Each week I’ll be picking a random ASX stock that I (personally, yes I’m aware it may have been covered at some point in history) rarely see discussed online – and that I do NOT hold – that you voted for, for us to dive into for some Due Diligence (“DD”).

This is for us to have a look at what it does, comb over their financials, and conduct some polling on general sentiment. Not all of these stocks may be sexy or appealing; the whole point is to shine a light on what companies are doing out there on the ASX which never get much coverage – for good or bad.

The main purpose being to add some more variety in coverage to the standard blue chips or meme stocks we see pumped day in and day out, and hopefully discover some hidden gems or innovative companies on the Aussie market.

Here’s this week’s Random Stock of the Week.

Company name: Aeris Resources

Ticker: AIS

Industry: Mining

Headquarters: Brisbane, QLD

Market cap: ~$300m

Current share price: ~$0.135

1-year Performance: +28.5%

What they do, smoothbrain version: conduct cap raises & stagnate their share price… while also mining both copper and gold.

What they say they do, wanky version: “Aeris is a mid-tier mining company focused on growth and delivering shareholder value through efficient operations, greenfields and brownfields exploration and value-adding acquisitions.” 🍆👋

What they do, actual version: Brisbane-based Aeris Resources (AIS) are a hybrid copper and gold mining company with a duo of flagship assets that form the backbone of their current operations and revenue generation.

While the company has been listed for quite a while – they debuted on the ASX back in 2011 – Aeris had a tumultuous history through its first couple of years of listing that are now largely irrelevant to where the company currently sits today.

It was initially listed as Straits Resources, struggling along for several years before undergoing a corporate restructure in 2015 and rebranding to its current name of Aeris Resources to reflect a “new positive beginning” of more efficient operations moving forward.

Throughout its initial operations, the company has been focused on copper mining and production, with its key asset the Tritton Copper project situated around 50km north-west of Nyngan in north-west NSW.

The mine began operations in 2005, and in its present state can be counted on to produce around 19,000 – 20,000 tonnes of copper per year. The project is a complex of two mines (both underground), and its associated processing plant.

However, the ‘modern iteration’ of AIS really only came into existence midway through 2020, when Aeris also acquired ownership of the Cracow Gold project located in central QLD in July of the same year – along with mining and explorations licences for the surrounding goldfields.

This mine had recommenced its operations in 2004, and the company has estimated for it to produce between 64,000 – 66,000 ounces of gold moving forward. As it stands now, AIS can claim the title of the only mixed small-cap copper and gold producer on the ASX.

