Investing in stocks/shares on the ASX can certainly be fun; but what happens when tax time rolls around and you realise you need to pull all your figures together?

Here’s some options for how to keep track of your portfolio – specifically for Australian investors.

Stock buys, sells, currencies, cost bases, brokerage fees, CGT, dividends, franking credits, share splits, returns of capital… the Australian investing system is pretty convoluted, and unfortunately accurately reporting all of your investing activity to the Australian Tax Office (ATO) each year can quickly become a pain.

It can especially be a shock to the system for newer Aussie investors who have never done their first tax return before; even if you choose to pay for an accountant, there’s a ton of info you’ll still need to pass them to ensure you’re reporting accurately.

This doesn’t even take into account in the simple “fun factor” of trying to see your actual portfolio returns in an easy to understand way while factoring in all of the above, either.

Unfortunately, the majority of Australian brokerage apps and banks still do a pretty poor job of providing ‘true’ returns figures, leading many Aussies to have to hunt around for alternative ways to track their portfolios and dividends.

We guess that’s why you’re here though, right?

Well, as far as keeping track of your investment portfolio goes, Australians have a few main choices to pick from.

These are:

1. Use Sharesight

Pros:

- Web-based, so accessible from anywhere

- Automatically tracks dividends, currency gains/losses, brokerage fees

- Great tax / CGT reporting functionality for Australian investors

- Can be configured to automatically add your buy/sell trades

- Free for portfolios of 10 holdings or less

Cons:

- Fairly expensive (although can be tax deductible)

