Nowadays, we’re fortunate to have access to a whole host of online tools at a few touches of a button that investors in decades past could have only dreamed of.

From stock research tools, to record keeping software, to tools to help calculate your investment tax & more, there are plenty of available tech-driven shortcuts that can make your life as an Australian investor easier.

Here are 10 of the best tools for Australian investors that you can start using today (not including brokers – if you’re after info on the best brokers check out our “Which ASX Broker App is Best?” article).

NOTE: we are not affiliated with any of these companies/sites.

1. Tradingview Screener & Charting

What it’s useful for: quick stock discovery and general statistical overviews; filtering & screening according to your criteria

If you’re looking to discover potential new stocks to invest in, there are few better choices of where to begin than Tradingview’s Stock Screener tool.

We’ve cited this tool in multiple places throughout this website for a reason. There simply isn’t any other tool out there that provides so much functionality that you can access for free without some kind of annoying ‘Freemium’ restriction, clunky or slow UI issues, missing information, or any combination thereof.

The Screener allows you to sort and filter through pretty much every single individual stock and ETF across every single major stock exchange in the world including the ASX, returning near-instant results any time you add in an extra filtering criteria.

You can customise & save your preferred columns and their order (or multiple of these), set up pre-set combinations of filters that you rely on and save them for future use, sort by every individual column, and much more.

All of the major statistical and financial metrics & ratios are available to add or remove, and Tradingview’s data is also some of the most quickly-updated after companies release their latest financial data to the market vs. any other I’ve found – even for the Australian markets.

The only real downsides are a lack of ability to export to a CSV/spreadsheet file on the Free plan, and that you pretty much need to use the tool on a Desktop device (they have a mobile app which works fine, but viewing this kind of extended data table format is just always going to work better on a desktop screen).

Other than that, this should basically be one of the most-used tools on the entire internet by any individual stock-picker, Aussie or otherwise.

