

| CRED | BetaShares Australian Investment Grade Corporate Bond | 0.25% | Fixed-rate Australian corporate bonds ETF. | 05 Jun 2018 | 5.13% |

| CRYP | BetaShares Crypto Innovators ETF | 0.67% | Global ETF focused on companies involved in cryptocurrency. | 04 Nov 2021 | -18.23% |

| CURE | ETFS S&P Biotech | 0.45% | US ETF focused on the biotech subsector of the healthcare sector. | 12 Nov 2018 | 12.33% |

| DBBF | BetaShares Ethical Diversified Balanced | 0.39% | Globally diversified ETF with a 50% allocation to stocks and 50% allocation to bonds, with an ethical overlay. | 11 Dec 2019 | 7.30% |

| DGGF | Betashares Diversified Growth | 0.39% | Globally diversified ETF with a 70% allocation to stocks and 30% allocation to bonds. | 10 Dec 2019 | 9.68% |

| DHHF | Betashares Diversified High Growth | 0.19% | Globally diversified ETF with a 100% allocation to stocks. | 05 Dec 2019 | 12.79% |

| DJRE | SPDR® Dow Jones® Global Real Estate Fund | 0.50% | Tracks a global portfolio of REITs & real estate investments. | 15 Nov 2013 | 9.09% |

| DMKT | AMP Capital Dynamic Markets Fund (MF) | 0.61% | Fund that employs dynamic allocation among mix of markets & sectors. | 05 Aug 2016 | -0.17% |

| DRUG | BetaShares Global Healthcare ETF - Currency Hedged | 0.47% | Global ETF focused on healthcare companies, excluding Australia. | 09 Aug 2016 | 10.46% |

| DVDY | Vaneck Vectors Morningstar Australian Moat Income | 0.35% | Income-focused ETF oriented around 25 high yield Australian companies that meet Morningstar's critera. | 10 Sep 2020 | 18.54% |

| DZZF | Betashares Diversified Conservative Income | 0.39% | Globally diversified ETF balanced between 90% stocks & 10% bonds, with an ethical overlay. | 12 Dec 2019 | 10.59% |

| E200 | SPDR S&P/ASX 200 Esg | 0.13% | Tracks the ASX200 ESG Index. | 05 Aug 2020 | 21.19% |

| EBND | VanEck Emerging Income Opportunities Active (MF) | 0.95% | Globally diversified bonds & currencies ETF. | 13 Feb 2020 | -0.01% |

| EEU | BetaShares Euro ETF | 0.45% | Tracks the price of the Euro vs. the AUD. | 11 Jul 2011 | 1.16% |

| EIGA | eInvest Income Generator Fund (MF) | 0.80% | Diversified ETF oriented around providing monthly dividend income. | 07 May 2018 | 4.88% |

| EINC | BetaShares Legg Mason Equity Income Fund (MF) | 0.85% | Australian ETF oriented around providing quarterly dividend income. | 19 Feb 2018 | 5.32% |

| EMKT | VanEck Vectors MSCI Multifactor Emerging Markets Equity | 0.69% | Emerging markets ETF with a focus on "quality" indicators. | 12 Apr 2018 | 4.39% |

| EMMG | BetaShares Legg Mason Emerging Markets Fund (MF) | 1.00% | Global ETF of companies in fast-growing international economies. | 11 Jun 2019 | 13.51% |

| ERTH | BetaShares Climate Change Innovation | 0.65% | Global ETF of companies that aim to reduce their C02 emissions. | 11 Mar 2021 | 14.15% |

| ESGI | VanEck Vectors MSCI International Sustainable Equity | 0.55% | Global ETF tracking sustainable companies, excluding Australia. | 08 Mar 2018 | 13.54% |

| ESPO | Vaneck Vectors Video Gaming and Esports | 0.55% | Global ETF tracking video game & e-sports companies. | 10 Sep 2020 | 10.81% |

| ESTX | ETFS EURO STOXX 50 | 0.35% | Tracks the top 50 listed companies on the EUROSTOXX. | 21 Jul 2016 | 10.31% |

| ETHI | BetaShares Global Sustainability Leaders | 0.59% | Global ETF tracking 100 environmentally-conscious companies, excluding Australia. | 09 Jan 2017 | 21.13% |

| ETPMAG | ETFS Physical Silver | 0.49% | Tracks the spot price of silver. | 02 Feb 2009 | 3.14% |

| ETPMPD | ETFS Physical Palladium | 0.49% | Tracks the spot price of palladium. | 04 Feb 2009 | 17.51% |

| ETPMPM | ETFS Physical PM Basket | 0.44% | Tracks the spot price of gold, silver, platinum and pallidum. | 02 Feb 2009 | 4.86% |

| ETPMPT | ETFS Physical Platinum | 0.49% | Tracks the platinum spot price. | 04 Feb 2009 | -1.26% |

| EX20 | BetaShares Australian Ex-20 Portfolio Diversifier | 0.25% | Tracks the companies in the ASX200, that aren't in the ASX20. | 07 Oct 2016 | 10.21% |

| F100 | BetaShares FTSE 100 ETF | 0.45% | Tracks the largest 100 companies on the London Stock Exchange. | 16 Jul 2019 | 3.79% |

| FAIR | BetaShares Australian Sustainability Leaders | 0.49% | Australian ETF focused on sustainable & ethical companies. | 29 Nov 2017 | 10.45% |

| FANG | ETFs Fang+ | 0.35% | ETF containing high-growth technology companies, largely in the US. | 02 Mar 2020 | 44.89% |

| FEMX | Fidelity Global Emerging Markets Fund | 0.99% | Emerging markets ETF featuring between 30 & 50 global companies. | 05 Nov 2018 | 17.78% |

| FLOT | VanEck Vectors Australian Floating Rate | 0.22% | Australian Floaing Rate Bonds ETF. | 07 Jul 2017 | 1.70% |

| FOOD | BetaShares Global Agriculture Companies ETF - Currency Hedged | 0.57% | Global food & agriculture companies ETF, excluding Australia, AUD hedged. | 04 Aug 2016 | 9.25% |

| FUEL | BetaShares Global Energy Companies - Currency Hedged | 0.57% | Global energy companies ETF, excluding Australia, AUD hedged. | 21 Jun 2016 | 0.96% |