- App is terrible, need to use web version to accomplish anything

- Graphs sometimes load very slowly

- Does not cater for options trading, and only ~8 types of crypto

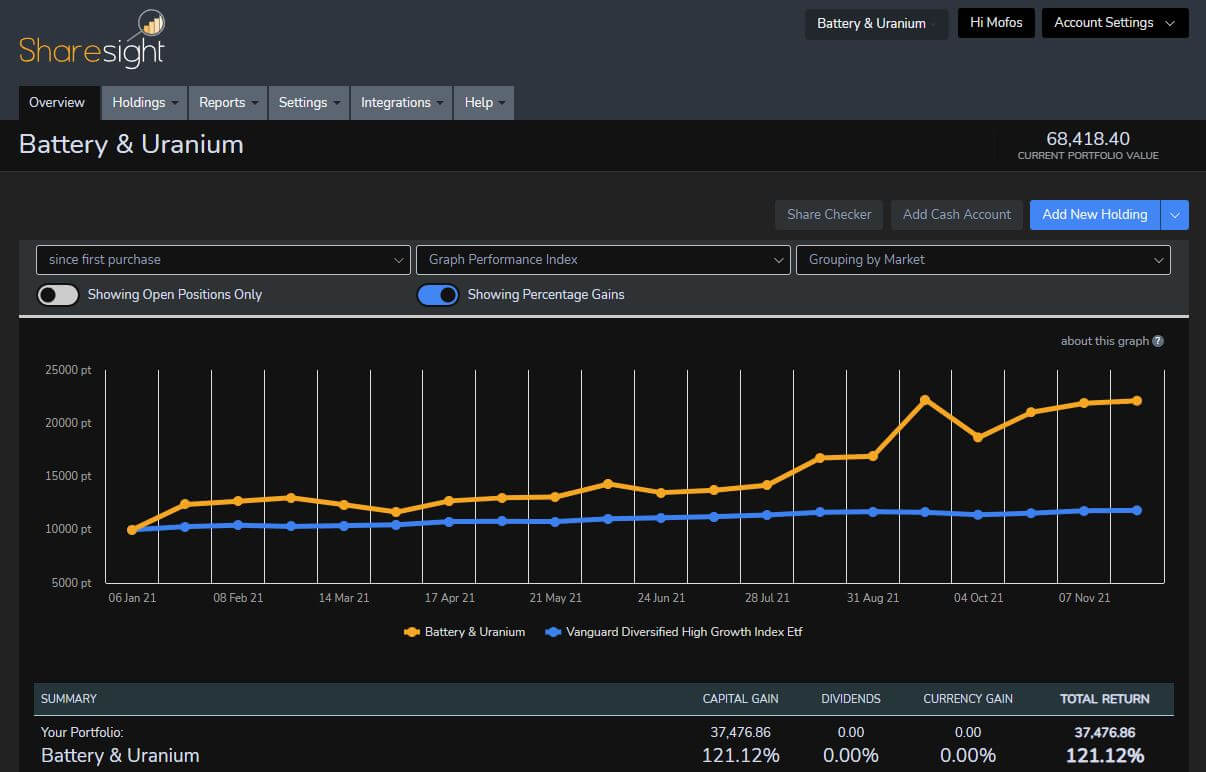

Sharesight is a portfolio tracker SaaS software platform designed to consolidate all of your investments in one place.

The software actually originated in New Zealand before branching out to also be based in Australia, but has been continually iterated on and customised with the goal of servicing all the whacky and annoying tax and brokerage issues specific to the ASX.

It’s become pretty much the default go-to option for Aussie investors in recent years as a result, with none of the others out there remotely as fully fleshed-out in terms of functionality for what Australians need.

The platform integrates/has arrangements with pretty much all of the major Australian brokers that 99% of you reading this will likely be using, allowing you to import your portfolio via a couple of available methods.

Depending on the broker, you can either click a tile that will open a connection with your broker, allow you to enter your login details, and then automatically import your historical trade data in, OR download a CSV from your broker and re-upload that into Sharesight. The software then takes everything and compiles it into handy gain/loss charts complete with factoring in dividends, brokerage fees, currency gain/loss (for non-Australian investments), etc.

You can then view your portfolio’s performance over whatever time period you choose, benchmark it against any existing ETF or stock to see how you performed, run reports to see any expected upcoming dividends from your holdings, view your portfolio’s diversity by a wide range of classifications, and much more.

There’s a ton of reporting functionality built-in that you can splice and play around with to your heart’s content, but by far the most useful for Aussie investors will be its tax functionality.

Come tax season, you can run reports breaking down your trades for the year from a Capital Gains Tax (CGT) perspective, with the option to choose from a variety of sale allocation methods (e.g: First In, First Out (FIFO), Last In, First Out (LIFO), Minimise CGT, and a couple of other defaults).

Then, it’s simply a matter of taking this data and either using it to help complete your own tax return direct with the ATO, or passing it onto your accountant.

Sharesight also allows you to simply share your portfolio with another person (e.g: your accountant) and give them read-only access so they can access this data themselves to complete your return without having to email a bunch of extra documents back and forth.

I’ve been using Sharesight for several years, and while it has some flaws – its app is pretty worthless (just use the web version instead), it’s fairly pricey, and it has a couple of issues with UI/UX and speed – it’s still pretty much best-in-class for what the vast majority of investor Aussies need for tracking their portfolios.

There are other, fancier-looking overseas solutions out there that offer basic portfolio tracking, but Australia’s investing requirements & rules are too different to the rest of the world to be able to recommend them to be either as accurate or as useful.

Website: https://www.sharesight.com/au/

2. Track it in a spreadsheet

![]()

Pros:

- Cheap/free depending on where you get the sheet from

- You get ‘full control’ over what you want it to contain

- Increasing number of finance features/queries supported by Google Sheets

- Can be configured to automatically add your buy/sell trades

Cons:

- Manual, clunky, time-consuming

- Can be prone to user error/data entry mistakes

- No/minimal automation

- Can quickly become big/bloated for larger portfolios

- Reliant on the creator to keep it updated

Ahh, the trusty spreadsheet, a staple of investing forums and message boards worldwide.

Regardless of what flavour you prefer – be it Microsoft Excel, Google Sheets, OpenOffice or something else – there are a wide range of versions out there people in the investing community have hacked together to try and consolidate all of their share holdings/prices/returns into a single, accurate sheet.

Most of these have been built by crafty spreadsheet gurus using a range of complex formula as well as data connectors to “suck in” investment data from external sources. The majority of them use either Excel or Google Sheets, with the latter taking advantage of Google’s Finance functionality to compute all the data.