Web link: https://www.tradingview.com/screener/

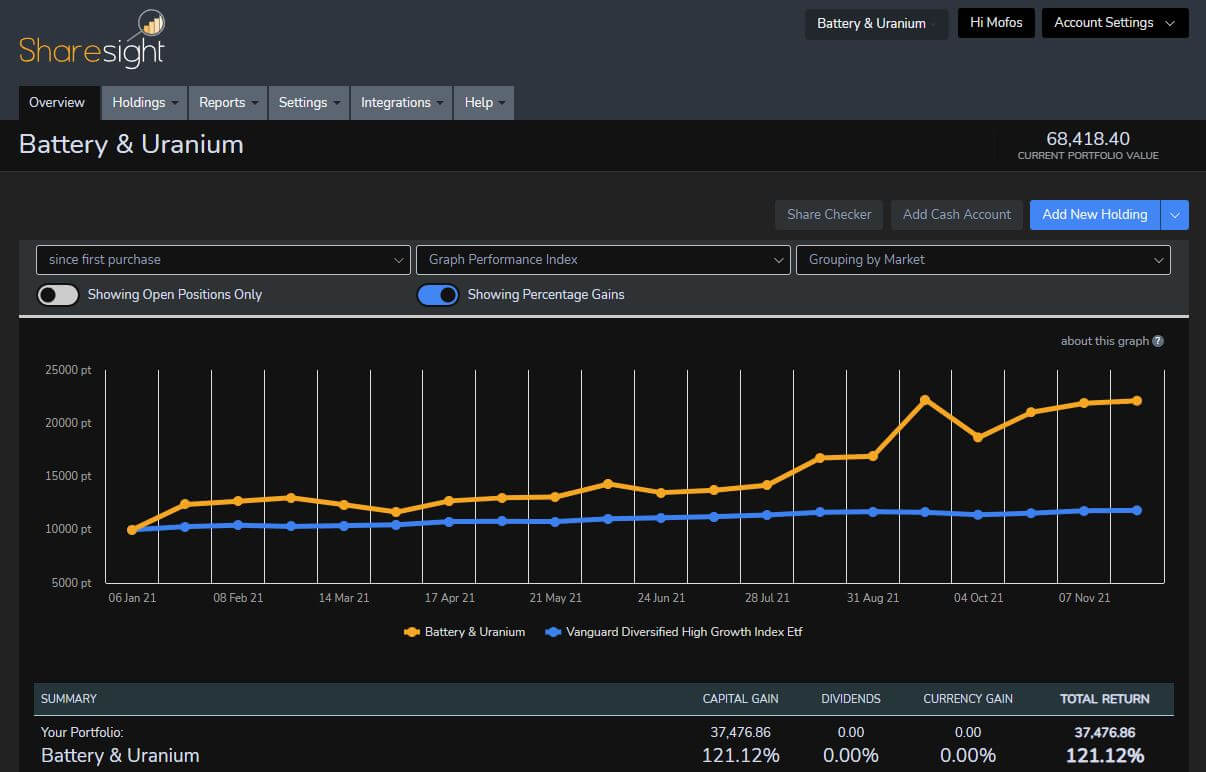

2. Sharesight

What it’s useful for: portfolio performance reporting; keeping track of trading information for tax purposes

While performing buy and sell trades on the market may often be interesting and fun, few people would probably say the same about keeping up-to-date records of all those trades.

Due to pretty stringent requirements by the Australian Tax Office (ATO), it’s important for Aussie investors to keep track of multiple aspects of their trading history for when reporting time rolls around to ensure you don’t incur the wrath of the regulator.

Dividends, adjusted cost bases, AMIT reporting requirements, currency adjustments for overseas shares, franking credits and many other fiddly and annoying items all need to be recorded correctly, which can become a huge chore.

It’s also time-consuming, boring, and prone to user error; good luck if you make a typo and then have to come back several months later and try to find out where everything went wrong before submitting your tax return.

In the past, most people used to rely on increasingly bloated and convoluted Excel spreadsheets and or lacking/incomplete annual reports from their broker to keep on top of everything.

However, in recent years with the SaaS (Software as a Service) revolution, several online tools and apps have popped up globally to try and make all of this easier.

For the Aussie investor, the best of these is Sharesight. While there are other, mostly overseas, software options that can approximate some of what Sharesight does, Sharesight stands out as it has been largely built to cater to the strange whims of the Australian share market and our tax laws.

The product is a hybrid New Zealand/Australia company, and has multiple specific reports designed specifically for the Aussie tax year – CGT reports, the ability to choose your desired reporting method to maximise/minimise tax gains, unrealised CGT reports and more which all can be run and either used yourself to complete your tax return, or exported & passed on to your accountant.

Outside of tax time, Sharesight also tracks your ‘true’ portfolio performance that most brokers don’t accurately show.

The software factors in dividend income and currency fluctuations, and is particularly handy if you use more than one broker as it can auto-import trades made in multiple platforms and consolidate them into one view.

Web link: https://www.sharesight.com/au/

3. MarketIndex

What it’s useful for: at-a-glance stock performance; filtering company announcements

A fast, responsive and simply better-performing all-round stock profiling website for the Australian share market, MarketIndex essentially does much of what the Official ASX Website (more on that below) does, except faster, better, and makes it all more easier to access.

MarketIndex just do a better job on their individual stock profile pages of compiling all the major at-a-glance company information into a single consolidated view (that works quickly and clean on mobile devices as well) than any other website.

Their stock charts are instantaneous and responsive, allowing you to change preset date ranges, toggle between standard and Candlestick charts, add indicators for market announcements to chart movements, and much more.

These views also provide written summaries of each company, allow you to view tables of key financial metrics, see changes in substantial share holdings by key figures, and suggests ‘similar’ companies related to the stock you’re currently viewing for further explanation.

Our favourite aspect of MarketIndex’s stock profiles is the way they consolidate all of the most recent ‘Market Announcements’ into a dedicated section which can be filtered by both “All” and “Price Sensitive Only” while linking directly to the PDF files of company’s reports.

This allows you to promptly access recent market financial updates, AGM reports, and any other significant news in a faster and more efficient manner than most other ASX-related websites out there.

The site also has a number of other dedicated landing pages for handy lists, such as viewing all Australian ETFs by category, see stocks that are paying upcoming dividends, and listings of all ASX companies that released a market announcement for the given day.

It’s simply an excellent all-round ASX-related site that continues to grow and get better as time goes on.

