Now more than ever, it’s easier for people with a few extra dollars lying around to get started with investing thanks in large part to our good friend: technology.

A wide range of companies and tools have sprung up in recent years so that any Aussie 18+ years old with a heartbeat and $500 (and sometimes, not even that much) can now acquire shares in ASX and foreign-listed companies, all in a matter of minutes.

But just because it’s easy, doesn’t make it completely clear on how to start for someone who’s utterly new to investing. If you’re an Aussie who fits that description, then this article is for you.

Here’s our no-BS newbie’s guide to how to get started with investing in the ASX for the average, non-baller new Australian retail investor.

Jump to a specific section:

- Intro/Disclaimer

- Gathering your Paperwork

- Choosing a Broker

- Picking a Strategy

- Doing your Research

- Depositing Money into your Broker

- Placing an Order – Market Order vs. Limit Buy

- Configuring your Share Registries

- Tracking your Trades & Returns

- Keeping Records & Doing your Tax

1. Intro/Disclaimer

Congrats, you’re about to start doing something productive with your money instead of letting it sit in a bank account wasting away to inflation, or dumping it into unproductive assets.

This alone puts you ahead of a ton of Aussies who couldn’t be bothered and/or live paycheck to paycheck, so give yourself a minor pat on the back just for taking the first step.

Bear in mind, investing is generally intended to be a longer-term play, depending on what strategy you follow. Many will say if you don’t plan to invest your money for at least 5 years and/or will need it before then, then you should keep your money in a savings account instead.

This statistically has some truth to it, and investing can be risky; but is not a blanket rule, and shorter time horizons can still be profitable. In the end – it’s your money, your decision.

Now that that’s out of the way, the first step is…

2. Gathering your Paperwork & ID

Before you dive into the sexy apps, websites, and brokers below, you’ll need to have a couple of documents/cards on hand to set yourself up.

While the requirements may differ slightly from broker to broker, the process is quite quick and painless nowadays – in general all you’ll need is:

- To be an Aussie at least 18 years of age

- An email address

- An Australian bank account

- An Australian mobile phone number

- A current Australian residential/postal address

- A valid Australian driver’s license AND/OR (depending on broker) a Medicare card or Australian passport

- An Australian Tax File Number

- At least $500 to invest (we recommend a $1,000 minimum due to brokerage fees, but more on that later)

As long as you have all of the above, you’re pretty much set.

Most ID verification processes with brokers these days have been automated to a certain extent. The only additional processing that needs to occur is for CHESS-sponsored / individual HIN brokers (see: “What is CHESS?” in our FAQ) as they need to be linked to your personal details.

If you’re signing up with a ‘Custodial Model’ broker (see: “What is a Custodial Model broker?” in our FAQ), then you won’t need to wait and can start trading almost immediately after.

The only other piece of documentation you’ll need to fill out is if you’re signing up to trade US shares – a W-8BEN Form.

In a nutshell, this is a form that provides tax benefits to foreign investors buying American stocks.

It’s compulsory, however with Custodial Model brokers (which the US, and basically the rest of the world, uses) you can simply “agree” to the terms of the form and they will automatically submit/confirm them online for you in a matter of moments.

3. Choosing a Broker

Once you’ve got all your documents together, the next major choice is which brokerage website/app you’ll be looking to choose.

There is endless debate about this online, and with new apps popping up every day – and each trying to claim some minor benefit or selling point over the others – it can be a little overwhelming.

Pretty much every Australian stock brokerage app has its own Pros and Cons, and what is ‘best’ will depend on what you’re looking to do investment-wise.

We’ve put together an article called “Which is the Best Australian Brokerage App (for me)?” in which we dive into the pros & cons of each one in greater detail, but the current TL;DR version that we’ve found best for our needs and may suit newer investors at time of our latest update to this article in early 2023 is:

- For trading exclusively Australian individual shares: CMC Markets or Stake

- For trading exclusively US individual shares & ETFs: Interactive Brokers

- For trading exclusively Australian ETFs: CMC Markets or Stake

- For trading both Australian & US individual shares: Stake

There are a ton of additional smaller/niche apps out there that aim to serve different purposes, and each have their own positives and negatives depending on what specific functionality is most important to you.

We would have previously used CommSec or SelfWealth as Australian-only investors, however now that Stake has stepped up with CHESS sponsorship & a mere $3 brokerage fee per trade, it’s hard to find another option that would likely suit most beginners.

Note when we say ‘beginners’, we assume you’re starting from scratch, and looking to buy and hold shares for a reasonable amount of time and not intra-day trade too often. If that’s instead the case, then there may be other more suitable brokers for that purpose at time of writing.

If something changes in the future to provide enough of a point of differentiation, we’ll update this article as necessary.

Regardless of your choice, their apps are available for download on both Apple & Android devices in their respective app stores, and all of them offer web-based experiences as well. These range anywhere from basic (Superhero) up to great (CommSec).

It may be best not to overcomplicate things at this stage of your investing journey; and you can always switch over down the track should new features/deals arise.

Brokers typically don’t charge fees to switch to another broker; however some of them can take anywhere from days to weeks to complete the transfer process, which can be annoying.

Just like with individual stocks, showing blind loyalty to any one specific broker is pretty pointless – especially when there’s the option to just pick whichever offers the combo of best deal on brokerage + CHESS sponsorship for Australian shares.