Some of the best of these include:

- DoughRoller’s here: https://www.doughroller.net/investing/an-awesome-and-free-investment-tracking-spreadsheet/

- InvestmentMoats’ here: https://investmentmoats.com/stock-market-commentary/portfolio-management/introducing-our-free-stock-portfolio-tracker-spreadsheet/

- This one built by Australian Reddit user /u/fletchDigital: https://docs.google.com/spreadsheets/d/1UhIf0tRlCBNfC1iH26Cbnm_JC2vPOqrVk8kZW3eDul8/edit#gid=915260412

- This one built by Australian Reddit user /u/oldworlds: https://docs.google.com/spreadsheets/d/10MRjupIWNNAO4fdKkgW9QM_IUpPrduHtKz_JiS8JUUA/edit#gid=0 (just delete the link spam at the top of the document)

Damn, those are some long URLs…

To the builders’ credit, some of these are impressively advanced; they’ve built in the ability to see portfolio diversity, visualise performance in basic charts, and see basic profits/loss figures.

The obvious ‘pro’ for most people for going the spreadsheet route will be that it’s essentially free – once you’ve downloaded them and spent time setting them up, they don’t cost any more than the time you need to invest each time you make a trade, and/or collating the data for tax time.

However, there’s enough reasons for us that we don’t go this route ourselves.

First, most investing spreadsheets out there are built by Americans, and catered to the US market. This means they require more fiddling to make ASX-friendly, and may not even support ASX-listed shares in the first place.

Currency also becomes an issue, and the aforementioned pain-in-the-backside Aussie tax issues are also often not catered for.

The next is a matter of both time, and accuracy. It’s on you to ensure you manually update every trade, holding & dividend, and do it correctly – make a single data entry error once that you come back to and don’t remember in future, and it can screw you over come tax time (as well as simply throwing out your returns results).

Lastly, I simply value my time more than I do the money required to pay for a software subscription to handle/automate all this stuff for me.

Combined with the potential for user error, and I’d rather just eat the fee & pay for Sharesight or similar as a “cost of investing” – but that’s just me.

3. Rely on your broker

Pros:

- Free/included in standard costs of your broker

- Some brokers do an increasingly decent job

- Will include your entire trading history with that broker

Cons:

- Requires you to “fill in the blanks” & rely on a spreadsheet anyway

- Lots of manual copy-pasting at tax time

- Don’t factor in dividends/currency fluctuations – why??

- A pain if you use multiple different brokers

Another option here is to rely on the portfolio performance reporting your broker provides, and then spend time chopping & changing their financial reporting come tax time.

Each of the major Australian brokers and brokerage apps handles this differently, and the quality of their tracking and reporting varies – however you’ll at the very least be able to see basic performance indicators like your number of units held, average buy price, and daily & total gain/loss for the stocks you hold.

For whaever reason, they don’t factor in brokerage fees to performance (really strange) which can make the “return” figures look distorted after you’ve just bought a stock, and tend to provide performance figures that simply focus on daily price movements & capital gains since purchase date rather than ‘true’ annualised returns.

Broker performance numbers also simply provide a view into the gains from the date you bought only; you can’t see how your portfolio’s performed over a certain period of time vs. other benchmarks, or within a specific date range.

Some of them also offer in-app Reports sections which provide PDF-version summaries of various key actions you’ve taken throughout the past financial year, whether it’s buy & sell trading history, lists of realised & unrealised gains, and general summaries of your portfolio’s holdings & diversity levels.

These can then be exported and used for tax time, or whatever other purpose you need them for.

However, the same issues tend to pop up here – collating each indivdual report, having to calculate dividends & adjusted cost basis, and more rare but complex occurrences like share splits & consolidations – make for a bunch of report juggling that can quickly become confusing.

For the brokers that allow you to invest in both ASX & overseas (typically US) shares, they also don’t show currency fluctuations since the date you purchased. This becomes painful for when you’re thinking of selling in particular, as you may end up choosing to sell out at a time when the currency you bought in is weaker, losing some “gains” as a result of currency loss as well.

As a result, most people end up relying on a mixture of their broker’s reporting & a spreadsheet or resorting to a purpose-specific portfolio tracking tool anyway, which kind of defeats the purpose of relying on them at all in the first place.

