Each week I’ll be picking a random ASX stock that I’ve rarely seen discussed online – and that I do NOT hold – that you voted for, for us to dive into for some Due Diligence (“DD”).

This is for us to have a look at what it does, comb over their financials, and conduct some polling on general sentiment. Not all of these stocks may be sexy or appealing; the whole point is to shine a light on what companies are doing out there on the ASX which never get much coverage – for good or bad.

The main purpose being to add some more variety in coverage to the standard blue chips or meme stocks we see pumped day in and day out, and hopefully discover some hidden gems or innovative companies on the Aussie market.

Here’s this week’s Random Stock of the Week.

Company name: Australian Agricultural Company

Ticker: AAC

Industry: Livestock Production

Headquarters: Newstead, QLD

Market cap: ~$900m

Current share price: ~$1.50

P/E ratio: ~6.9

1-year Performance: +34%

What they do, smoothbrain version: Got beef? They kill cows. Lots of cows.

What they say they do, wanky version: “We have dedicated the best part of 200 years to perfecting our art. Respect for the land and our cattle runs deep through our veins; the desire to produce only the best has been passed down by the generations before us.” 🍆👋

What they do, actual version: If you’re looking to invest in an ASX company which is about as polar-opposite to a fly-by-night, flash-in-the-pan as could possibly be – this one would be about it.

That’s because the Australian Agricultural Company (AAC) is an old company – and when we say ‘old’, we mean ‘about as old as you can currently get in Australia’, given it’s the oldest continually-operating company in the country.

Founded waaaay back in its original form in 1824, the company primarily deals with cattle production, rearing, and slaughtering.

AAC operate an integrated cattle production system covering the whole livestock supply chain; one that is spread out over an absolutely massive amount of Aussie terrain.

Their holdings include property which covers an area of approximately 70,000 square kilometres of land – that’s about 2,000 square km bigger than the entirety of Tasmania, or what is colloquially known as “a shitload”.

All this as well as an array of individual farms, cattle stations, properties, feed lots, and everything else you need to rear cows for quality meat falls under their remit.

The company specialises in the production of both grain-fed and Wagyu beef, and on the consumer side their Westholme & Darling Downs meat brands form the bulk of their branded meat sales.

AAC’s distribution & revenue consists of both domestic and export markets, with the Asian & South-East Asian region still making up the bulk of their overseas trade.

It has traditionally been their core market across the majority of the company’s history as a listed company, although recent trends have seen them make a concerted push to ramp up efforts at brand awareness and distribution partnerships to North America & the USA in particular.

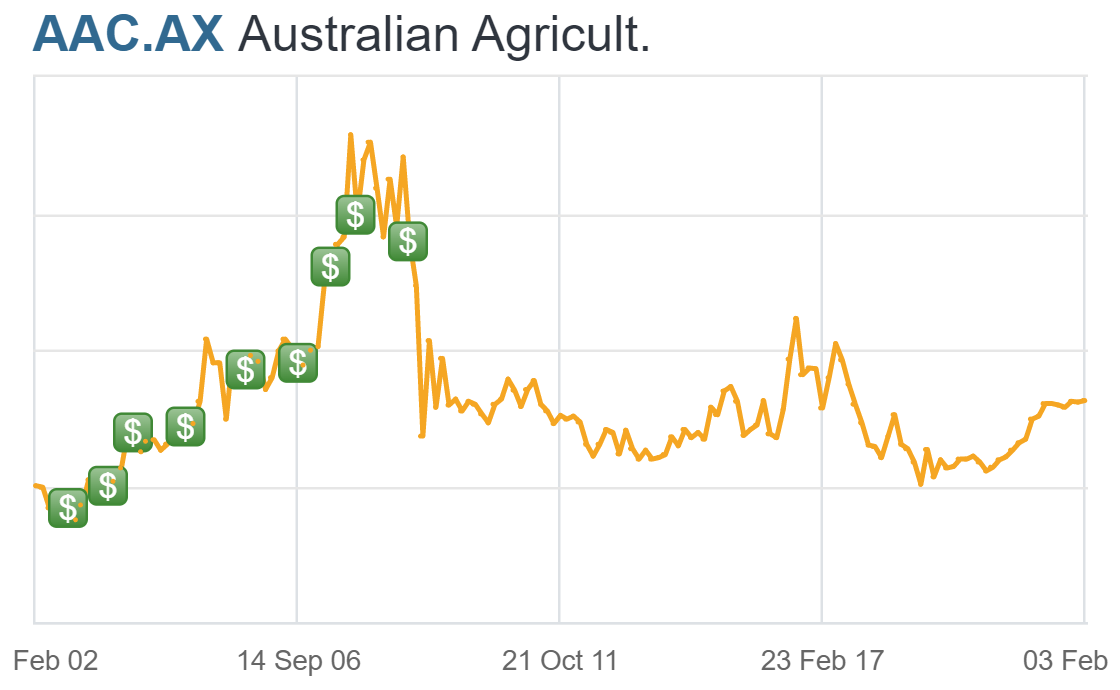

The company went through a relative share price boom during the mid-2000’s, coinciding with an increased demand for Aussie produce and hot-running beef markets in the SEA region during this time. This petered out afterwards, and ever since share prices have been relatively flat.