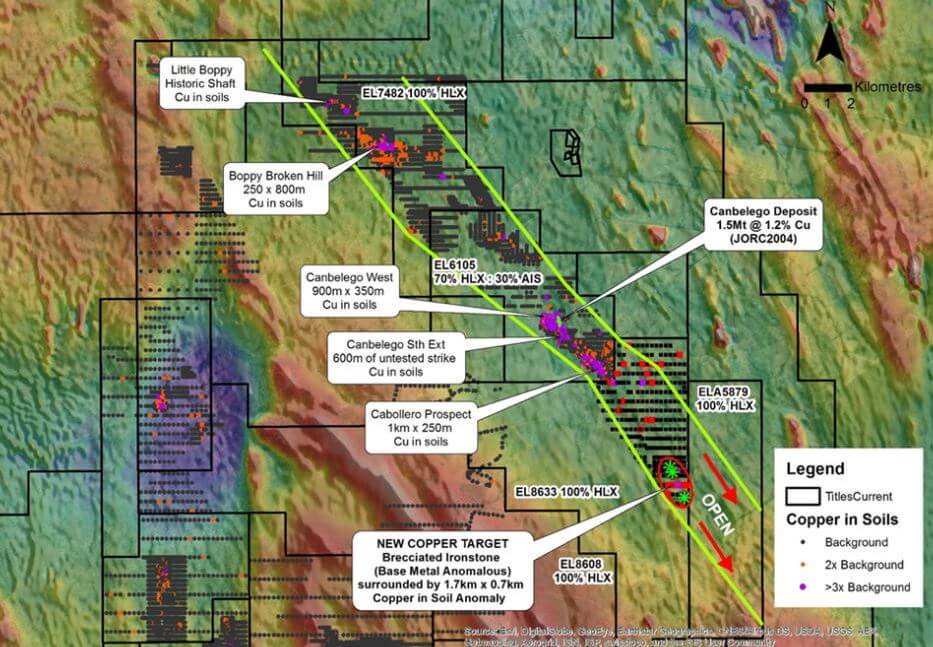

Aeris also has a subsidiary which has a joint venture underway with another subsidiary of ASX-listed Helix Resources (HLX) – the Canbelego joint venture.

This is a 40km² prospective copper project located to the south-east of Cobar in central NSW which has shown recent potential via broad zones of copper sulphide samples. The region has plenty of copper exploration activity taking place, with multiple other prospecting listed and unlisted companies searching its tenements due to a history of rich copper deposits.

Aeris Resources’ current management have proven pretty adept at rescue projects and essentially ‘saved’ the Tritton mine operations many years ago, taking over a resource with a limited Life of Mine and conducting explorations nearby to search for additional deposits to extend the resource’s life further.

As of time of writing, AIS have identified three new copper ore sources/deposits that they’re looking to develop at their Tritton complex and are showing promise.

Chief among these are its Constellation Deposit which sits around 45km to the north-east of its existing Tritton operations and within a fairly easy distance for trucks to transport ore to its mill. The company is expecting to release an update of Constellation’s mineral resource in June 2022.

In closer proximity lies the Budgerygar deposit around 600m from its Tritton mine, which also looks promising and has recently returned upgraded mineral resource size & estimate grades that have improved upon initial estimates.

Its location relative to the company’s existing operations should make things much easier to bring into production given it can be accessed via current infrastructure vs. building an entirely new mine.

As a stock, AIS has had some fairly predictable peaks and valleys over the past few years, following a cycle that has repeatedly lead to its share price rapidly climbing and then drifting down each time. This has happened often in spite of raking in fairly solid revenue figures & varying degrees of profit.

One of the major factors for this is likely its propensity for cap raises and share dilution. This first started in June 2020, when AIS issued a cool 1 billion new shares at $0.03 per share to raise money from institutional & retail investors, in order to help fund the purchase of the Cracow mine from Evolution Mining (EVN).

After a couple of following quarters of solid gold production achieved, the share price gradually recovered post-purchase (and post-Covid-19 dip) culminating in a peak in March 2021, when the company’s quarterly update showed impressive volumes of both gold and copper achieved across its projects.

These trends pointed towards AIS having a cracking end of financial year for 2021, and the company delivered, posting around $430 million of revenue and net profit of $61 million.

Combined with several releases around positive drilling results from their Constellation project, and in June 2021 Aeris’ share price hit an all-time-high (at the time) of $0.225.

However, as we often see with listed companies, AIS took the opportunity to capitalise on all this sentiment & conduct another capital raising around the same time.

They held the raise at $0.175 per share for another approximately 287.9 million new shares issued (around a 15% discount to market price at the time of issue) in order to conduct further exploration opportunities at Cracow & Tritton.

In August 2021, the share price hit another all-time-high of $0.24 as buzz around the company and sentiment on the EV / electrification revolution was humming.

Soon after in the same month, AIS released their annual report which again showed strong financial results, but one key metric that would seemingly affect the business moving forward was starting to creep up: AISC.

AISC, or “All In Sustaining Costs” in mining terms, is essentially a single figure that sums up the cost per unit of metal sold for the company. Over each successive quarterly report, Aeris’ AISC figures climbed towards the latter part of 2021, with lower grades of copper achieved from the Tritton mine only exacerbating things further.

The company’s share price has thus essentially been flatlined for the better part of a year due to these factors.

This has resulted in a situation with its seemingly-strong fundamentals currently being largely ignored by the market as fears around continued cost rises and its existing short Life of Mine weighing on sentiment.