4. Picking a Strategy

Ahh, the most controversial part of any investor’s budding career: choosing an investment strategy to stick to.

Outside of maybe politics, there are few topics that have caused more debate, or had more literature written on them over the years than ‘best investing strategies’ and similar topics.

The truth is, much like broker apps, there’s no true ‘best’ answer – as what suits each person will change based on a number of variables.

Things like risk appetite, investing timeframe, available money to invest, level of patience and much more all come into play here.

At their heart, all of the variations and sub-variations of investing strategies basically can be narrowed down into a few core styles, that again each have their own pros and cons.

These are:

A. Broad, “global index” based investing a.k.a “Passive Investing”

Risk level: lowest

Pros:

- requires minimal effort/thought/free time

- the ‘least risky’ shares investing style possible (note: all types of share investing is still “risky”)

- lowest management fees

- statistics show it typically outperforms most active investors in the long-term

- massive diversity means ‘a rising tide lifts all ships’ for your portfolio

Cons:

- tracking the index means you can’t outperform; if the index goes down, you go down

- no chance to capitalise on specific global trends

- you’ll likely end up investing in companies you ‘don’t like’ or are ‘morally against’ by default

- can be ‘boring’

A potential go-to starting point for anyone who is ‘new to investing’. Seriously; if you got here by Googling or searching forums for something like “how to start investing in Australia”, then this is an available easy default until you learn more about investing – and maybe even beyond then.

This strategy involves buying a single, massively diverse ETF (Exchange Traded Fund; essentially, a ‘bundle’ of stocks all grouped together) that aims to track a huge range of companies across multiple markets – with the aim of following global economic market growth, while minimising investment management fees.

If you’re the type who wants an ultimate “set and forget” approach and doesn’t need excitement in their investing lives, doesn’t have a lot of free time, or never plans to treat investing as a “hobby”, in many ways it can be the best bet.

Numerous studies have shown that the majority of active investors don’t outperform the index anyway; so you could simply buy the index and hold it for the long term.

If this sounds appealing, and you’re the patient type, you can simply search for an ETF such as “DHHF” in your brokerage app – or another globally diverse fund like it – and hold it for as long as you can. This means through market rises, crashes, and everything in-between.

In DHHF’s case, it is a 100%-shares, all-in-one portfolio solution offered by provider BetaShares focused on stocks, and with low management fees (0.19%).

Its entire purpose is to be a one-stop-shop ETF that doesn’t really need to be combined with anything else.

“If you’re the type who wants an ultimate “set and forget” approach and doesn’t need excitement in their investing lives, doesn’t have a lot of free time, or never plans to treat investing as a “hobby”, in many ways it can be the best bet.”

People over-analyse other similar funds and minor variations of this to death; as a newbie, this is all you may really need to do when starting out.

Buy it, hold it, and add more money to it when you can. The general aim of this style is to take advantage of compounding returns, hopefully aiming for average returns of ~7-8% per year, over the course of decades.

Here’s an example of the USA’s S&P500 index over the past 30-odd years as a visual example of the potential of “index investing” in action over time:

… which sums up the Passive Investing principle of “over a long enough time period, the index always goes up”.

There will likely be dips and crashes along the way; be strong, and just keep holding (or even better, buying in). Diamond Hands, and all that good stuff.

Spend too much time Googling this topic as a newbie, and you’ll get distracted with over-analysis of questions like: “But what about DHHF vs. VDHG?”; “What about a VAS/VGS 50-50 split?”; “What about Emerging Markets ETFs?”, and on, and on.

Until you know more about investing, this is most likely just noise that will distract you.

If Passive Investing is appealing to you, you might as well just buy a broad fund like DHHF in minimum $1,000 increments whenever you’re able to amass that amount of money, and be done with it.

And there’s absolutely nothing wrong with that. Seriously.

B. Sector-based ETF investing, a.k.a “Semi-Passive Investing”

Risk level: medium

Pros:

- a compromise between broad index tracking & individual stock picking

- allows you to select from an ever-increasing variety of sectors/categories

- don’t have to research/keep track of individual companies

- can select themes that align with your personal beliefs

Cons:

- some of these ETFs have unnecessarily high management fees

- pick the wrong sector(s), and you can underperform the index

- … why not just pick individual stocks?

- … why not just track the index?

With the ever-continuing growth in popularity of ETFs as an investment vehicle, more and more major fund providers continue to come up with more niche ways to carve up blocks of companies into sellable products.

They then package these into sector-specific, or “Thematic” ETFs, and charge for the privilege of investing in them.

There’s seemingly multiple new thematic ETFs popping up every other week – covering spaces like Cloud Computing, Hydrogen, Ethical Investments, Crypto companies, Aussie Resources, Robotics, and everything in between (we have an extensive list of current Australian ETFs here).

The menu is extensive enough nowadays that you can pretty much find something that’s sure to align with your own circle of competence, personal beliefs, or general trend-following.

While this might initially sound appealing, there can be a couple of glaring flaws that come with a lot of these sector-specific ETFs.

The main one of these is simply the management fees that are charged by the companies as part of maintaining/rebalancing each fund.