| FUTR | Janus Henderson Global Sustainable Equity Active ETF | 0.80% | ETF oriented around environmental & socially conscientious companies. | 22 Sep 2021 | 2.59% |

| GBND | Betashares Sustainability Leaders Diversified Bond | 0.49% | Global & international bonds, with an ethical screen overlaid. | 28 Nov 2019 | 0.57% |

| GCAP | VanEck Bentham Global Capital Securities Active ETF | 0.59% | Global bonds & similar, excluding Australia. | 05 Aug 2021 | -0.50% |

| GDX | VanEck Vectors Gold Miners | 0.53% | Global gold-mining companies ETF. | 26 Jun 2015 | 10.62% |

| GEAR | BetaShares Geared Australian Equity | 0.80% | Tracks the ASX200 Index, geared. | 02 May 2014 | 9.99% |

| GGOV | Betashares Global Government Bond 20+ Year | 0.22% | High-quality global bonds ETF, AUD hedged. | 12 May 2020 | -2.32% |

| GGUS | BetaShares Geared U.S. Equity Fund - Currency Hedged | 0.80% | Geared exposure to the US market, AUD hedged. | 18 Aug 2015 | 24.84% |

| GOAT | Vaneck Vectors Morningstar World Ex Australia Wide Moat | 0.55% | Global ETF tracking a range of 'wide moat' companies. | 10 Sep 2020 | 21.74% |

| GOLD | ETFS Physical Gold | 0.40% | ETF that tracks the spot price of physical gold. | 28 Mar 2003 | 7.95% |

| GOVT | SPDR® S&P®/ASX Australian Government Bond Fund | 0.22% | Commonwealth and State Government market bond ETF. | 27 Jul 2012 | 3.12% |

| GRNV | VanEck Vectors MSCI Australian Sustainable Equity | 0.35% | Sustainable/environmentally conscious ETF of companies which have passed a screening process. | 03 May 2016 | 6.67% |

| GROW | Schroder Real Return Fund (MF) | 0.90% | Diversified asset cluss fund aiming for a return of CPI plus 5%. | 16 Aug 2016 | 3.86% |

| HACK | BetaShares Global Cybersecurity | 0.67% | Global ETF oriented around companies providing cybersecurity services. | 01 Sep 2016 | 19.95% |

| HBRD | Active Australian Hybrids Fund (MF) | 0.55% | Monthly income-generating ETF oriented around hybrid securities. | 17 Nov 2017 | 4.63% |

| HETH | Betashares Global Sustainability Leaders | 0.62% | Global ETF oriented around companies recognised as environmental leaders. | 22 Jul 2020 | 28.56% |

| HEUR | BetaShares WisdomTree Europe (Currency Hedged) | 0.56% | ETF oriented exclusively around European listed companies, currency hedged | 16 May 2016 | 10.03% |

| HGEN | ETFS Hydrogen ETF | 0.69% | Hydrogen-technology-centric companies ETF. | 07 Oct 2021 | 8.90% |

| HJPN | BetaShares WisdomTree Japan (Currency Hedged) | 0.56% | ETF oriented exclusively around Japanese listed companies. | 16 May 2016 | 11.17% |

| HLTH | Vaneck Vectors Global Healthcare Leaders | 0.45% | Global healthcare ETF aiming for growth, excluding Australia. | 10 Sep 2020 | 16.84% |

| HNDQ | BetaShares NASDAQ 100 ETF - Currency Hedged | 0.51% | Tracks the NASDAQ100, curency hedged. | 22 Jul 2020 | 30.86% |

| HQLT | Betashares Global Quality Leaders | 0.38% | Global ETF consisting of 100 "quality" companies, excluding Australia, AUD hedged. | 11 Jun 2020 | 26.98% |

| HVST | BetaShares Australian Dividend Harvester Fund (managed fund) | 0.90% | Income-oriented ETF designed to provide monthly payouts & maximise franking credits. | 03 Nov 2014 | 2.33% |

| HYGG | Hyperion Global Growth Companies Fund | 0.70% | Global, growth-focused diversified ETF. | 22 Mar 2021 | 20.94% |

| IAA | iShares Asia 50 | 0.50% | Asia-centric ETF covering 50 of the top companies in Asia, excluding Japan. | 10 Sep 2008 | 7.78% |

| IAF | iShares Core Composite Bond | 0.15% | ETF of fixed income bonds issued in the Australian debt market. | 14 Mar 2012 | 3.65% |

| ICOR | Ishares Core Corporate Bond | 0.15% | Australian corporate bonds ETF with ESG/ethical screening filter. | 03 Jun 2020 | 1.08% |

| IEM | iShares MSCI Emerging Markets | 0.68% | Tracks a mix of emerging market companies. | 10 Oct 2007 | 2.44% |

| IESG | iShares Core MSCI Australia ESG Leaders ETF | 0.09% | Ethically-focused Australian securities ETF aiming for outperformance. | 04 Jun 2021 | 9.12% |

| IEU | iShares Europe | 0.59% | Europe-centric ETF tracking a wide range of companies of all sizes. | 10 Oct 2007 | 2.61% |

| IFRA | VanEck Vectors FTSE Global Infrastructure (Hedged) | 0.52% | Global ETF tracking infrastructure companies in developed countries. | 03 May 2016 | 7.64% |

| IGB | iShares Treasury | 0.18% | ETF for fixed income bonds issued by the Australian Treasury. | 14 Mar 2012 | 3.35% |

| IHCB | iShares Core Global Corporate Bond (AUD Hedged) | 0.26% | Global fixed-rate debt ETF, AUD hedged. | 17 Dec 2015 | 4.10% |

| IHD | iShares S&P/ASX Dividend Opportunities | 0.30% | Australian ETF oriented around quality, dividend-paying companies. | 09 Dec 2010 | 4.89% |

| IHEB | iShares J.P. Morgan USD Emerging Markets Bond (AUD Hedged) | 0.51% | US market bonds ETF, AUD hedged. | 14 Dec 2015 | 4.31% |

| IHHY | iShares Global High Yield Bond (AUD Hedged) | 0.56% | Global corporate bonds ETF, AUD hedged. | 14 Dec 2015 | 5.33% |

| IHOO | iShares Global 100 AUD Hedged | 0.43% | Global ETF tracking 100 large companies, AUD hedged. | 22 Dec 2014 | 11.07% |