Web link: https://www.marketindex.com.au

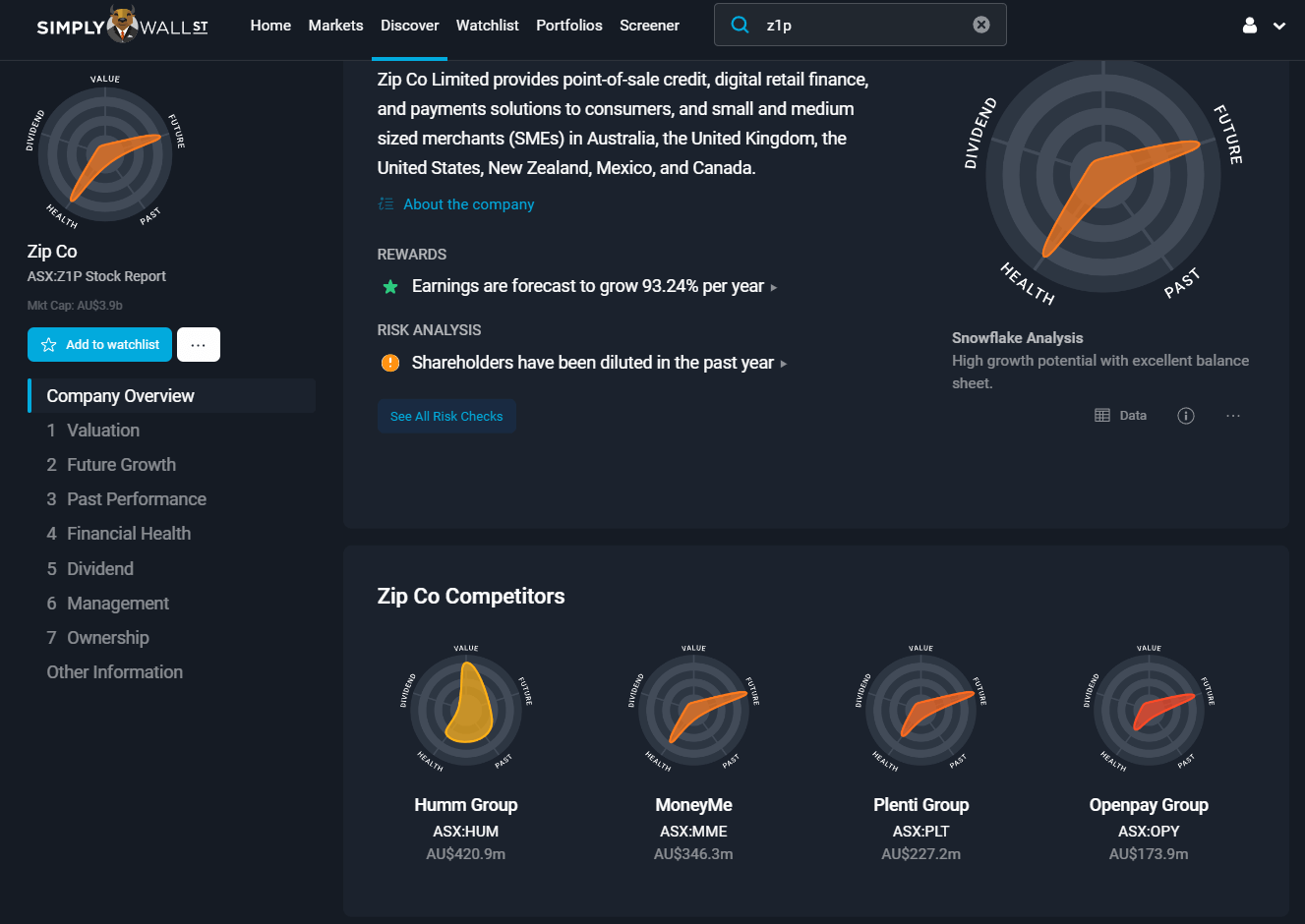

4. Simply Wall Street

What it’s useful for: visual representation of company figures; insider ownership buying/selling

This is one for those who get headaches from looking at table upon table of company and market data.

Simply Wall St is an Aussie company that takes the majority of key financial and high-level stock related valuation info and repurposes it all into an array of more visually-appealing graphical representations instead.

Part stock screener/discovery engine, part analysis tool, and part news feed, the platform allows you to take in the majority of essential info in a far more digestible way, with colour-coded chart and graph displays all clear and easy to soak in.

It also does a solid job of benchmarking each of these core metrics against industry and sector averages on the same market – not only for the ASX, but several of the larger stock exchanges around the world as well.

This means you can quickly see whether the stock looks “undervalued” vs. its peers rather than just the market as a whole, and make better decisions on whether or not to include it in your mental watchlist.

While most of this data can be obtained through some of the other tools elsewhere on this list, where Simply Wall St really shines is its breakdown of company Management and Ownership.