It’s not uncommon for these to have around a 0.7% annual management fee, which may not sound like much – however, compared to something like VAS (Vanguard’s Australian Shares ETF) which has a mere 0.1% fee, and you’re already over half a percent “down”, that you’ll need to make up for in performance.

Compound this over time – and bearing in the fact you may choose a sector that ends up underperforming the index anyway – and it’s not insignificant.

These ETFs can serve as a decent way to ‘weight’ your portfolio more towards a certain market category without having to keep track of individual companies however.

The other con is that it’s often too common to see new investors end up buying multiple of these ETFs that end up overlapping with one another, and end up with some weird Frankenstein-type portfolio of ETFs.

This can both defeat the purpose of picking a theme in the first place, while making things more unnecessarily complicated at tax time as well.

If you’re going to go this route, you may want to ensure you limit yourself to 1 or 2 thematic ETFs max. Otherwise, you might as well just start looking at picking individual stocks that don’t have management fees attached to them anyway.

C. Individual Stock Picking: for Dividend Income, a.k.a “Dividend Investing”

Risk level: higher

Pros:

- allows you to obtain actual money in your bank account on a semi-regular basis

- paying dividends most often means the company is profitable

- can be decent for those with shorter timeframes

- typically beneficial for older investors as a source of income

Cons:

- tax issues with realised gains

- dividends can be a sign a business doesn’t know how better to reinvest its money to grow

- not always ideal for younger investors

- can require discipline not to simply spend/waste dividend money

As far as individual stock picking goes, Dividend Investing is one of the more popular strategies in Australia in particular.

This is due to both our country’s companies’ tendency to pay dividends in the first place, as well as our fairly unique Franking Credit system which allows you to avoid being taxed twice on dividend income received.

It’s a strategy that tends to be less common in countries like the USA, in which companies tend more towards taking excess profits and buying back their own shares, for example.

Dividend Investing means you’ll receive periodic cash payments based on the amount of company shares you hold, allowing you to realise some actual income back without having to sell the shares you own.

This has obvious benefits of being able to put that money to practical everyday use, and is why it’s particularly popular with older investors who use it as a source of income after building up money over the long term.

Many Australian companies who pay dividends also offer a Dividend Reinvestment Plan, which allows you to automatically re-invest the dividends paid back into acquiring more shares of the company, and again attempting to maximise your shareholding over the long term.

Companies that pay dividends generally are seen as potentially safer than more growth-focused stocks seeing their business model has already proven to generate profits – if they’ve got the money to pay out a dividend, they must be doing something right, right?

Well, there are the same argued pros and cons of investing in dividend-paying companies vs. growth stocks you’ll see regularly pop up: Does paying a dividend mean the company has no idea how to better reinvest their own profits?

Is it worth eating more tax just to receive a dividend? Could I get better returns focusing solely on growth stocks and taking more risk if I am young?

That’s up to you.

D. Individual Stock Picking: for Growth, a.k.a “Growth Investing”

Risk level: highest

Pros:

- simply put: maximum risk, maximium return

- opens up a far wider variety of potential companies

- some cool companies trying newer, innovative things

- many can become targets for acquisitions

- a single contract/deal can lead to large gains

Cons:

- often means companies with no/little profitability

- not for the faint of heart: volatility is common

- no dividend to offset lack of share price growth

- a single lost contract/deal/PR piece can lead to large losses

Typically the type of investing most newbies have in mind when they picture “the stock market”, with its media portrayals of dizzying highs and soul-crushing lows.

Growth Investing usually means aiming for up-and-coming companies that look like they will have a bright future. This is true even if their company balance sheet may not yet prove that to be the case.

There’s a tendency to group this in particular with “Tech stocks” over the past couple of decades, as people want to find the likes of AfterPay and other rare Aussie startup software darlings that have made ridiculous returns.

However, any company which is in its infancy stages and willing to sacrifice profits for revenue, market share, or asset growth can be seen as a “Growth Investing” opportunity.

A miner who is drilling land in pursuit of mineral reserves, a biotech company going through clinical trials of their new drug, a retailer aiming to acquire volume of customers above all else… all of these are just some examples of “growth” companies.

These types of companies are harder to “screen” for when conducting Due Diligence, as they often don’t have the same baseline fundamentals from several years’ worth of data that more established businesses do.

As a result, they can be largely driven by things like sentiment and media narrative, with positive news releases tending to have an outsized impact on their share price performance.

Of course, there are also countless combinations and sub-variations of all of the above – I myself look to invest in profitable small-caps simply because that’s what I enjoy (you can read our article on “How to do Due Diligence on Stocks” which outlines this process).

Only you can know your own level of patience, discipline, and risk tolerance.

5. Doing your Research

NOTE: this section only really applies if you’re looking to invest in individual stocks. If you’re instead only planning to invest in ETFs/index funds, you can skip to the next part.

For all investing styles outside of the broadest, “Passive Investing” style listed above, you’ll no doubt come to a point where you’ll need to buckle down and do some research on which ETF, or individual companies, you’re interested in investing in.

You’ll no doubt soon come across the acronym “DYOR” in countless online circles related to stock investing.

This stands for Do Your Own Research, which most of the time when people spout it online basically means “don’t hold me accountable for my shitty ‘investing advice’ I got off the back door of a toilet stall.”

Most people recommending individual stocks online tend to have at least some kind of agenda for pushing it on you, whether that’s owning the stock themselves, or being a media company/website that’s paid to shill the stock by the listed company itself.