| IHVV | iShares S&P 500 AUD Hedged | 0.10% | Tracks the S&P500, AUD hedged. | 22 Dec 2014 | 12.54% |

| IHWL | iShares Core MSCI World All Cap (AUD Hedged) | 0.12% | Global ETF covering a wide range of companies, AUD hedged. | 29 Apr 2016 | 14.08% |

| IIGF | Intelligent Investor Australian Equity Growth Fund (MF) | 0.97% | Australian ETF focused around investing in "undervalued" Australian companies. | 06 Oct 2020 | 26.90% |

| IIND | BetaShares India Quality | 0.80% | ETF that tracks 30 of the largest "quality" companies in India. | 06 Aug 2019 | 13.35% |

| IJH | iShares Core S&P Mid-Cap | 0.07% | US ETF tracking a wide range of mid-cap companies. | 11 Oct 2007 | 10.53% |

| IJP | iShares MSCI Japan | 0.49% | ETF oriented exclusively around Japanese listed companies. | 10 Oct 2007 | 3.67% |

| IJR | iShares Core S&P Small-Cap | 0.07% | US ETF containing around 600 small-cap companies. | 10 Oct 2007 | 10.69% |

| IKO | iShares MSCI South Korea Capped | 0.59% | ETF oriented exclusively around South Korean listed companies. | 15 Nov 2007 | 3.56% |

| ILB | iShares Government Inflation | 0.18% | Bonds ETF, for inflation-linked fixed income securities | 14 Mar 2012 | 4.16% |

| ILC | iShares S&P/ASX 20 | 0.24% | Tracks the ASX20 Index. | 09 Dec 2010 | 7.33% |

| IMPQ | Einvest Future Impact Small Caps Fund (MF) | 0.99% | Ethically-focused ETF covering small-cap companies. | 23 May 2019 | 18.11% |

| INCM | Betashares Global Income Leaders | 0.45% | Income-oriented ETF tracking global equities (excluding Australia). | 23 Oct 2018 | 3.30% |

| INES | Intelligent Investor Ethical Share Fund (MF) | 0.97% | Australian, ethically-focused ETF. | 12 Jun 2019 | 19.28% |

| INIF | Intelligent Investor Aus Equity Income Fund (MF) | 0.97% | Aims for returns of 1% above the S&P/ASX Accumulation Index. | 19 Jun 2018 | 7.91% |

| IOO | iShares Global 100 | 0.40% | Global ETF that tracks 100 large-cap companies worldwide. | 10 Oct 2007 | 7.18% |

| IOZ | iShares Core S&P/ASX 200 | 0.09% | Tracks the ASX200 Index. | 09 Dec 2010 | 7.40% |

| ISEC | iShares Enhanced Cash | 0.12% | Passiving investing ETF aimed at outperforming bank bills. | 06 Jun 2017 | 1.19% |

| ISO | iShares S&P/ASX Small Ordinaries | 0.55% | Tracks the companies in the ASX300 that aren't in the ASX100. | 09 Dec 2010 | 3.95% |

| IVE | iShares MSCI EAFE | 0.32% | ETF that tracks companies within Europe, Austral-asia & the Far East. | 10 Oct 2007 | 2.98% |

| IVV | iShares Core S&P 500 | 0.04% | US ETF that tracks the S&P500 while minimising fees. | 10 Oct 2007 | 10.58% |

| IWLD | iShares Core MSCI World All Cap | 0.09% | Global ETF covering a range of market cap sizes that coincide with MSCI's screening process. | 28 Apr 2016 | 14.89% |

| IXI | iShares Global Consumer Staples | 0.46% | Global ETF containing consumer staples-centric companies. | 12 Mar 2009 | 10.25% |

| IXJ | iShares Global Healthcare | 0.46% | Global ETF containing healthcare-centric companies. | 12 Mar 2009 | 13.19% |

| IYLD | Ishares Yield Plus | 0.12% | Australian corporate bonds ETF. | 01 Jun 2020 | 1.30% |

| IZZ | iShares China Large-Cap | 0.74% | Tracks the top 50 listed China companies. | 15 Nov 2007 | -0.26% |

| KSM | K2 Australian Small Cap Fund (MF) | 1.31% | Australian ETF with a diversified portfolio of small & mid-cap companies. | 15 Dec 2015 | 5.82% |

| LNAS | ETFs Ultra Long Nasdaq 100 | 1.00% | Tracks the NASDAQ100 while employing geared returns. | 13 Jul 2020 | 63.17% |

| LPGD | Loftus Peak Global Disruption Fund (MF) | 1.20% | Global ETF focused on businesses with "disruptive" elements. | 09 Nov 2020 | 18.46% |

| LSGE | Loomis Sayles Global Equity Fund | 0.99% | Concentrated portfolio of global ETFs that pass a screening process. | 01 Oct 2021 | 8.47% |

| MAAT | Monash Absolute Active Trust | 1.38% | Australian ETF with a mix of both long & short positions. | 10 Jun 2021 | 10.98% |

| MAET | Munro Global Growth Fund (MF) | 1.35% | Global ETF focused on long-term growth companies. | 02 Nov 2020 | 14.67% |

| MGOC | Magellan Global Fund (Open Class) (MF) | 1.35% | Global ETF consisting of 20 to 40 stocks. | 30 Nov 2020 | 12.76% |

| MHG | Magellan Global Equities Fund (Currency Hedged) MF | 1.35% | Global ETF with currency hedging. | 10 Aug 2015 | 9.88% |

| MHHT | Magellan High Conviction | 1.50% | ETF designed to encompass only "outstanding" companies that are "undervalued". | 31 Aug 2021 | 0.82% |

| MICH | Magellan Infrastructure Fund (MF) | 1.05% | Infrastructure-centric ETF with protections against currency movements. | 22 Jul 2016 | 6.46% |

| MKAX | Montaka Global Extension Fund (MF) | 1.25% | Global ETF that contains a mixture of both long and short investments. | 24 Jun 2020 | 16.33% |

| MNRS | Global Gold Miners ETF - Currency Hedged | 0.49% | Global gold mining companies ETF, hedged to AUD. | 29 Jul 2016 | 3.41% |

| MOAT | VanEck Vectors Morningstar Wide Moat | 0.49% | ETF that contains 20 "quality" global companies according to Morningstar's "moat" rating. | 26 Jun 2015 | 16.73% |