While some of this can be put on management, a lot of it has been due to factors simply out of AAC’s control. As the agricultural – and livestock in particular – sector is vulnerable to climate conditions and events, the last few years have not been kind to AAC’s operations.

This was particularly so during the period from 2018-2020, during which hard droughts hit most of the areas in the Northern Territory & Queensland in which AAC’s farms operate. This reduced calving yields and greatly increasing incidental drought-related costs that massively ate into revenue – to the tune of a cool $60 million at the peak of the bad times.

As if these macro environmental conditions weren’t hard enough, in early 2019 a severe Gulf flooding event occurred which hit four of the company’s pastoral properties. This caused massive damage, and the loss of tens of thousands of heads of cattle.

At time of writing, the past couple of financial years have been kinder for AAC. With cattle numbers slowly recovering and both the prices of beef & the massive landholdings the company sits on continuing to increase in value, these contribute in multiple ways to the company’s bottom line.

AAC IPO’d as a listed company in 2001, and has returned an average of 4.10% annualised p.a (including dividends) since listing.

What looks good:

- At a base level, this is a company that simply looks underpriced share-price wise vs. the raw net value of its assets. The company owns a significant amount of farm/grazing land which has been soaring in price over the past couple of years; each uptick of agricultural land price has a direct effect on increasing their NTA in lockstep.

- An additional 8% growth in the price of rural farmland has been forecast in 2022 by rural lender Rabobank, which equates to pure ‘passive’ value increases for AAC. All told, the company is now sitting on about $1.1 billion AUD of assets – with a market cap of only $900m at time of writing. That’s pretty crazy.

-

While the company’s cattle volumes have been down, this has been somewhat counteracted by both the increase in beef prices and reduced costs of production. Livestock values are also forecast to increase by another 8% – and 11% for cattle in particular – in 2021-22 by the Australian Bureau of Agricultural and Resource Economics, due to strong meat demand & tighter meat supplies.

-

These price and supply constraints have been compounded by Chinese embargoes against one of Australia’s key competitors in the meat industry – Brazil – meaning export conditions are currently even more in Australia’s favour. With the Chinese also placing some additional restrictions on Argentina & the UK as well, it puts AAC in a strong position pricing-power wise to squeeze out some extra margins.

- The UK recently agreed to an increase on the maximum tariff-free allowance quota for Aussie beef farmers, from 35,000 up to 110,000 tonnes. This provides potential additional profits from activity/product exported there.

- The company is experiencing a significant growth in brand presence in the North American market. Over 50% of their branded sales growth has come from here since the 2020-21 period. This has given AAC the ability to price-gouge a little bit, as the Yanks are willing to pay a premium (up 33%) for the company’s loin and rump meats.

- This has come on the back of AAC embarking on an ‘influencer’ partnership-centric campaign to grow awareness of their branded products by partnering with US chefs. Combined with increased selling via direct-to-consumer online marketplaces in this market, and it looks like the most promising growth channel the company has at the moment.

- All of these positives have combined with marked improvements in recent levels of rainfall to make for quite the economic turnaround for AAC. After its two hard-hit years climate-wise, they are back to a solid level of profitability, turning in a $83m NPAT and operating profit of $30m. As a result, their financials are no longer an eyesore:

- The fact that the company is sitting on major significant assets gives it a lot of potential flexibility, should it choose to act. With farmland prices at a peak and becoming only more desirable, AAC could choose to sell off some of these assets at a premium price to one of the many cashed-up ‘land-bankers’ out there. This could be done either to lean-down operations, or reward suffering shareholders with a Return of Capital / Special Dividend.

- Compared to its peers in the ASX ‘agricultural companies’ subsector, AAC looks well undervalued purely based on basic Price to Earnings. While there’s no exact like-for-like business on the exchange to compare it to – the closest is probably Elders (ASX:ELD) – on raw fundamentals it seems like a company worth more than it’s currently sitting at. Here’s how this space stacks up at time of writing:

- It’s rare that a listed company outside of a REIT or similar has the luxury of simply “not really doing anything”, and having its assets increase in value regardless. This provides something of a buffer for shareholders who may not entirely trust AAC’s management decisions. Even if the board simply continue to spin their wheels & maintain the status quo, the land & cattle prices will do a lot of the heavy lifting for them.

- The company has publicly declared that Covid-19 labour restrictions, which have had adverse effects on many other sectors & eaten into profits and operating hours, have not overly impacted their operations. The sector remains optimistic this will remain the same in the near-term.

- AAC has an interesting mix in terms of company ownership. There’s a high level of insider ownership, but this comes almost solely courtesy of Bryan Glinton, trustee of “The AA Trust” – a Bahamas-based entity of British businessman Joe Lewis. His main company, Tavistock Group, owns over 200 companies in 15 countries, and he’s also the majority owner of British Premier League team Tottenham Hotspur. It’s about as un-involved a majority holder you can get on the ASX – for both good, and bad.