Hence, ‘Doing Your Own Research’ is something you’ll need to eventually be confident in conducting yourself.

There are, again, multiple factors that might influence your desire to pick and choose a certain investment/ETF/individual stock.

Some of the most common reasons can be:

- You understand and/or have some kind of experience with the company in daily life

- You believe the company/sector of companies has a bright future

- You are a fan of the management/ownership of a company

- You’re looking for large dividend payouts

- The company has proven their business model can/will be profitable

- You heard about it from some dipshit online (seriously, avoid this being the sole reason if you can – sincerely; me, a.k.a Some Dipshit Online)

… and numerous other initial eye-catchers that might intrigue you in the first place.

Once you have a company or three you’re interested in at a surface level, it’s probably time to go a little deeper.

There are countless “research companies” and software tools out there which have been set up to recommend, or provide insight into, public companies for investment.

Each of these claim to be the best, each feature “expert analysis”, and each usually makes big coin off providing this kind of “advice” – even though many of them often conflict with each other on the same company or stock.

This is big business, and it can be hard for newbies to determine the difference between paid media fluff (many sites are simply paid to pump up certain companies), and the truth.

From Morningstar to Motley Fool and everything in between, they’ve almost all got some kind of monetary incentive to push certain stocks or ETFs in your direction.

But there’s one thing that doesn’t lie: the numbers.

The beauty of being a publicly-listed company is that each company is regularly forced to disclose financial updates to the market, with their latest numbers written there in plain sight.

Earnings, profit, debt, return on equity, free cash flow, EBITDA… all these and more are terms you’ll come across when pouring over your first ASX Company Earnings Report… and immediately feeling your eyes glaze over: a rite of passage for any new ASX investor.

We’re not going to cover all the terminology here, because there are other places out there online which have done so better and in more detail.

However, here are some of the key basic terms/metrics that are probably worth familiarising yourself with first up as a n00b:

- The difference between Revenue and Profit

- Market Cap

- Price to Earnings Ratio (P/E)

- Return on Equity (ROE)

- Net Debt to Equity (D/E)

- Free Cash Flow (FCF)

There are countless other more advanced metrics out there featuring different ratios, time-weighted calculations, technical indicators, and innumerable other ways to break down a company – however many of them still stem from these basic concepts.

As a newbie, you probably don’t want to get too bogged down yet; brush up on terms like those as a decent starter so you at least understand the basics first.

So, assuming you want to research metrics like these – where could you look online?

I find each of these below to be the best tools for my own use, and you’ll see me reference them in various other places throughout this site.

Most of them are free and ad-supported; some require payment to unlock their “full” features, but most of the time you don’t need to bother – especially as a newbie.

These are:

- The ASX Official Site – www2.asx.com.au

- TradingView’s Stock Screener – tradingview.com/screener

- Market Index – marketindex.com.au

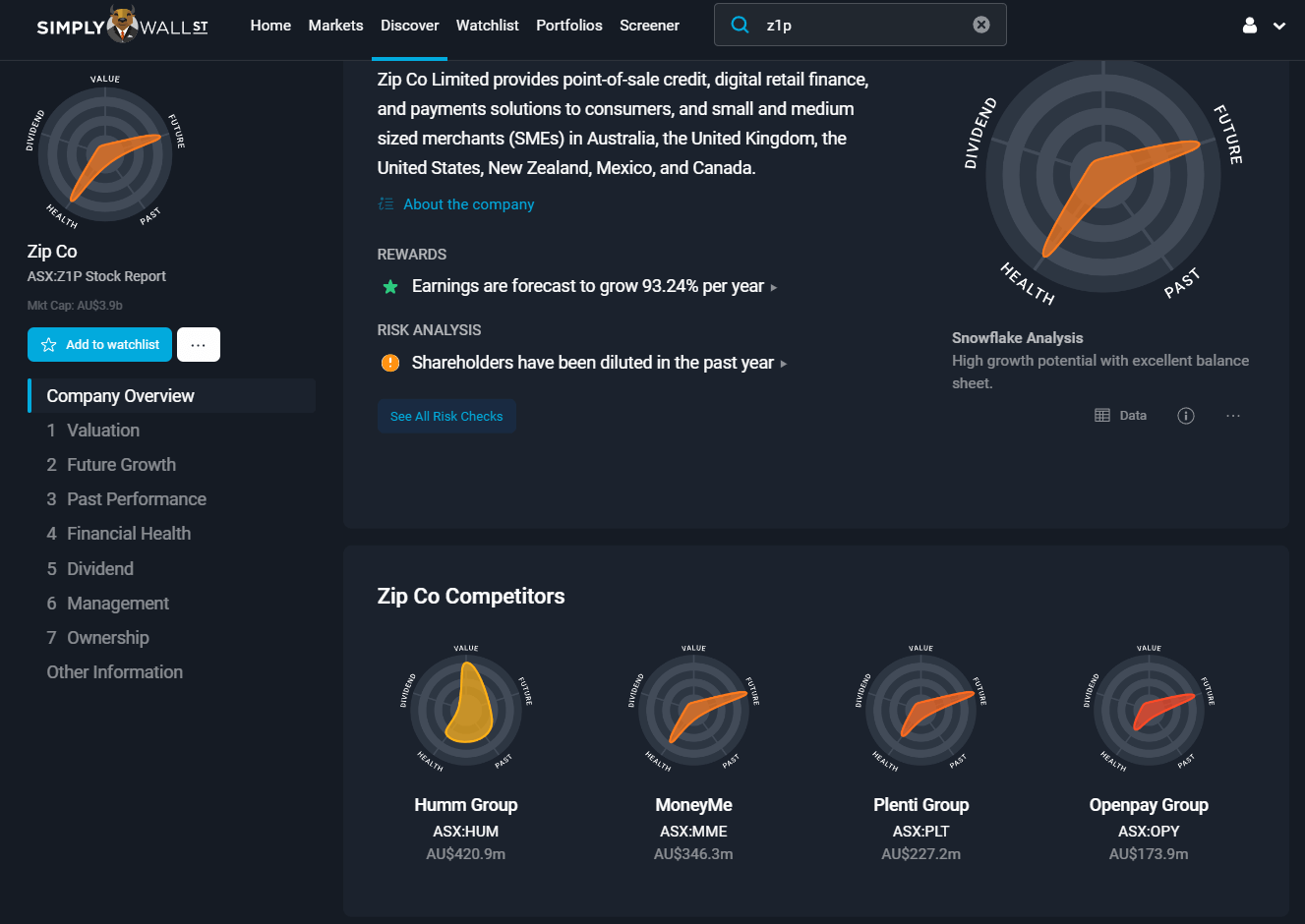

- SimplyWallStreet – simplywall.st

Side note: I have no idea why the official ASX website has a “www2” as its web address, as it makes it look about 50% dodgier than an official site should, but it just does.

Here’s what you can look for on each one when doing basic research.

The ASX Official Site

The ASX’s website is solid and provides some good at-a-glance company info despite being a little clunky in places on mobile.

It’s good at some things that some of the non-official other sites here aren’t, and vice-versa.

What it does well: The main uses we like it for are the at-a-glance charting with daily trade volume bars, and the up-to-date company revenue/profit figures.

These two sections are the most useful parts when looking at individual companies in our book:

What it doesn’t do well: the ASX site shows a summary of ownership/management as simply a list of names; it doesn’t show how much they own and/or whether they have bought or sold recently.

They also don’t even bother giving a 1-paragraph summary of what the company actually does… which seems strange/lazy for an official site:

The best section of the individual stock profiles here are the simple bar charts that show Revenue & Profit for the last handful of years, as well as a snapshot of other top-level, basic metrics:

It’s an easy initial way to see whether or not the company is growing on an annual basis, or if it’s burning through funds just to grow while not actually making money.

It also provides a handy at-a-glance look at at its dividend breakdown and key factors such as if the company’s dividends are franked, when they are recorded and paid, and similar essential info for stocks that pay a dividend.

The main downside of using the ASX site for research is that you have to already know what company you’re looking for; it’s not really a “discovery tool”, and has no screening functionality to search or filter stocks by certain metrics.

As a result, it’s more of a ‘backup’ for quick info and checking the viability of stocks you’re already aware of.

That’s where the next tool comes in…

TradingView’s Stock Screener

I’ve touched on this before in my “How to do Due Diligence on Stocks” article (visit that link for an example process on how to use the tool more in-depth), but suffice to say that TradingView’s Stock Screener is the best free tool I’ve found online for discovering new companies that fit certain requirements.

What it does well: Shout out to the UI designers at TradingView for producing a blazing-fast tool that allows you to immediately filter through thousands of stocks with minimal load time or interface lag.

They cover pretty much every stock on every major stock exchange worldwide, and the ASX is no exception.

The amount of filtering options they provide is staggering. Almost every single metric you can think of outside of some more advanced time-weighted combinations is here, and you have full customisation over adding extra metrics, saving columns, adding and removing filters, and much more.

Want value companies that pay dividends over a certain %? Want companies that provide the best possible return on investment %? Want to view only companies under a certain market cap size?

It’s all just a couple of clicks away, and fast as hell.

After selecting the ASX (Aussie flag icon), simply click the little “filter” icon on the top row of each column, and you can break any of the metrics down to remove stocks you don’t want to see:

You can sign up for a free account on TradingView, and it’s worth doing just so you can save your Columns & Filters for future visits.

Note to any aspiring programmers or designers out there who are thinking “I might come up with a tool to filter stocks and make money off it!”: this is the benchmark for stock filtering and screening.

If you can’t make something better than this, it’s honestly not worth bothering.

What it doesn’t do well: It’s a bit clunky on mobile phones seeing it’s basically a massive spreadsheet, and even the app doesn’t handle this very well; it’s simply a restriction of viewing mass data in table format on mobile devices.

Not really something TradingView can do too much about themselves unfortunately.

TradingView also doesn’t provide some of the other essential “DYOR” information for those who want to go deeper after they’ve found stocks of interest – most importantly: Company Announcements, and Insider Ownership.

For these (and why they’re important), you’ll want to visit…

Market Index

In many ways, MarketIndex is a faster/slicker/more modernised version of the Official ASX Website; it’s another Aussie-made site that’s also extremely fast-loading and well-put-together.

What it does well: MarketIndex covers most of the essential, top-level company info that the ASX’s website does, however it also offers a couple of extra key sections that come in very handy.