| MOGL | Montgomery Global Equities Fund (MF) | 1.32% | Global portfolio of 15 to 30 diversified companies. | 20 Dec 2017 | 9.10% |

| MVA | VanEck Vectors Australian Property | 0.35% | Tracks the largest Australian listed REITs. | 16 Oct 2013 | 10.33% |

| MVB | VanEck Vectors Australian Banks | 0.28% | Australian banks-centric ETF. | 16 Oct 2013 | 7.41% |

| MVE | VanEck Vectors S&P/ASX MidCap | 0.45% | Australian ETF that tracks those in the ASX100, that aren't in the ASX50. | 16 Oct 2013 | 4.99% |

| MVOL | iShares Edge MSCI Australia Minimum Volatility | 0.30% | Tracks the MSCI Australian index, with a focus on minimising volatility. | 19 Oct 2016 | 8.96% |

| MVR | VanEck Vectors Australian Resources | 0.35% | ETF that tracks a mix of Australian resources companies. | 16 Oct 2013 | 8.45% |

| MVS | VanEck Vectors Small Cap Masters | 0.49% | ETF that tracks a mix of Australian & international small-caps which pay dividends. | 28 May 2015 | 7.79% |

| MVW | VanEck Vectors Australian Equal Weight | 0.35% | Australian ETF covering 75 Australian companies, equally-weighted. | 06 Mar 2014 | 9.75% |

| NDIA | ETFS Reliance India Nifty 50 | 0.80% | Tracks 50 of the largest companies in India. | 21 Jun 2019 | 8.13% |

| NDQ | BetaShares NASDAQ 100 | 0.51% | Tracks the performance of the NASDAQ-100 Index. | 26 May 2015 | 22.70% |

| OOO | BetaShares Crude Oil Index ETF - Currency Hedged (Synthetic) | 0.69% | Tracks the performance of Crude Oil, hedged against movements in the AUD/USD exchange rate. | 16 Nov 2011 | -15.07% |

| OZF | SPDR® S&P®/ASX 200 Financials EX A-REIT Fund | 0.40% | Tracks the ASX200 Financials Ex-A-REIT Index. | 14 Apr 2011 | 7.84% |

| OZR | SPDR® S&P®/ASX 200 Resources Fund | 0.40% | Tracks the ASX200 Resources Index. | 14 Apr 2011 | 1.51% |

| PAXX | Platinum Asia Fund (Quoted Managed Hedge Fund) MF | 1.10% | Asia-centric ETF seeking to track a mix of "undervalued" listed investments in Asia, excluding Japan. | 14 Sep 2017 | 8.04% |

| PIXX | Platinum International Fund (Quoted Managed Hedge Fund) MF | 1.10% | Global ETF seeking to track a mix of "undervalued" listed investments worldwide. | 14 Sep 2017 | 5.98% |

| PLUS | VanEck Vectors Australian Corporate Bond Plus | 0.32% | Australian government and semi-government bonds ETF. | 11 May 2017 | 3.71% |

| PMGOLD | Perth Mint Gold | 0.15% | ETF for tracking physical gold, housed in Western Australia's Perth Mint. | 05 Jan 2011 | 5.63% |

| POU | BetaShares British Pound | 0.45% | Tracks the British Pound vs. the AUD. | 11 Jul 2011 | 1.87% |

| QAU | BetaShares Gold Bullion ETF - Currency Hedged | 0.59% | Tracks the price of gold, hedged against movements in the AUD/USD exchange rate. | 04 May 2011 | 1.28% |

| QFN | BetaShares S&P/ASX 200 Financials Sector | 0.34% | Tracks the ASX200 Financials-x-A-REIT Index. | 15 Dec 2010 | 7.83% |

| QHAL | VanEck Vectors MSCI World ex-Australia Quality Hedged | 0.43% | Global ETF tracking 150 global companies that meet a range of "quality" signals, excluding Australia, hedged to AUD. | 25 Mar 2019 | 22.02% |

| QLTY | BetaShares Global Quality Leaders | 0.35% | Global ETF tracking 150 global companies that meet a range of "quality" signals, excluding Australia. | 08 Nov 2018 | 21.03% |

| QMIX | SPDR® MSCI World Quality Mix Fund | 0.40% | Global ETF tracking a mix of large and mid-cap international companies. | 14 Sep 2015 | 11.79% |

| QOZ | BetaShares FTSE RAFI Australia 200 | 0.40% | Australian ETF that tracks the ASX200. | 11 Jul 2013 | 8.10% |

| QPON | BetaShares Australian Bank Senior Floating Rate Bond | 0.22% | ETF for bonds issued by Australian banks. | 07 Jun 2017 | 2.03% |

| QRE | BetaShares S&P/ASX 200 Resources Sector | 0.34% | Tracks the ASX 200 Resources Index. | 15 Dec 2010 | 1.84% |

| QSML | VanEck MSCI International Small Companies Quality ETF | 0.59% | Global ETF covering a wide range of global small-cap "quality" companies. | 10 Mar 2021 | 17.14% |

| QUAL | VanEck Vectors MSCI World ex-Australia Quality | 0.40% | Global index of "quality" companies from a range of overseas markets, excluding Australia. | 31 Oct 2014 | 17.04% |

| QUS | BetaShares S&P 500 Equal Weight ETF | 0.29% | US ETF that tracks the S&P500 index, with each company within equally-weighted. | 19 Dec 2014 | 11.21% |

| RARI | Russell Australian Responsible Investment | 0.45% | Ethically-focused Australian securities ETF. | 09 Apr 2015 | 5.65% |

| RBTZ | BetaShares Global Robotics and Artificial Intelligence | 0.57% | Global ETF covering a range of prominent robotics & AI companies. | 14 Sep 2018 | 16.38% |

| RCB | Russell Investments Australian Select Corporate Bond | 0.28% | Australian corporate fixed income securities. | 13 Mar 2012 | 3.28% |

| RDV | Russell High Dividend Australian Shares | 0.34% | Australian ETF focused on yield-producing blue-chip companies. | 14 May 2010 | 6.24% |

| REIT | VanEck Vectors FTSE International Property (Hedged) | 0.43% | Global ETF consisting of REITs (excluding Australia) that derive much of their income from rent. | 02 Apr 2019 | 6.08% |

| RGB | Russell Australian Government Bond | 0.24% | ETF for Australian semi-government fixed income securities. | 13 Mar 2012 | 3.75% |