External ‘fear factors’ globally haven’t helped matters either, leading to underwhelmingly stagnant performance for AIS as a share for much of the past 12 months.

So how might AIS do in 2022 and beyond moving forward? Let’s take a look.

AIS has returned 26.29% p.a. (annualised) over the past 5 years, with no dividends paid.

What looks good:

- AIS is one of the rare occasions where a smallcap “explorer” is profitable with still plenty of potential built-in for share price growth, and also has existing operations in place to provide extra exploration & drilling cashflow. Normally companies of this size are either heavily in debt or relying on more frequent capital raises simply to exist in the hopes of striking a discovery; AIS has at least several good, profitable years “built in” that gives it a buffer to extend life of mine operations.

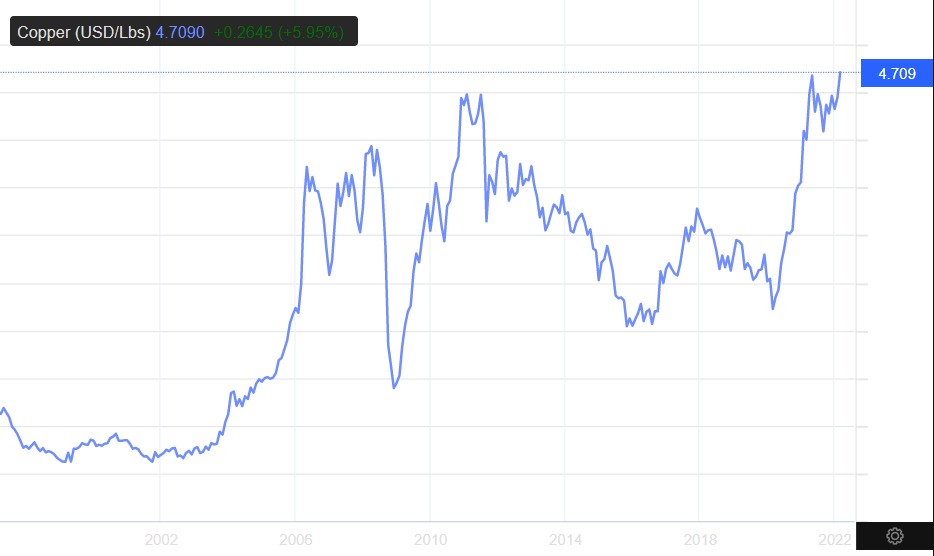

- Rising prices of both copper and gold have been working in AIS’ favour in the background for the latter half of 2021 & beginnings of 2022. Copper reached record highs in March 2022 at over $4.7 USD per pound and shows no sign of slowing down, with global supply deficits cites in the near-term due to its status as a key component for the renewables & electric vehicles boom:

- Likewise, gold broke out of a slump to start 2022 as well, with global inflation fears & conflict between Russia and the Ukraine triggering a flee to its supposed “safe-haven” nature. It has approached the fabled $2,000 USD mark at several points, and given continued instability may finally crack the barrier in the near future. Both of these should add substantially to AIS’ bottom line in its upcoming financials and may trigger a re-rate:

- Aeris has additional resource deposits looking to come online in the coming months around mid 2022, which should help raise some of the current declining copper grades being achieved at Tritton substantially.

- Initially, the company has unveiled maiden Constellation resource estimates of 3.3 million tonnes at 1.4% copper grades and a total of 47,000 tonnes of copper. With updated results and estimates due later in the year, positive announcements from these should help improve sentiment further and allay some concerns about remaining quantities of resource:

- The Budgerygar deposit has given higher grade indications, with its mineral estimate coming in at 1.7%. This should be up, running and adding to production levels in the coming months.

- Lastly, its other prospective project, Avoca Tank is a small, high-grade deposit with an estimated mine life of 4 years. Its 2.6% grades are planned to be mixed in/topped up to the existing Tritton production to help increase overall grades and profitability as well.