The first of these is its “Announcements” section. Simply search for an individual stock, and you’ll be presented with plenty of great data, including:

For the noobs out there: ASX-listed companies are obliged to make public announcements for significant changes, losses or achievements that affect their company, as well as provide regular reports on their financial status (can be quarterly, or half-yearly depending on the company).

These are some of the most significant factors that will move the share price of a company up or down; a major new contract signed, client lost, mineral discovery or lawsuit – among countless other things – can make or lose you some serious money, quick-smart.

MarketIndex provides a great, fast way to see some of these announcements the company has made dating back several years. All you need to do is click the link, and you’ll be presented with a PDF of the document pushed to the ASX by the company itself.

These announcements are generally divided into ‘Price Sensitive’ (things that the ASX deems will have a direct impact on the company’s revenue in some way), and ‘Standard’ or ‘Non-price Sensitive’ (the exercising of options, hiring of minor new staff members, the company attempting to spruik something that the ASX deems pitiful, etc.)

MarketIndex also provides some decent info about company management buying & selling, the Top 20 holders of the company’s stock, historical share price data and more.

What it doesn’t do well: MarketIndex tends to present most of its financial data in tables as opposed to graphs or visualisations.

For visual learners, and especially newbies, it can be a bit overwhelming… and the Official ASX Site presents revenue/profit data in a more visual way anyway.

It also doesn’t present some of the other key data points as clearly as the next tool…

Simply Wall St

Simply Wall St is an Australian (Sydney) made tool that aims to make the “visualisation” of some of the most common data points & valuation metrics used in stock investing easier to… well… visualise.

What it does well: Showcases insider buying/selling, and insider ownership volumes in the easiest-to-grasp manner of any tool out there.

The platform has had plenty of extra bells & whistles added over the years – it can serve as a stock screener, company profile tool, watchlist, and “general investing inspiration” board.

It does each of these to varying degrees of success (some of the above platforms do these better/quicker), however its best aspect for research purposes from our perspective are its ‘Management’ and ‘Ownership’ sections for each stock.

Why is looking at these items important? The theory behind this is twofold:

- You can see if directors/board members are continuing to invest their own money back into the business at the current (or similar) share prices, often seen as a ‘show of confidence’ in the company’s future, and;

- If a significant portion of the company is owned by its management team, they have a built-in incentive to want to see it grow so that they make more money as well, unlike some fly-by-night CEOs who may only be using a company to pad their resume.

Simply Wall St’s visuals of this make it easy to see both sides of the coin here, in terms of both insider buying/selling depicted by this chart:

or in table form, if you prefer:

and then the current overall breakdown of who and what owns what percent of the company:

Again, this is just another factoid to keep in mind that isn’t the be-all and end-all of buy signals, but an incentivised management team is almost always better than one that isn’t.

Once you feel comfortable enough with the company’s fundamentals, sentiment & your knowledge of its operations to the point you’re interested in buying its stock, it’s time to move onto the next step.

6. Depositing Money into your Broker

Buying shares costs money (surprise), and in order to make your first buy order you need to ensure that your brokerage app or website of choice is properly funded.

Most of the apps out there these days are making it easier and easier to get your money from your bank account into their ecosystems, with a couple of staple options typically available to choose from.

The two main options, depending on whether they’re supported or not are:

- BSB transfer: the broker will have either set up a ‘bank account’ in your name through a silent bank partner tied to your user profile within the app. You can then simply create a ‘Payee’ containing that BSB & Account Number combination in your bank’s app or web interface, and then transfer money across just like you would into any other bank account.

- PayID: some Aussie brokers have PayID functionality available – which typically means the broker will generate a dynamic email address tied to your account (something like u184248e@example.com), which you can then set up in your bank as a Payee and deposit money for instant funding that way.

Bear in mind for both of these options, the first time you try to deposit money into them your bank will likely freeze the transaction for 24 hours as it passes automated fraud checks (especially if you’re depositing over $1,000 AUD).

This is frustrating and can be stressful for those who don’t realise it, as you’re frantically refreshing your broker app and seeing a $0 balance.

Don’t worry if you don’t see the money go through immediately – as long as you entered the correct details, the funds will likely clear and be available within the next day or two.

After making your first deposit, most banks/brokers will then allow future deposits to the same BSB/PayID combo to go through near-instantly, or at least in around 15 minutes at the most.

The last thing to remember is that for buying ASX shares with “CHESS Sponsored/Individual HIN” brokers, $500 is the minimum amount you can spend to buy shares in a single transaction.

Non-CHESS/Custodial Model brokers may allow smaller amounts than this; just remember to bear in mind the brokerage fees you’re paying for each transaction, as these can eat into your returns if you’re frequently only buying small amounts.

7. Placing an Order – Market vs. Limit Buy

Now it’s time to place an order!

Most brokers provide the option to either perform buy orders based on the total number of shares, or the total value of money you want to spend, with the number of shares you get scaling accordingly with that $ figure.

For example, let’s say I want to buy shares in Fortescue Metals Group (FMG).

I can enter a buy order for $5,000, and based on the current price above, I’ll get 291 shares for a total of $4,990.65 (not including brokerage).

OR, if I prefer round numbers, I can enter a buy order for, say, 300 shares, and it would cost me $5,145 (not including brokerage).