| RINC | BetaShares Legg Mason Real Income Fund (MF) | 0.85% | Tracks a mix of A-REITs, utilities and infrastructure stocks. | 19 Feb 2018 | 7.90% |

| ROBO | ETFS ROBO Global Robotics & Automation | 0.69% | Global ETF focused on a range of robotics companies. | 14 Sep 2017 | 17.66% |

| RSM | Russell Australian Semi-Government Bond | 0.26% | ETF for Australian semi-government fixed income securities. | 13 Mar 2012 | 3.21% |

| SELF | Selfwealth SMSF Leaders (MF) | 0.88% | Broker SelfWealth's index of 75 stocks. | 12 Nov 2019 | 2.74% |

| SEMI | ETFS Semiconductor ETF | 0.57% | Global ETF oriented around prominent semiconductor production & related companies. | 31 Aug 2021 | 13.96% |

| SFY | SPDR S&P/ASX 50 | 0.29% | Tracks the ASX50 Index. | 26 Dec 2001 | 6.48% |

| SLF | SPDR® S&P®/ASX 200 Listed Property Fund | 0.40% | Tracks the ASX200 A-REIT Index. | 18 Feb 2002 | 4.17% |

| SMLL | BetaShares Australian Small Companies Select | 0.39% | Tracks the ASX Small Ordinaries Accumulation Index. | 11 Apr 2017 | 11.11% |

| SNAS | ETFs Ultra Short Nasdaq 100 | 1.00% | ETF used to short the NASDAQ100 index in a single fund. | 13 Jul 2020 | -54.76% |

| SPY | SPDR® S&P 500® ETF Trust | 0.09% | US ETF that tracks the S&P500 index. | 13 Oct 2014 | 17.42% |

| SSO | SPDR® S&P®/ASX Small Ordinaries | 0.50% | Australian ETF that tracks the companies in the ASX300 that aren't in the ASX100. | 13 Apr 2011 | 4.13% |

| STW | SPDR S&P/ASX 200 | 0.13% | Australian ETF that tracks the ASX200. | 26 Dec 2001 | 6.58% |

| SUBD | Vaneck Vectors Australian Subordinated Debt | 0.29% | Australian bonds / subordinated debt ETF in AUD. | 30 Oct 2019 | 2.22% |

| SWTZ | Switzer Dividend Growth Fund (MF) | 0.89% | Income-focused ETF oriented around maximising franking credits. | 24 Feb 2017 | 6.81% |

| SYI | SPDR MSCI Australia Select High Dividend Yield Fund | 0.35% | Australian dividend-focused ETF aiming for higher yield than the average on the ASX. | 29 Sep 2010 | 6.76% |

| TECH | ETFS Morningstar Global Technology | 0.45% | Tracks 25 to 50 global companies covering software & technology. | 11 Apr 2017 | 24.04% |

| UMAX | BetaShares S&P 500 Yield Maximiser Fund | 0.79% | ETF that tracks the S&P500 index's performance while focusing more on regular dividend income. | 19 Sep 2014 | 9.77% |

| USD | BetaShares U.S. Dollar | 0.45% | ETF that tracks the USD vs. the AUD. | 01 Feb 2011 | 3.04% |

| VACF | Vanguard Australian Corporate Fixed Interest Index | 0.26% | Tracks the Bloomberg AusBond Credit 0+ Yr Index. | 25 May 2016 | 3.20% |

| VAE | Vanguard FTSE Asia ex Japan Shares Index | 0.40% | Diversified Asia-centric ETF for prominent Asian countries, excluding Japan. | 11 Dec 2015 | 9.62% |

| VAF | Vanguard Australian Fixed Interest Index | 0.20% | Income-generating, government-issued Australian securities ETF. | 31 Oct 2012 | 3.10% |

| VAP | Vanguard Australian Property Securities Index Fund | 0.23% | Australian ETF that tracks the performance of the ASX300's A-REIT index. | 15 Oct 2010 | 9.55% |

| VAS | Vanguard Australian Shares Index | 0.10% | Australian ETF that tracks the performance of the ASX300. | 08 May 2009 | 8.52% |

| VBLD | Vanguard Global Infrastructure Index | 0.47% | Global infrastructure-focused ETF featuring over 140 companies concerned with infrastructure & construction. | 23 Oct 2018 | 9.98% |

| VBND | Vanguard Global Aggregate Bond Index (Hedged) | 0.20% | Income-generating, government-issued global securities ETF. | 13 Oct 2017 | 2.92% |

| VCF | Vanguard International Credit Securities Index (Hedged) | 0.30% | Income-generating, government-issued global securities ETF. | 08 Dec 2015 | 3.07% |

| VDBA | Vanguard Diversified Balanced Index | 0.27% | Global ETF with 50% bonds, 50% stocks. | 22 Nov 2017 | 7.12% |

| VDCO | Vanguard Diversified Conservative | 0.27% | Global ETF with 70% bonds, 30% stocks. | 23 Nov 2017 | 5.29% |

| VDGR | Vanguard Diversified Growth | 0.27% | Global ETF with 30% bonds, 70% stocks. | 22 Nov 2017 | 8.67% |

| VDHG | Vanguard Diversified High Growth | 0.27% | Global ETF with 10% bonds, 90% stocks. | 22 Nov 2017 | 10.18% |

| VEFI | Vanguard Ethically Conscious Global Aggregate Bond Index (Hedged) | 0.26% | Income-generating, government-issued global securities ETF. | 24 Sep 2018 | 3.43% |

| VEQ | Vanguard FTSE Europe Shares | 0.35% | ETF to track European companies of a range of sizes. | 11 Dec 2015 | 7.43% |

| VESG | Vanguard Ethically Conscious International Shares | 0.18% | Global, ethically-focused diversified companies ETF. | 13 Sep 2018 | 16.38% |

| VETH | Vanguard Ethically Conscious Australian Shares | 0.16% | Australian, ethically-focused diversified companies ETF. | 14 Oct 2020 | 20.48% |

| VEU | Vanguard All-World ex-US Shares Index ETF | 0.08% | Global, large-company ETF excluding the USA. | 12 May 2009 | 6.99% |

| VGAD | Vanguard MSCI Index International Shares (Hedged) | 0.21% | Global, large-company ETF (excluding Australia), with dividends auto-reinvested, Australian currency hedged. | 21 Nov 2014 | 11.16% |