Their charts showcase the salaries of the CEO and board, as well as their level of insider ownership and how the company is owned as a whole – whether that be by institutions, insiders, or the general public.

It’s also the best tool to see at-a-glance the level of insider buying and selling that’s happening with a particular stock; if the CEO is selling down a lot of shares, it’s usually not a great sign and another useful metric to keep in your investing arsenal.

Web link: https://simplywall.st/

5. Official ASX Website & App

What it’s useful for: all-around, at-a-glance company financial information; receiving announcement notifications/alerts

The ASX’s official website is a bit of a hybrid of elements of multiple other tools and sites listed here, combined with a more extended hub for general ‘investing education’ guides and resources.

It’s the main ‘source of truth’ from which the majority of other markets content providers on this list pull their figures from, and is often the first to showcase up-to-date charts & updates of the most recent company financial figures upon their submission to the ASX as a whole.

This serves a dual purpose for a couple of types of users. For everyday people after market and individual stock data, it makes it the most current source of info for dividend dates & franking information, profit and revenue growth charts, and doing a decent job of at-a-glance fundamental data on a company-by-company basis.

For those who are app or software developers, or looking to scrape data for other uses, it’s also the main provider of API feeds for live pricing, market announcements and various other add-ons.

While its individual stock pages are a little dry – and do a minimal job of explaining what each company actually does – one of the main benefits of using the site is being able to receive announcements/alerts for news on your desired ASX stocks as soon as they’re made available to the market.

It’s a decent, free, starting point for people starting their research journey into individual companies that also won’t spam you with advertising some of the more commercialised sites out there are prone to as well.

Web link: https://www2.asx.com.au/

6. CommSec

What it’s useful for: real-time ASX/Chi-X market depth; creating multple watchlists to view stock prices in realtime

While CommSec also serves as Australia’s largest stock brokerage platform, that’s not necessarily the reason we’re listing it here.

The Commonwealth Bank’s broker system is very robust, information-rich and highly functional, however the excessive brokerage fees that CBA charge for the privilege often simply aren’t worth using it for trading – especially for newer or smaller-scale Aussie investors.

The good thing is you don’t actually need to use CommSec as your brokerage to buy and sell, in order to still take advantage of what it does best.

CommSec is one of the only brokerage platforms that allows access to a real-time data feed of the ASX’s trading activity; you’ll find that many of the cheaper brokers have ‘delayed pricing’ as they pay for the cheaper diet-ASX data stream which only provides trading and order flow on a 15-minute delay.

While this won’t matter for long term buy-and-hold investors, those wanting to see activity in real-time can create a watchlist(s), and see all the trades and pricing as they happen.

It’s particularly useful for seeing how the market reacts to price-sensitive market announcements and being able to react accordingly; oftentimes, 15 minutes can be the difference between losing a lot vs. only a little money.

As an added bonus, CommSec also allows you to set up Push Notifications for any company on the ASX through to your phone as they go live.

This again is extremely handy for individual stock-pickers to not get caught unawares should something negative happen with a stock you hold.

Web link: https://www.commsec.com.au/

7. Stock Doctor

What it’s useful for: comprehensive company financials & stock screening/exporting

In terms of Australian stock analysis tools, Stock Doctor is the closest thing to a “Rolls Royce” of analytical software – both in terms of its functionality, and its price.

While most of the other ‘cheaper’ tools on this list attempt to get by via a mix of automation and semi-primitive “AI” solutions, Stock Doctor takes a more hands-on approach by adding more human-driven research overlaid on top of the data.

One of the key benefits of the platform is reponse time; it’s quick to factor in recent ASX financial updates and recalculate stock valuations, while the written portions of the stock analysis go into greater detail in a more relatable way.

Of course, that’s not to say the data is lacking here. Far from it – this is one of the most robust solutions on the market, with colour-coded ratings of each metric flagging them from Distress to Strong helping to take some of the sting out of staring at all the numbers.

It also contains many other elements of functionality offered by some of the similar platforms listed here such as screening, watchlists, a company events calendar and more.

Of particular note is their Star Stocks rating system, by which they flag only a small percentage of stocks on the ASX as “Stars” (either Growth or Income) at any one time, and with a strong track record of these having performed above the market dating back to 2012.

A tool for the more “serious investor”, if you’ve got the money then Stock Doctor can perform the functionality of a couple of tools on this list all in one.