- Aeris is priced well based on book value of its assets, with total assets of around $200 million and a market cap of just over $300 million. Throw in a P/E ratio of around 6 based on estimated updated earnings, and again, given its assets and profitability, it looks “cheap” as far as all major fundamentals for a producing miner go.

- AIS has paid off plenty of debt over the past couple of years – including the remainder of its outstanding balance recently – and is currently debt-free.

- The company also has accumulated tax losses of around $300 million on its books which can be claimed to increase profitability moving forward.

- As of its most recent financials, AIS has clocked up around $75 million in cash on its balance sheet. This is a fairly impressive amount to end up with, especially given they have been spending pretty significant dollars on exploration & growth activities for a company of this size. It gives them some flexibility in ways to act moving forward, for further exploration or even towards funding a (potential) small acquisition if one makes sense.

- AIS was selected to be added to the All Ordinaries index in March 2022 rebalance, which may finally garner it a few extra eyeballs from funds and other institutional investors.

- The company is coming of a series of down quarters with low grades and production numbers which likely aren’t representative of its true value moving forward. The fact that its share price has stagnated more than outright tumbled has shown that there is a fairly solid baseline of support for the stock – all it may need is a little extra push.

- In general, AIS management have been doing a good job of remaining profitable while working with a major ore body with declining grades and conducting fairly major expansion & exploration activities. This bodes well moving forward, as long as prices for their core commodities remain relatively high.

- While most may be after AIS for its status as a copper miner, the Cracow gold mine has proven a solid acquisition that has allowed the company to pay down its existing debt and finance its copper projects. This again reflects well on management’s ability to make solid and well-though-out acquisitions without frittering away money carelessly.

What doesn’t look good:

- Hedging costs/prices has proven to be a recent thorn in the company’s side. AIS management made some recent misjudgements in price hedging, as gold and copper values continued to rise yet the company was receiving locked-in lower than market prices for its resources. Its copper hedges (at 30%) wind up in the June quarter of 2022, while its gold hedges finish in the September quarter.

- This has been unfortunate on the gold side in particular, as AIS hedged 70% of their gold production for the period. With 5,250oz of gold hedged at $2,538 (AUD), at current prices this has likely cost the company millions of dollars – and will likely do so even more in the near future if prices hold & global inflation fears linger.

- Covid-19 looks to have had caused lingering issues with staffing levels that continued through the latter half of 2021 and into early 2022, which may result in bother lower production & contribute to yet higher AISC costs over the coming quarter/for the financial year. AIS gave indication that this would factor in for January & February of 2022 at least.

- The issue of high AISC issues eating into profit margins is one that’s been prevalent across the Australian mining industry in general over the past year+, with increased labour, energy and other input costs all working in tandem to offset some of the profitability of rising prices for materials. AIS reported AISC (god, these two acronyms being similar for this company is annoying 😅) for gold of $1,563 AUD in its December 2021 quarter and $4.68 AUD per pound for its copper (ouch), which may not be sustainable & need to be decreased as much as possible moving forward.

- There’s no denying that the Tritton mine has been producing some of its lowest-ever copper grades recently. It’s imperative for AIS to get its expansion projects up and running smoothly and within reasonable budgets, as any delays will mean that the ‘race against time’ for its sustainable profitability becomes even more urgent.

- An estimated spend of ~$50 million of capex for development of their mine life extension projects at Tritton is pretty eye-watering.

- Simply put, AIS’ share price performance has not tracked performance-wise with the rising price of copper and gold. While most other copper and gold miners across the ASX outside of those who have had disastrous operational issues have climbed substantially, Aeris’ has instead continued to trend gradually downwards with the market showing little enthusiasm for the stock in spite of positive macro sentiment for its core commodities.

- Life of mine appears to be the main concern that is holding retail investment back, with a lack of awareness/faith in its extension projects. Money may instead simply be ‘sitting on the sidelines’ and waiting to see proof by way of volume numbers, meaning the share price may not turn around any time soon.