| VGB | Vanguard Australian Government Bond Index | 0.20% | Income-generating, government-issued Australian securities ETF. | 30 Apr 2012 | 3.23% |

| VGE | Vanguard FTSE Emerging Markets Shares | 0.48% | Emerging markets ETF, with dividends auto-reinvested. | 21 Nov 2013 | 7.21% |

| VGMF | Vanguard Global Multi-Factor Active ETF (MF) | 0.33% | Globally-diversified, outperformance-oriented ETF. | 15 Apr 2019 | 11.02% |

| VGS | Vanguard MSCI Index International Shares | 0.18% | Global, large-company ETF (excluding Australia), with dividends auto-reinvested. | 20 Nov 2014 | 12.90% |

| VHY | Vanguard Australian Shares High Yield | 0.25% | ASX-centric ETF focused on high-yielding dividend companies. | 27 May 2011 | 7.99% |

| VIF | Vanguard International Fixed Interest Index (Hedged) | 0.20% | Global government-security income ETF, Australian currency hedged. | 08 Dec 2015 | 2.72% |

| VISM | Vanguard MSCI International Small Companies Index | 0.32% | Global ETF tracking high-performing small-cap companies. | 13 Nov 2018 | 13.11% |

| VLC | Vanguard MSCI Australian Large Companies Index | 0.20% | ETF tracking largest ASX-listed companies & property trusts. | 26 May 2011 | 7.78% |

| VLUE | VanEck MSCI International Value ETF | 0.40% | Global ETF tracking 250 companies with a high "value" indicator. | 10 Mar 2021 | 13.97% |

| VMIN | Vanguard Global Minimum Volatility Active | 0.28% | Global ETF focused on minimising volatility, Australian currency hedged. | 19 Apr 2018 | 6.27% |

| VSO | Vanguard MSCI Australian Small Companies Index | 0.30% | Australian small-cap companies ETF. | 26 May 2011 | 6.50% |

| VTS | Vanguard U.S. Total Market Shares Index | 0.03% | US-centric ETF covering broad range of companies of all sizes, with exceptionally low management fee. | 12 May 2009 | 15.29% |

| VVLU | Vanguard Global Value Equity Active | 0.28% | Global ETF oriented around companies with a high "value" indicator. | 17 Apr 2018 | 7.68% |

| WCMQ | WCM Quality Global Growth Fund (MF) | 1.25% | Global high growth sector ETF. | 03 Sep 2018 | 20.01% |

| WDIV | SPDR® S&P® Global Dividend Fund | 0.50% | High-dividend yield company ETF consisting of stocks with a long track record of solid dividends. | 08 Nov 2013 | 7.00% |

| WDMF | iShares Edge MSCI World Multifactor | 0.35% | Tracks companies of various market caps in 23 worldwide markets. | 20 Oct 2016 | 13.08% |

| WEMG | SPDR® S&P® Emerging Markets Fund | 0.65% | Emerging markets ETF covering large and mid-cap companies. | 15 Nov 2013 | 7.56% |

| WRLD | BetaShares Managed Risk Global Share Fund | 0.54% | Globally diversified shares ETF. | 21 Dec 2015 | 9.59% |

| WVOL | iShares Edge MSCI World Minimum Volatility | 0.30% | ETF for a subsection of the MSCI World Index focused on lower volatility. | 14 Oct 2016 | 10.21% |

| WXHG | SPDR® S&P® World ex-Australia (Hedged) Fund | 0.35% | Global large and mid-cap companies excluding Australia, foreign currency hedged. | 09 Jul 2013 | 10.91% |

| WXOZ | SPDR® S&P® World ex-Australia Fund | 0.30% | Global large and mid-cap companies excluding Australia. | 19 Mar 2013 | 14.93% |

| YANK | BetaShares Strong U.S. Dollar | 1.38% | Tracks the change in the AUD vs. the USD. | 24 Jan 2017 | -0.52% |

| YMAX | BetaShares Australian Top 20 Equity Yield Maximiser Fund (managed fund) | 0.76% | Quarterly income-providing ETF from companies in the ASX20 index. | 26 Nov 2012 | 5.37% |

| ZUSD | ETFS Enhanced USD Cash | 0.30% | Tracks the USD vs. the AUD. | 01 Jul 2015 | 0.63% |

| ZYAU | ETFS S&P/ASX 300 High Yield Plus | 0.35% | ASX300 ETF focused on the highest yielding stocks within the index. | 12 Jun 2015 | 5.68% |

| ZYUS | ETFS S&P 500 High Yield Low Volatility | 0.35% | US stocks ETF aiming for higher dividends than the S&P500. | 12 Jun 2015 | 8.82% |

What is an ETF?

ETF stands for Exchange Traded Fund (please don’t be one of those fools who calls it an “EFT”, which stands for “Electronic Funds Transfer” and makes zero sense) and basically refers to a “bundle” of individual stocks / shares which either track a certain index, or follow a specific theme.

This can be anything from Clean Energy, to Chinese Tech, to Food Producers, all the way up to almost containing the entire global market in a single ETF.

What is the benefit of ETFs?

ETFs allow you to gain exposure to a whole index or sector without having to buy and keep track of tons of individual stocks. They allow for “instant diversification”, and can be ideal for those who couldn’t be bothered doing deep dives into individual companies, keeping track of their financials, selling and buying on certain news, etc.

They’re the ideal “lazy” way to invest – and that’s not said in a negative way.