This might seem basic/obvious, but the key thing here is to make sure you are entering the number into the correct field.

For example, I’ve seen multiple people make the awkward (and sometimes hilarious) mistake of accidentally ordering 5,000 shares of a company when they meant to order $5,000 worth of shares.

If that company is trading at $5 per share, well… you’ve just accidentally committed to buying $25,000 of the company instead of $5,000. Don’t be ‘that guy’.

The other main option you’ll have here is to either place an order for a buy at “Market Order”, or a “Limit Buy”.

In almost all scenarios for individual shares, you’ll probably have a target price in mind that you want to buy the stock at, so “Limit Buy” will be the default choice.

This simply means you’ll enter the target maximum price you’re willing to pay per share, then have your bid placed in the “order queue” for anyone who’s willing to sell their shares to you at that price.

If you’re bidding the same amount as other people, the people who placed their order for that price before you will be ‘ahead of the queue’, and have their orders filled first.

“Market Order” is mainly used when you just want to enter a position in the company no matter what, and will automatically pay whatever the top current bid is for shares being offered for sale on the market.

This does serve a purpose – for example, if you’re looking to just Dollar-Cost Average into an index ETF and don’t really care what price you get it for, as you’ll be holding long-term and the small difference in bid prices doesn’t really matter.

Otherwise, it’s almost always better to use Limit Price and adjust your bid price up or down to ensure you don’t end up paying too much.

The last option you may see in your broker is a date option – to choose whether you want to put your bid in to expire by a certain date, or just select “Good For Day”. This simply means that if your bid does not get fulfilled within that day’s ASX trading session, then the order will be automatically cancelled and you won’t gain or lose anything.

Once your bid has been accepted for your successful Buy Order, most brokerage apps will send you an automatic Trade Confirmation Email to your associated email address as a record of your trade, how many shares you acquired, and how much you paid for it.

8. Configuring your Share Registries

Once you’ve made your first share purchase, or first couple of share purchases, brace yourself – the spam is coming.

The ASX and its partner Share Registries (companies who handle the administration of shareholders for listed companies, and the ‘ownership’ of the shares and attribute them to you) are some primitive mofos who seem to love destroying an Amazon Rainforest’s worth of trees to spam every holder with letters for every occasion.

Welcome letters, Update of Details letters, Acknowledgement of Bank Account letters, Annual General Meeting Voting Form letters, Please Tell Us Your Favourite Icecream Flavour letters… the amount of annoying physical mail you’ll soon find cluttering up your letterbox will have you sighing in disgust.

While these companies continue to say they’re “almost done” digitising the process, they sure as hell aren’t there yet.

As a result, one of the first things you’ll want to do is log on to the relevant Share Registries and configure your Settings/Preferences for things such as preferring digital communications, opting in or out of Dividend Reinvestment Plans, and more.

The major Share Registries for Australian shares are:

These companies cover the vast bulk of share-related admin for Aussie stocks, and feel slightly “90’s dial-up internet” in terms of user interface.

Log in to these with one of the details you would have received in a Welcome letter, and you’ll have the info for each invidual company you hold that they provide admin for.

These systems all feel so, so antiquated, with painful password retrieval processes and experiences that suck on mobile phones and feel very “government” overall.

Just go in once, hammer out all your Preference settings such as your Address, Bank Account, Communications and other crucial details, then hope that you’ll never have to log into them again for the forseeable future, or until tax time rolls around.

9. Tracking your Trades & Portfolio Returns

Note: we’ve got a dedicated “How to Track your Portfolio Returns” article that goes into a bit more individual detail on each item listed here.

Buying and selling stocks is all fun and games, but you also need to be sure that you’re keeping track of everything.

This is not only for your own benefit – so you can see how much $$$ you’re actually making (or losing…) on your investments, but also because once a year the dreaded spectre of the Australian Taxation Office (ATO) rises from its grave and makes your tax return extra-spicy and complicated.

Some of the most important things you’ll need to be keeping track of are:

- Your trade buy/sell amounts and their prices at the time of doing so

- Dividends received from any stock you hold

- Franking credits offered on any of those dividends

- Currency fluctuations if you’re investing in overseas companies

- Distribution & AMIT details for ETFs

- Mergers/acquisitions/share splits & other corporate actions

If this all sounds complicated and unnecessarily painful, that’s because… it is. Australia’s investment tax system is pretty convoluted, and not having adequate records when tax time rolls around can be stress-inducing.

Most Australian brokers do a pretty poor job of aggregating all this data into the one place, and while they’re getting better many of them simply expect you to put into place your own systems such as spreadsheets or 3rd party software to do it all properly.

At time of writing, Aussies typically default to two major methods of portfolio tracking:

1. Use Sharesight

Sharesight has fast become one of the most recognisable Aussie tools for investors since DIY investing has taken off, as it’s a software tool designed pretty much exactly around the pains of Australia’s investing ecosystem.

This is a SaaS (Software As A Service) tool which allows you to automatically import your trades into a single dashboard and have the system take care of most of the essentials for you.

Getting your initial portfolio into the system can either be laughably easy or semi-painful depending on what broker you use, however their system that allows you to have your broker automatically forward your Trade Confirmation Emails into your dedicated Sharesight account & process all your trades without having to do anything is pretty sweet.