- There has been minimal insider buying of shares on market over the past year, even as the share price has gradually drifted down. A dose of on-market buying by management may help provide some confidence given the share price is allegedly looking so ‘cheap’. Insiders also only own 3.8% of the shares on issue:

- The sheer amount of share dilution in AIS’ stock no doubt also plays a role. The company currently has over 2.2 billion shares on issue, with the hefty amount of volume needed to sustain positive share price movement and break through resistance all contributing to its inability to gain any ground.

- There remains some uncertainty about the company’s stance in terms of mergers & acquisitions. It was rumoured to be involved in talks around making a play for Glencore’s CSA mine (which was later snapped up by international firm Metals Acquisition Corp), which did not happen, and it’s been expected to make one for a while yet nothing appears to be in the pipeline… and so, life of mine concerns remain.

- Delays in assay return times are another compounding negative factor the company has cited, which again are likely to delay decision-making as well as keep a more extended lid on public market sentiment as they’re having to push back result release dates even further.

Summary: Much like its share price, AIS at the moment sits in the middle of a sort of awkward ‘transition’ phase as it has to balance between maintaining a feasible level of profit from its current operations while also pumping in significant amounts of capex to ramp up its profitability.

As always, the market fears uncertainty, and there’s a level of built-in uncertainty that seems to be baked into the company’s share price. This has combined to result in one of the more unusual disconnects between fundamentals and share price performance in the resources sector on the ASX.

Aeris operates with two booming commodities, is profitable, has shown good debt management, and has outlined clear plans to boost their near-term profitability in clear headline bullet points for everyone to see.

And yet, the company sits at a market cap well below that of both many unprofitable listed companies and/or other mineral explorers yet to earn a single cent in revenue.

It certainly doesn’t look outrageously-priced even among its other ASX copper-centric peers, either:

AIS also seems to be suffering from a certain level of confusion about its nature as a company amongst many investors.

Most companies down this smaller end of the spectrum are expected to specialise and then promote one material specifically to draw in bulls about that particular commodity – be it lithium, iron ore, copper or anything else.

Its ‘dual-brand’ nature of being half gold/half copper (even though it isn’t, really) makes it harder for many to value at a glance, and counter-intuitively might be working against it from a share price perspective.

Sprinkle in its round of seemingly-declining production figures in terms of both volume & AISC for those having a quick glance at the stats, as well as its chart, makes AIS look like a company in decline as a result.

The dilution mentioned multiple times above also likely doesn’t help. It creates the fear that this company might be an “annual cap-raiser” that will struggle to gain ground, and lead people to assume there’s better investments even elsewhere in the same sector.

This of course doesn’t tell the whole story.

Conclusion: Assuming Aeris Resources can keep to its schedule targets for its additional Tritton feeds and start showing increased copper grades flowing through in its reports, this could re-rate as soon as third-quarter of calendar year 2022.

It’s got seemingly-good management and macro factors for both of its core commodities working strongly in its favour; much will come down to how much the increased input and labour costs end up factoring in to AISC levels.

While you could potentially jump in this now and gamble on its next results being strong purely off the back of commodity price increases, I’d personally want to hold off for now, to wait and see what the figures actually look like.

Although in doing this you might miss out on the initial share price spike should the numbers look rosy, I’d rather see proof that things have turned the corner and then put some money in for the next few years afterwards even if it means costing myself some initial profits.

The market in the past has shown fairly lukewarm responses to otherwise good results from AIS, and unfortunately sentiment does still matter in terms of the profits you can make on smallcaps even if their solid fundamentals say otherwise.

I personally currently hold rival copper producer Sandfire Resources (SFR) in my portfolio as I am bullish on copper in general, and they themselves have already demonstrated in recent reports early in 2022 just how much input prices (such as power) can put a drain on a company’s profitability.

I’d thus rather want to see if the same case applies to AIS before chucking my money in.

Company website: https://www.aerisresources.com.au/

MarketIndex page: https://www.marketindex.com.au/asx/ais

Feel free to add your own opinions on AIS in the comments below.

Would you buy this stock? Why or why not? Feel free to vote in the poll.