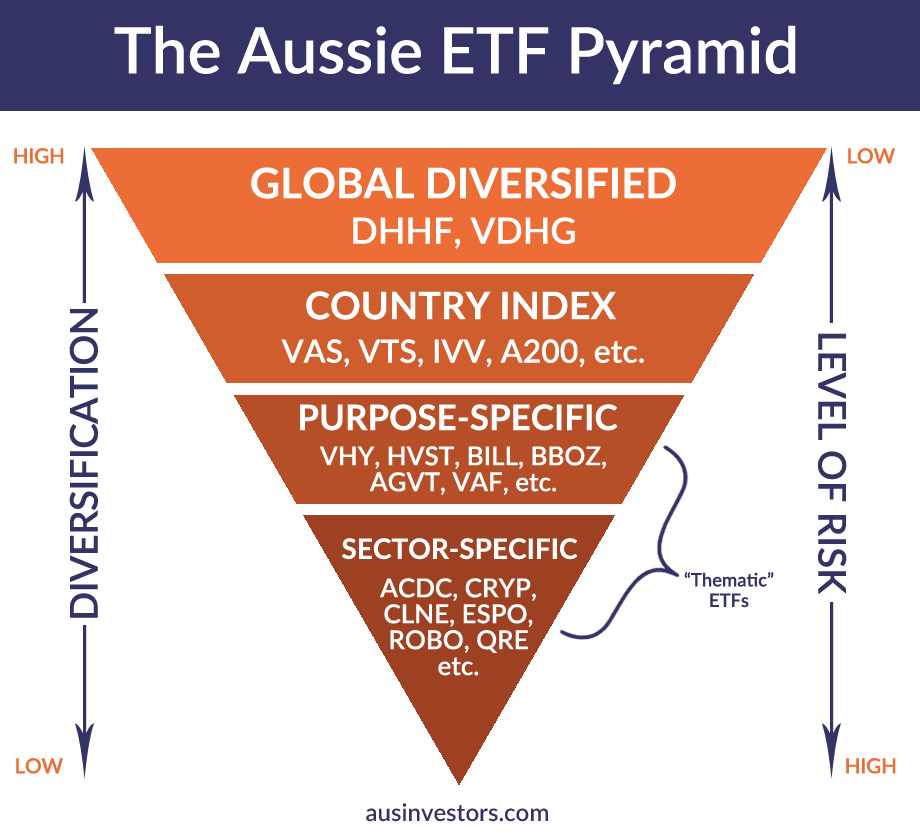

The Australian ETF Pyramid

ETFs can generally broken down into ‘categories’ or ‘tiers’ based on the level of diversity of the bundle of individual stocks they hold within. The general rule is, the more specific/concentrated the ETF, then the greater the risk (and potential return).

Picture it something like this:

Exactly which Australian ETF(s) will be best for you then largely depends on your investing style and how active you’re looking to be, which we’d break down into the following, below:

1. The big boys of global diversification: DHHF and VDHG

Pros:

- Instant global diversification

- Extremely low management fees

- Requires minimal thought/research

- About as low risk as you can get in terms of stock investing

Cons:

- Limited to “market performance”; no real way to outperform

- “Boring” investing; don’t expect adrenaline-rushing gains

- Pay distributions, which you can be taxed on

Ideal for: the “hands-off” or beginner investor who doesn’t believe – or want to put the effort – in trying to ‘beat the market’ OR does not yet know enough about investing to pick more specific investments

We’ll get this out of the way quickly: if you’re a new investor who is even asking the question “which ETF should I buy?”, then this could easily be your default choice. Diving deeper into other options before you understand more will likely only be confusing, and there’s no guarantee it will lead to outperformance in the end anyway.

These are two of the most common Australian ETFs you’ll no doubt come across in your initial research for “best Aussie ETFs”, and they’re popular for a variety of reasons.

DHHF (run by BetaShares) and VDHG (run by Vanguard) aim to provide as broad exposure as possible to the global market within a single ETF, covering a massive array of stocks spread out over multiple stock exchanges throughout the world. They’re essentially “an ETF of ETFs”.

As a result, they’re about as risk-averse as you can get in terms of stocks investing; their diversity means that even if a single country’s index underperforms, you’ve still got enough exposure elsewhere to hopefully offset that fact.

The general line of thought behind investing in such broad-based indices is that, since most people don’t end up beating the performance of the index on a long-term basis – even with all the effort and research they put in – then why bother trying?

The option exists to just chuck your money into broad funds like DHHF or VDHG, and spend your time on energy on other things (such as progressing your career), and you’ll generally get a solid return on your money over the long haul that will end up beating many ‘active’ investors anyway.

There’s nothing wrong with this line of thought, and for new investors who are willing to commit to the long term and let the power of compounding do their thing, they certainly serve the purpose.

One other thing to note about these ETFs: their entire point is diversification, so if you’re asking yourself “should I also buy (insert other ETF here)?”, then you’re instantly defeating the point of these ETFs in the first place.

There’s also much haggling in online communities over which of these two ETFs are better than the other; but realistically the differences are so small that for someone just starting their investing journey the gap is so negligible it doesn’t really matter.

Better to just pick one that takes your fancy and be done with it, and you’ll likely already be ahead in the long term of people who don’t bother investing at all in the first place.

For those who want to dive into the technicalities, DHHF might slightly be the better choice of the two due to its microscopically-lower management fee, lack of bonds exposure and lower distributions… but as a newbie, you can’t really go wrong with either, and it’s generally not worth wasting your time fretting over the two.

DHHF is also far newer than VDHG as an ETF, so there’s not as long of a track record of its overall performance.

However it is also 100% exposed to shares as opposed to VDHG’s 90%/10% ratio which can work in its factor from a growth perspective as well, and as a result it’s our default recommendation at this point.

For reference, here’s how both have performed for the duration of their existence (courtesy of Sharesight):

DHHF (since 2019):

VDHG (since 2017):

If you’re just starting your investing journey and don’t plan in the future to branch out too much further into individual stock-picking, then putting your cash into one of these with the intention of getting better returns than a savings account makes for an obvious starting point.

One other thing to note about these ETFs: their entire point is diversification, so if you’re asking yourself “should I also buy (insert other ETF here)?”, then you’re instantly defeating the point of these ETFs in the first place.

The amount of over-thinking I see people do when creating some weird Frankenstein ETF portfolio of VDHG/DHHF + multiple other ETFs that overlap makes me roll my eyes.

Sure, you can add in a tech-centric ETF for example if you feel like the sector is going to outperform – but if you feel that way, why not just ignore the global ETFs and show conviction, and go hard into that sector-specific ETF in the first place?

2. Country-based indexes & ‘largest company’ indexes: VAS, VTS, IVV, A200 etc.

Pros:

- Country/market-specific indexes

- Allows you to “pick countries” you think will outperform

- Generally very low management fees

- Still very solid diversification

Cons:

- You may pick a country that underperforms the global index

- Still little potential for outperformance

The “next tier” of ETFs basically boil down to those which track country-specific indexes and their various “Top 500’s”, “Top 200’s”, “Top 50’s”, etc.

While it’s slightly laughable to call these “more risky” than options like DHHF or VDHG – considering how diverse they still are – they do have a slightly more concentrated series of factors such as currency exposure & individual country/regional geopolitical risk.