It helps eliminate the possibility of data entry errors when maintaining a spreadsheet, and calculates dividends, share splits, currencies and all of the other essentials too.

It allows you to benchmark your own portfolio performance with other individual stocks or ETFs so you can get an idea of how you’re faring, and provides links to news articles written by 3rd parties providing news coverage on individual stocks you hold, which is all pretty sweet.

The system’s CGT reports and various tax exports that can be downloaded as a CSV or provided as access to your accountant are a massive time-saver as well.

The only downside is it’s fairly expensive on the higher-tier plans, and their Android/iOS app sucks; however, the web version is fine, and Aussies are typically able to use Sharesight as a tax write off which helps alleviate some of both of these pain points.

If your portfolio contains 10 holdings or less, Sharesight also offers a Free plan for portfolios of this size which can cover most of what you need for portfolio tracking as well (particularly handy for those who only hold a couple of ETFs).

Link: https://www.sharesight.com/au/

2. Maintain a spreadsheet

Spreadsheets are often the default, free, way that most first-timers will resort to when looking to track their portfolio returns.

There are plenty of them out there online, and considering almost everyone has Excel or uses Google Sheets, they can be an appealing initial thought for keeping track of everything.

You’ll have to manually keep track of your buy and sell trades and prices, dividends as they come in, franking credits and more all manually with a spreadsheet.

![]()

Suffice to say that the combination of potential for user error and the sheer effort of keeping everything up to date in a spreadsheet is why we simply personally prefer to opt for automated solutions (e.g: Sharesight or some other overseas alternative software out there) as we simply value our time more than the money it costs.

If you’re after a good investment tracking spreadsheet, we link to several of the best we’ve found online here.

3. Rely on your broker

In general, regardless of which Aussie broker you use, you’ll probably notice as tax time rolls around that they don’t do the best job of providing accurate views of performance – which is why there’s a market out there for alternative software solutions in the first place.

Several of them are getting better about this – Superhero currently has the best array of transaction/trade reports & CGT centric PDFs you can download that we’ve seen among the Aussie brokers – but there’s still several pieces missing.

Dividends, adjusted cost bases, average buy prices etc. are never really done properly within brokers, and the more shares you hold the more complicated an inaccurate the reporting tends to get.

CommSec provide probably the most comprehensive tax & performance reporting docs of the major DIY brokers, but even they have each necessary item for reporting broken up into clunky individual PDFs you have to all download separately and collate together.

10. Doing your Tax

What’s the reason for needing to be so strict and accurate when tracking your true returns? The gloomy spectre of the ATO (Australian Taxation Office) is the main reason why.

Income from shares, a.k.a Capital Gains – whether it be realised gains from selling shares, dividends, or distributions paid from ETFs or other funds – is taxed just like your regular income. That means you’ll be taxed at the same marginal tax rate you already are at.

This is why things like Franking Credits and the CGT Discount are two of the most important factors to keep in mind in the Aussie investing landscape (any relief you can get from tax is a bonus), and why tracking all of the above is crucial.

If you hold your shares for over a year before selling, you’ll only be taxed at half the CGT rate – so sometimes those 💎🙌 really do pay off.

Likewise, if you sell stocks you’ve made a loss on during the same financial year, you can use those losses to offset the gains from the profitable stocks you sold. Confused yet?

Regardless, once tax time rolls around at the end of the financial year and you’ve gathered all your share trading documentation, you’ll have two options with how to handle things:

1. Do your own tax return – due 31 October

If you’re planning to tackle your tax return yourself, you’ll have a few months after the end of the financial year to ensure everything’s together.

As part of this, you’ll need to make sure you have records of:

- All your share buys and sells for the financial year

- ETF tax docs for distributions (usually provided by your ETF provider, e.g: Vanguard, BetaShares, etc.). These can arrive pretty late/lead to ETF investors getting stressed and ranting about it online every year.

- Dividends received and/or Dividend Reinvestment Plans that were reinvested into

- Total capital gains made during the year

Make sure you’ve provided your Tax File Number (TFN) to your broker, so when you go to complete your tax return the ATO can auto-populate dividend figures.

All of this often means sorting through a shitload of paperwork, or betting on the fact you’ve kept your trusty spreadsheet 100% in order/up to date throughout the year.

Otherwise, you might prefer to just…

2. Pay for an accountant – due as late as 15 May

One for the procrastinators out there (guilty), being registered & filing with a tax agent gives you several extra months worth of time before the due date.

While newer investors might balk at the idea of paying more money when trying to maximise your returns, a good tax accountant is well worth eating the annual fee for in our opinion.

Oftentimes there’ll be enough they can confirm or fix from your share trading activity over the past year to make up for the cost of their fees anyway; plus, any liability for mistakes then becomes their job to fix, rather than yourself.

You’ll still need to provide your accountant with a record of your trading activity and/or the documentation from the past financial year, which means you’ll likely be at least semi-reliant on one of the above solutions (or combination thereof) in the end.

Fees for accountants obviously vary, but expect to pay at least a couple of hundred bucks for a return that includes a reasonable amount of share trades over the past year.

The better your documentation, the less time the accountant will take – and the less you’ll likely have to pay.

So there you have it – hopefully enough to get you started on the whacky and wonderful path of Australian investing.

Anything we missed or you’d like to see added? Let us know in the comments below.