Web link: https://www.lincolnindicators.com.au/stock-doctor/

8. Barchart.com’s Momentum Indicators

What it’s useful for: at-a-glance technical analysis trend indicators; assessing current stock sentiment

There’s always much debate between different types of investors as to how much ‘value’ Technical Analysis (TA) has when it comes to judging when to buy or sell a particular stock.

Some critically refer to it as ‘reading tea leaves’, while others – particularly day traders and those looking to capitalise on sentiment – rely on it as one of the key tools in their investing arsenal.

Regardless, for newer investors it can still be another useful factor to keep in mind when attempting to gauge what the mid-term opinion about a stock is outside of looking at fundamentals or pouring over annual reports.

One of the best tools out there for this purpose is BarChart.com. While this isn’t an Aussie site, it still covers the ASX and provides a handy, aggregated overview of all the major TA indicators for each Australian stock compiled into an easy-to-read table format.

It provides simple BUY/HOLD/SELL ratings and bullish/bearish trend indicators based on moving averages, MACD oscillators, and showcases various points of pricing Support & Resistance that can make it easier to come up with a target buy and sell price for stocks you’re interested in – and hopefully time a solid entry or exit point.

Combined, you can get a pretty solid grasp of the factors that combine to gauge market sentiment without having to dive too deeply into the minutae of TA terms.

The site also provides a pretty solid database of general news & info on the status of commodities, currencies and other price movements across global markets as well.

Web link: https://www.barchart.com/

9. The Australian Financial Review

What it’s useful for: industry-wide news; macro-economic information; individual company profiles & interviews

As the single majorly influential financial paper in Australia, the Australian Financial Review (AFR) is a mainstay of most ‘serious’ investors’ reading habits. However, the reason we’re recommending it here probably isn’t for the reason you’d think.

From our point of view, the AFR is not necessarily primarily useful because of the information it provides in and of itself a lot of the time – it’s useful because it sways public opinion on numerous investing trends, and has a large readership of influential and instiutional investors.

This means there’s often correlated market movements – specifically in the small cap space – after major AFR pieces that can allow you to ‘ride the wave’ of sentiment and buy in to companies that fit certain narratives.

It’s largely a result of Australia having such a small mainstream media sector concerned with finance & the markets; as a result, the publication has an outsized influence on public opinion among investors and is shared and cited almost everywhere.

I have seen multiple small to midcap companies’ share prices immediately respond on the next day of trading almost entirely due to coverage in the AFR.

This is not just because of the AFR article itself, but because of the ‘viral’ effect of having the same AFR articles syndicated and re-reported on on all the various social media and smaller-scale blogs across the Australian financial landscape.

The AFR is also a solid source of generalist macroeconomic information as they do a decent job of covering market movements and global trends outside of just the Australian landscape.

It’s not cheap, however it serves a purpose as another item in the investing ‘toolkit’ even though it isn’t strictly a ‘tool’ in the literal sense.

Web link: https://www.afr.com

10. HotCopper

What it’s useful for: real-time sentiment monitoring on ASX stocks, price-sensitive announcement notifications

Similar to the AFR, forum-oriented website HotCopper is not necessarily useful for the quality of its information.

90+% of the content posted by its community is honestly speculative and overly-optimistic garbage – however it serves as another source of gauging sentiment around specific companies/stocks and their most recent business updates.

Oftentimes this translates directly into volume of activity, particularly around small and micro-cap stocks for those looking to invest in the Wild West of the ASX.

HotCopper provides a section showcasing the ‘most commented’ stock codes of the day, and for smaller-cap stocks you can often jump over to apps like Commsec’s live Market Depth and see trading activity that correlates with similar volumes. This can provide opportunities for day traders and swing traders to capitalise if they’re careful.

The site’s division into sub-forums by ticker code tends to lead to an echo-chamber of overwhelming positivity in which any moderate or slightly negative comment around the particular stock is immediately flamed, or even reported to moderators to be removed.

However, there are a small handful of quality posters out there who do provide insightful information into some of the workings of particular companies.

These people tend to stand out from the rest of the drooling masses like a sore thumb (in a good way), with actual correct spelling/grammar and sentence structure a telltale sign amongst the rest of the rabble.

But – like with any other online crowdsourced information codex – these should be taken with an absolute dumptruck’s worth of salt grains.

Web link: https://www.hotcopper.com.au

Got any other useful tools for Aussie investors to recommend? Let us know in the comments below.