- The company announced in November 2021 that it was committing to a blueprint for increased sustainability. They claim to be focusing on trials to reduce methane emissions, contributing funds to a climate & nature advisory group, investing in developing tools for soil carbon isolation, and various other buzzword-filled greenwashing pursuits. Whether these turn out to be admirable or just PR fluff, remains to be seen; still, it’s good to at least be trying to improve things from an environmental perspective.

What doesn’t look good:

- For such a fundamental and established company, AAC not paying a dividend – nor issuing any guidance on one – now that they’ve returned to profitability is a little strange. It’s not inherently a bad thing in itself as long as shareholders see a clear plan for growth; however for a business like this, it can be seen as a sign of management not being confident about maintaining sufficient profits moving forward.

-

This is especially true for AAC given the stagnation of the share price. Growth in NTA value is all well and good, but when it’s not seen as giving back to shareholders – and again, not clearly being communicated for what the profits are being used for growth-wise – then at least a dividend could serve as some kind of drawcard to get new investors on board. Yield of some kind would help balance out this current stagnation.

- There’s no getting around it: beef and red meat companies in general are facing some fairly major social/ethical headwinds moving forward. Again, although it’s no real fault of AAC themselves, people are becoming increasingly aware of the environmental impact of cattle farming & livestock slaughter. While both vegetarianism & meat alternative products are growing, even those who continue to eat meat are shifting more to the consumption of pork & chicken as opposed to beef:

- The company is experiencing a combination of declining revenues, and boasts a fairly high level of debt. They’re sitting on approximately $350 million owed at time of writing, which gives them around a ~33% debt/equity ratio; a little high for out liking, despite all those assets.

- AAC made what turned out to be a highly misguided investment in a state-of-the-art abattoir in 2015 which ended up being a massive drain on funds, and resulted them mothballing it in 2018 with an associated mass loss of jobs at the facility. They now have a $100 million paperweight that’s a stranded asset sitting there and not doing anything productive, with little mention of what they’re planning to do with it to date.

- This extends over to what many see as a lack of board/management communication to shareholders. Where will the growth come from? Investors generally want to see something more than maintenance/stagnation out of a company’s roadmap, which is likely a major reason for the disinterest in this stock as a whole.

- As mentioned, they’ve attempted to put out “sustainability”-centric messaging, however the industry itself by its nature is always inherently going to be fairly unsustainable environment-wise. This may just be attempting to put a green band-aid on an open wound.

- At its core, this is a business operating in what is globally an increasingly anti-meat environment. This is echoed by industry-wide record low slaughter volumes that aren’t showing any signs of reversing in the future.

- Climate change also has to be accepted as a risk factor for an investment such as this, too. With droughts wreaking absolute havoc on a business like this – and the potential for them happening with increased frequency as time goes on – a lot of it comes down to a gamble on Mother Nature just as much as it does what management decides to do themselves.

Summary

AAC are in a position in which it looks like the short-term and mid to long-term prospects contradict each other.

This is a business that has somewhat “Bradbury’d” (that is, stumbled through pure luck) into a strong position in the short term largely due to factors out of their own control.

With a pretty incredible array of valuable assets that have rapidly gone up in value – and look to continue to do so in the near-term – as well as increased demand / reduced supply for their core product, they stand to make solid profits until these factors reverse.

The simple benefit of more rain can and has reversed their fortunes in and of itself; being able to charge higher margins is simply the icing on the beefcake.

However, the question remains: what will be the catalyst for any kind of turnaround in sentiment towards this company? The sheer fact that it’s currently priced below the net value of its assets shows an utter lack of positive sentiment in the company / sector in general as a far as shareholders go.

Sure, management has the ability to simply keep running things as usual and luxuriate in their land values steadily rising (for now), but surely shareholders would prefer to put their money in a more ambitious company – or just invest in real estate directly?

Conclusion: Add it all up, and despite my ‘investing fundamentals’ brain saying that this is criminally undervalued, in terms of market performance that doesn’t usually end up mattering much.

Simply put: what is there for shareholders (or prospective shareholders) of AAC to get excited about?

Could this at least become a decent dividend-payer, to balance out its lack of growth plans?

Sure, in the short term, things are looking fairly bright for AAC given the surge in prices of their beef/cattle & property, and continuing to plug their beef products in the US looks at least somewhat promising. For the company’s own sake, if not that of shareholders, at least.

However, given the macro headwinds, the dispassionate majority insider owner, a lack of interest in Investor Relations of any kind, and I can’t see any real reason to put money into this company unless management make a concerted effort to address these things.

Otherwise, might as well just put your cash into an agricultural REIT or similar instead?

I’d be interested in buying into this based on the fundamentals if it weren’t for management’s overall level of disinterest & lack of a clear investor roadmap; however as a result, until that changes I’d probably look elsewhere.

If companies are going to bother being publicly listed, they should engage more for the benefit of shareholders… otherwise they might as well just stay private.

Company website: https://aaco.com.au/

MarketIndex page: https://www.marketindex.com.au/asx/aac

Feel free to add your own opinions on AAC in the comments below.

Would you buy this stock? Why or why not? Feel free to vote in the poll.