The general principle with picking one of these over a broad-based global fund is whether or not you think that particular country’s top companies will outperform the rest of the world’s markets.

Some of the most popular Aussie ETFs within this ‘tier’ include:

- VAS (Vanguard’s broad-based Australian companies ETF in the ASX300)

- VTS (Vanguard’s broad-based US companies ETF for the entire index)

- VGS (Vanguard’s broad-based global companies ETF that excludes Australian companies)

- IOZ (Blackrock’s Australian companies ETF that tracks the ASX200)

- IVV (Blackrock’s US companies ETF that tracks the 500 largest cap companies)

- A200 (BetaShares’ Australian companies ETF that tracks the ASX200)

So, why pick any individual one over the other?

Do you have a particular level of faith in say, Australia’s mines-and-banks-heavy economy and top companies, over those in the USA over the next 10, 20, or 30 years? Or do you think America’s tech-heavy leanings give it greater potential for further growth? This is just one example of the purpose this ‘tier’ of ETFs can serve.

Your thoughts in that regard will allow you to pick an index that best follows your own school of thought, while still providing incredibly cheap and diverse exposure to a wide range of quality companies.

There’s much angst online about dissecting the minimal differences in individual management fees each of these ETFs have when picking one over the other.

There’s much angst online about dissecting the minimal differences in individual management fees each of these ETFs have when it comes to picking one over the other.

Again, the differences are negligible enough in this case that you may find it’s not worth wasting your time having an existential crisis over the choice.

Simply picking and committing to one is better than umm-ing and ahh-ing for days as you get 50 different conflicting opinions online from people with too much time on their hands.

Of course, there’s nothing preventing you from mixing/matching two or three of this level of ETF together into a single portfolio either; many Aussie investors choose some kind of mix of VAS (total Australian Shares) and VTS (total American market shares), for a 50/50 or 30/70 split as an example.

Just be aware that if you start going down the route of having so many index-centric ETFs in a portfolio, then it again puts you one step closer towards individual stock-picking, defeating the purpose… and you might as well just go back 100% into something like DHHF/VDHG in the first place and save yourself the mental effort.

The next “tier” of ETF concentration – commonly called “Thematic” ETFs – look to focus even further on a more specific classification, or “theme”, of stocks.

One major thing to bear in mind before you become too impressed by the “total returns” figures listed alongside most of these ETFs: many of them have only been created in the past couple of years and have only existed within a massive ‘bull market’.

So while their % gains numbers may look incredible, remember that the sample size for the majority of them is very small – you may typically want to gauge the returns of an ETF over at least a 5 year (preferably 10+ year) timeframe.

While the ETFs in this category are all typically lumped together, we prefer to divide them into two “sub-tiers”: what we’ll call “Purpose-Specific” ETFs, and “Sector-Specific” ETFs.

3. Purpose-specific ETFs: VHY, ETHI, HVST, BILL, etc.

Pros:

- Allow you to pursue a specific investing “tactic” (dividends, hedging, etc.)

- Can still be more diversified than sector-specific ETFs

- Allows for a degree of “ethical screening”

- Can provide portfolios with a more balanced risk profile

Cons:

- Can sometimes exchange safety for below-market performance

- “Ethics” of some are highly subjective

- Tax implications of being dividend-focused, etc.

- Management fees again an issue

This sub-category of ETFs are aimed more at fulfilling a specific investing “goal”, rather than targeting a theme or industry-classification-specific grouping of companies.

Their main purpose is to cater to those who want to follow an investment strategy or round out a portfolio, regardless of what type of companies are contained within to satisfy that strategy.

For example – if you’re after an all-in-one ETF solution in order to maximise your dividend income, it doesn’t really matter what kind of business the company conducts in order to pay those high dividend yields; whether they’re an iron ore miner, a bank, a profitable small services company, or anything else.

All that matters is you end up with the dividends in the end, thus fulfilling your purpose. Likewise, for the increasingly-popular trend of “ethical” investing; as long as the ETF excludes dodgy companies from a range of sectors, the end goal can likewise be industry-agnostic.

This ETF category also contains the likes of ETFs aiming to offer things like exposure to leverage, containing certain percentages of bonds or other risk-off asset classes, or even serve as a “proxy” for shorting entire markets.

They tend to be used more often as part of a larger overall portfolio than as a single solution in themselves, while allowing you to customise your level of risk still without having to dive into individual companies.

4. Sector-specific ETFs: ACDC, SEMI, QRE, OOO, etc.

Pros:

- Increasing number of sectors available to suit most investors

- Potential for exceptional outperformance

- Big time-saver vs. maintaining portfolio of individual companies in the sector

- Can allow you to “screen out” companies or sectors you don’t want to invest

Cons:

- Typically the highest % management fees of any ETF category

- One “step” away from individual stock picking

- As “risky” as ETF investing can get

- … why not just pick individual companies?

The separation between “Sector-specific” ETFs is that these tend to focus more on a subset of companies within the same space, producing similar products & services, rather than achieving a specific goal or purpose.

For example, the ability to invest in a variety of stocks all in the resources sector, those aiming to produce battery technology & metals, companies that deal with cryptocurrency, hydrogen producers and R&D companies, etc.

The sheer quantity of themes & groupings of companies available within this category nowadays is pretty wide.

The ETF providers seem to be banging their heads together each month with new ways to slice and dice up subsets of stocks in order to create extra buzz (and management fees).

Our issue with these kinds of ETFs is that they are really not that far away from individual stock-picking in terms of potential success & return rates – with the added layer of pretty high management fees slapped on top.

While it might not sound like much, paying a 0.7% annual management fee that automatically puts you in slightly “negative performance” required to overcome is worth bearing in mind.

And, of course, there’s the downside risk; while you might feel a certain sector is looking promising, pick the wrong one and, well…

That also obviously swings in the other direction as well – pick correctly, and you can achieve returns that destroy those of the market.

However, from our perspective, if you’ve gone this far down the rabbit hole – why not take the extra steps to educate yourself on how to assess individual companies instead?

It gives you a greater degree of portfolio control, saves you some management fees, will improve your financial knowledge, and can even be – dare we say – fun.

Otherwise, might as well just stick with a more diversified index fund.

What are your thoughts on the best ETFs for Australian investors? Let us know in the comments below.