4. Use an overseas software alternative

![]()

Pros:

- Tend to “look prettier”/have better UI than the above alternatives

- Are mostly app-based solutions vs. web-based for those who prefer

- Some that handle most major types of crypto

- Typically best-in-class for American stocks tracking/UI combo

Cons:

- Most don’t cater to Australian tax requirements

- Mainly oriented towards US/Canadian stocks

- Don’t track dividends/currency fluctuations

There are a pretty diverse range of foreign-made alternatives for portfolio tracking out there, many of which are more modern and have slicker UIs/apps having been more newly-built since the investing craze of the past year or two took off.

Pretty much all of them are American or Canadian, with the occasional European piece of software floating around out there as well. Being a bit of a UI nerd/snob myself, I’d normally say “go for it” if our domestic tax rules for investing weren’t so painful.

However, if you’re simply after basic performance tracking and want to be able to access it through a prettier app interface, and then just use your broker reports for tax time instead, there are some nice enough options out there.

Some of the best include:

- Delta: one for the c0oL dUdeS out there, Delta is a slick, app-based stock & crypto tracker with a darkmode UI that knows exactly who its audience is. It’s got some of the best-in-market functionality in terms of crypto tracking and support, and a pretty impressive range of connectors for brokers & stocks importing globally as well. However, it’s lacking a couple of Aussie brokers (e.g: Superhero), so if you use them you’ll either have to do manual holding entry, or look elsewhere.

The onboarding process is quite good, and while its importing function can have some issues with associating Australian assets with the default holding names, you can quickly manually associate any of those that throw up importing errors. Its pricing model is based on the number of connectors you require; an annual subscription kicks in afterwards. Again, it’s fine for basic portfolio performance tracking, but lacking in tax reporting.

Price: $82 (USD) per year for Pro.

- Kubera: of all the internationally-made portfolio trackers, this is the one we’d pick if we weren’t bound by the requirements of Aussie investment reporting. Kubera does the best job we’ve found out there of catering for multiple asset classes while also having a modern/fast UI, catering for the ASX pretty well, and having a properly functional app/desktop site combo vs. being mainly app-based.

It’s slicker, more modern and lightweight than the likes of Sharesight, and has plenty of solid Aussie auto connectors too. However all that prettiness is made redundant slightly by being lacking in tax reporting functionality, which is one of the major points of paying for these kinds of software in the first place.

Price: $150 (USD) per year.

- Personal Capital: this is the “big daddy” of personal finance/portfolio trackers overseas (US-centric) and will often show up in searches when you’re trying to find this kind of software. It’s more of an “overall personal wealth” software system that just also happens to have a portfolio tracking element as part of it.

The good part of the software is that you can access its financial tools for free; the bad news is that the platform is monetised by its reps reaching out to offer you “wealth management consultancy” services in order to make their money once you hit a certain investment threshold. Its interface is quite nice, but again it’s so American-oriented and lacking functionality that makes it ideal for Aussies. Pocketbook is the Aussie equivalent software for this; would suggest using the combo of Sharesight + Pocketbook for Australians after this level of tracking, personally.

- Stocklight: the closest thing to an Aussie-centric portfolio tracker app that’s got most of the functionality people would likely be after for basic portfolio tracking, Stocklight is worth a look if you’re after portfolio performance & watchlist monitoring within an app-environment.

The premium version allows you to receive push notifications for price-sensitive announcements on your phone, and view news updates relevant to your shareholdings. It lacks some of the automation of importing holdings & holding prices that Sharesight offers, and isn’t quite the tax tool, but it makes up for that in some other areas by being more research-focused instead.

Price: $13.99 AUD per month for paid version.

- Yahoo Finance: often one of the intial go-to’s for Aussies starting to try tracking their portfolio via an external tool, Yahoo Finance’s portfolio tracker is again decent & has a nice enough UI, but isn’t much of a step up from the functionality of just tracking your returns in your broker.

It doesn’t track/factor in dividends, brokerage fees or currency changes, and again is mostly geared to those in the USA.

The tracker has good coverage in terms of the markets, brokers & stocks it encompasses, but given the majority of Aussies mostly invest domestically & in the US, that benefit is offset by most of what it lacks. The free version is also ad-supported.

Price: $250 (USD) per year for premium, ad-free version.

How do you track your investment portfolio in Australia? Let us know in the comments below.